Am I Liable For My Spouse’s Tax Debt?

Tax debt can be a stressful topic, especially when it’s unclear who’s liable for covering it within a marriage. If your spouse has back taxes, understanding whether you’re liable for your spouse’s tax debt is essential. Whether you’re newly married or recently discovered an old tax debt, this article will help answer your questions.

By the end of this article, you’ll know when you might be accountable for your spouse’s taxes, when you’re not, and what you can do to protect yourself. Plus, we’ll explain why CuraDebt’s free consultation can be a valuable resource if tax debt concerns you.

When Are You Responsible?

In certain situations, you might indeed be responsible for your spouse’s back taxes. Here are the key cases:

1. Joint Tax Return Responsibility

When a couple files jointly, both spouses become jointly and severally liable. This means that both are fully responsible for the entire tax bill—even if one spouse earned all the income or owes the full debt. If the IRS has a back tax debt on a jointly filed return, they can pursue either spouse for the balance, which could mean garnished wages or seized assets.

2. Spousal Property Laws in Community Property States

In community property states, most debts incurred by one spouse during the marriage may be considered shared debts. These states include Arizona, California, Texas, and others. In these states, you could be responsible for your spouse’s tax debts, even if you weren’t aware of them.

3. Assuming Debt Responsibility by Agreement

If you sign an agreement with your spouse (like a prenuptial agreement or similar document) that includes responsibility for debts, you may be legally obligated to cover their tax debt if specified.

When Are You Not Responsible?

You are not automatically responsible for tax debts your spouse accrued before your marriage, and you may not be liable in the following cases:

1. Innocent Spouse Relief

If your spouse failed to report income, reported incorrectly, or claimed improper deductions on a jointly filed return, the IRS provides “Innocent Spouse Relief.” This program can absolve a spouse from responsibility if they were unaware of the tax errors.

2. Separation of Liability Relief

This option applies if you’re divorced, legally separated, or no longer living with your spouse. Under Separation of Liability Relief, you can request that the IRS assigns only a portion of the tax debt to you based on income and responsibilities.

3. Equitable Relief

If you don’t qualify for other forms of relief, the IRS may consider “Equitable Relief.” If, for example, your spouse committed fraud that resulted in back taxes, you may qualify for Equitable Relief, shielding you from responsibility.

Be Careful With Timing

Timing can be crucial in determining your liability. Here’s what to keep in mind:

- Debt Before Marriage: If your spouse incurred tax debt before you got married, this debt is typically their sole responsibility. However, once you’re married, the IRS may try to garnish joint assets if tax issues aren’t disclosed or managed properly.

- Debt Accumulated During Marriage: If the tax debt arose during your marriage, especially if you file jointly, it may affect both of you. This is important if you’re considering community property laws or are part of a jointly filed return.

It’s essential to understand your state’s tax laws and reach out for professional help if unsure. CuraDebt’s free consultation can help clarify your rights and options.

Consequences Of Tax Debt

If tax debt goes unresolved, the IRS has the power to take several actions to collect payment:

- Wage Garnishment: The IRS can garnish wages, taking a portion of your income until the debt is satisfied.

- Bank Account Levies: The IRS can place a levy on your bank account, freezing and potentially seizing funds.

- Property Seizure: In extreme cases, the IRS can seize valuable property, including vehicles and even homes.

- Credit Score Impact: Tax liens and unresolved debt can significantly lower credit scores, affecting your ability to obtain loans or mortgages.

Seeking professional assistance can help mitigate these impacts, especially if you’re unsure about liability. CuraDebt offers support to help clients facing IRS debt navigate these challenges. Take our free consultation now!

What People Are Saying On Forums

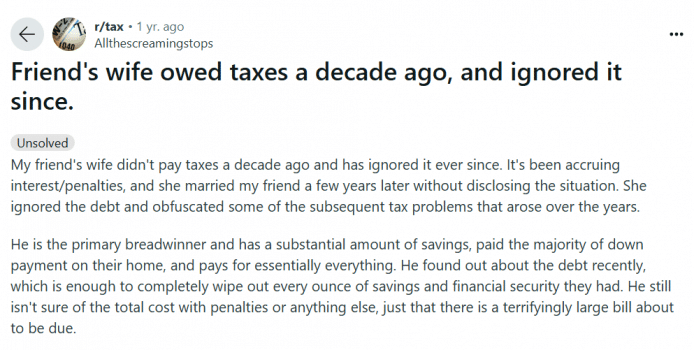

Forums like Reddit can be a helpful place for advice and firsthand experiences. For example, a user shared a story about a friend who, after getting married, learned his wife hadn’t paid taxes for over a decade. He feared the IRS might take their home but hesitated to contact a tax professional. Replies encouraged him to seek professional advice, as many users shared similar stories about finding debt relief and gaining peace of mind with expert help.

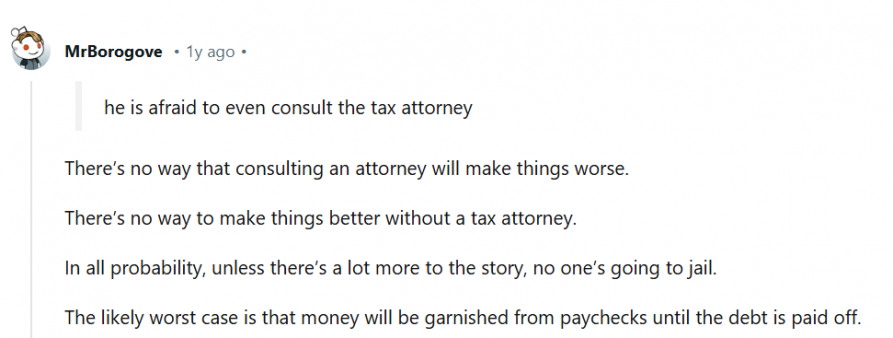

There are also some good tips available on other sites like LinkedIn and Quora, such as:

Innocent Vs. Injured Spouse Relief

These kinds of conversations show that tax debt issues are common, and addressing them with professional support often leads to the best outcomes. Curadebt offers a free consultation so you can regain control of your finances!

CuraDebt Reviews

We have helped countless clients find relief from tax debt through affordable, reliable services. With a free consultation, you can explore options tailored to your situation, whether it’s tax debt, credit card debt, or business debt. CuraDebt’s knowledgeable consultants are here to listen, assess, and guide you toward a debt-free future.

Here’s what some of our clients have to say:

If you’re ready to take the first step, contact us for a free consultation. You could be our next success story.

Conclusion

If you’re concerned about a spouse’s tax debt, know that understanding your rights is the first step. While some situations may make you partially responsible, others could protect you. Whatever your circumstances, proactive action is key to finding a solution.

If you’re facing tax debt or concerned about possible liability, consider reaching out to CuraDebt for a free consultation. Our team is here to help you explore your options and work toward a financial future free from the burden of debt.