Running a business is rewarding, but it’s not without its challenges. One of the most significant hurdles is managing finances effectively. Debt can be a useful tool for growth, but when mismanaged, it can spiral out of control, putting your business at risk. Recognizing the warning signs early can help you course-correct and avoid financial trouble. In this article, we’ll explore 5 signs your business is heading toward debt and offer actionable solutions to stay on track. If you’re already in debt, don’t worry—we’re here to help with a free consultation to guide you toward financial stability.

Financial Warning Signs To Watch For

Before we dive into the specific signs of impending business debt, it’s important to understand that no business is immune to financial challenges. However, being proactive and aware can help you navigate tough times with greater confidence.

5 Signs Your Business Is Heading Toward Debt

1. Cash Flow Problems Are Constant

Cash flow is the lifeblood of any business. If you’re frequently scrambling to cover expenses or find yourself waiting on overdue invoices to pay bills, it’s a red flag. Poor cash flow can lead to borrowing just to keep the business running, creating a dangerous debt cycle. Implement stricter invoice collection policies and consider using software to monitor cash flow in real-time.

2. Increasing Reliance On Credit Cards Or Loans

When businesses struggle to meet daily expenses, they often turn to credit cards or loans as a quick fix. While short-term borrowing can be helpful, relying on it regularly indicates deeper financial issues. Review your budget and identify areas to cut unnecessary expenses. Also, explore alternative funding options, such as grants or partnerships, to reduce reliance on debt.

3. Missed Payments On Bills Or Loans

Falling behind on payments is a clear indicator of financial stress. Missed payments only accumulate late fees. Prioritize bills and renegotiate payment terms with creditors to reduce immediate pressure.

4. Declining Revenue Without Cost Adjustments

A drop in sales or revenue is normal occasionally, but if it becomes a trend, it can jeopardize your business’s stability—especially if expenses remain the same or increase. Conduct a thorough analysis to identify why revenue is declining. Whether it’s market conditions or operational inefficiencies, address the root cause promptly.

5. Overextension Through Rapid Expansion

Expanding too quickly without adequate financial planning can strain resources. While growth is exciting, overextending can lead to operational inefficiencies and mounting debt. Develop a sustainable growth plan that includes realistic financial projections and ensures adequate reserves to support expansion.

If you’re seeing any of these signs in your business, it’s time to take action. CuraDebt offers a free consultation to help small business owners regain financial control and create a roadmap to success.

How To Avoid Small Business Debt

Preventing debt requires a proactive approach to financial management. Here are some tips to keep your business financially healthy:

- Create a Detailed Budget: Regularly update your budget to reflect changes in revenue and expenses.

- Build an Emergency Fund: Having a financial cushion can help you weather unexpected challenges.

- Invest in Technology: Use accounting and financial tools to track expenses and income efficiently.

- Seek Professional Advice: Consult with financial advisors or debt relief experts to manage finances effectively.

Are You In Debt? We Can Help You

At CuraDebt, we understand the challenges of running a business. Our team specializes in helping small business owners tackle debt through personalized solutions. Our free consultation is designed to help you explore your options and create a plan that works for your unique situation. Don’t let debt control your business—let us help you take back control.

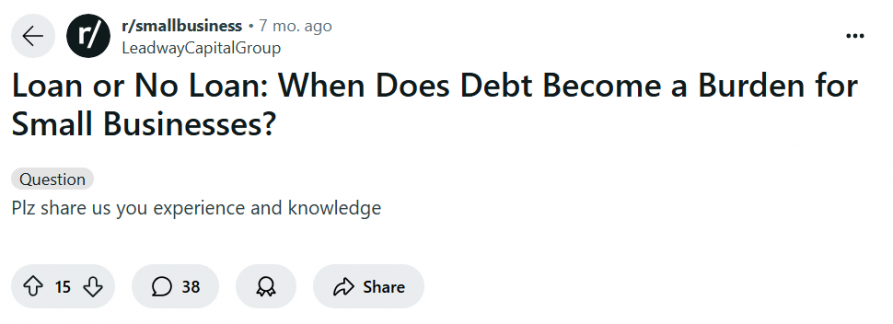

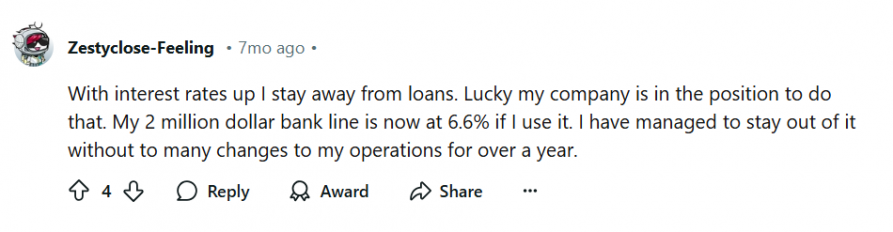

What People Are Saying Across Platforms

Sometimes, the best insights come from shared experiences. Here’s what people are discussing on platforms like Reddit and Quora about small business debt:

- “When Does Debt Become a Burden for Your Business?”

Most users agree that debt becomes problematic when you can’t pay it back on time. They also emphasize the importance of staying proactive to avoid accumulating unnecessary debt.

- “Does Refinancing Small Business Debt Really Help?”

Refinancing can provide temporary relief, but users caution that it may signal deeper financial problems. While refinancing can be helpful, it should be part of a broader financial strategy.

- “Can Small Businesses Go Into Debt Easily?”

Many agree that small businesses often face challenges that make debt unavoidable, such as delayed payments or seasonal downturns. However, good financial practices can mitigate these risks.

By participating in these discussions, you can gain valuable insights and avoid common pitfalls.

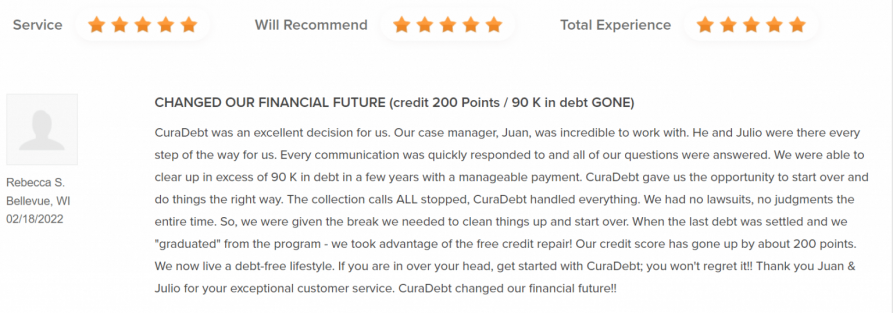

CuraDebt Reviews

At CuraDebt, we’ve helped countless small businesses regain their financial footing. From negotiating with creditors to creating personalized repayment plans, our clients consistently express gratitude for our services. You could be next!

Here’s what some of our clients have to say:

Need a loan or help with debt relief? CuraDebt is here for you.

Conclusion

Debt can feel overwhelming, but it doesn’t have to define your business’s future. Recognizing the warning signs and taking proactive steps can make all the difference. Whether you need help with cash flow, overdue bills, or declining revenue, CuraDebt is here to help.

Take the first step toward financial stability with our free consultation today. Let us help you turn things around and keep your business thriving!