When facing financial challenges, selecting the right debt relief company is crucial. Americor, a prominent player in the debt relief industry, offers various services to assist individuals and businesses in managing their debts. In this article, we will explore what Americor is, how it operates, the services it provides, and what customers are saying about their experiences. By the end, you’ll have a comprehensive understanding to determine if Americor is the right choice for your debt relief needs.

Need a loan or help with debt relief? CuraDebt is here for you.

What Is Americor?

Americor is a financial services company specializing in debt relief solutions. Founded in 2013 and headquartered in Irvine, California, Americor offers a range of services designed to help individuals and businesses reduce and manage their debts. The company focuses on providing personalized financial strategies to assist clients in achieving financial freedom.

Looking for a reputable debt relief company? Take our free consultation today!

How Does Americor Work?

Americor operates by assessing each client’s unique financial situation and developing a customized debt relief plan. The process typically involves:

- Initial Consultation: Clients provide detailed information about their debts, income, and financial goals.

- Debt Analysis: Americor reviews the client’s financial information to identify the most effective debt relief strategy.

- Program Enrollment: Clients enroll in a debt relief program tailored to their needs, which may include debt settlement or consolidation.

- Debt Negotiation: Americor negotiates with creditors to reduce the total debt owed, aiming for a lower payoff amount.

- Debt Resolution: Once settlements are reached, clients make payments to resolve their debts, leading to financial freedom.

Americor Services

This company offers several services to assist clients in managing and reducing their debts:

- Debt Settlement: Negotiating with creditors to reduce the total debt owed.

- Debt Consolidation: Combining multiple debts into a single loan with a potentially lower interest rate.

- Credit Counseling: Providing financial education and budgeting assistance to help clients manage their finances effectively.

- Tax Debt Relief: Assisting clients in resolving outstanding tax debts through negotiation and settlement.

Americor Reviews

Understanding customer experiences is vital when evaluating a debt relief company. Here’s an overview of Americor’s reviews across various platforms, including both positive and negative feedback:

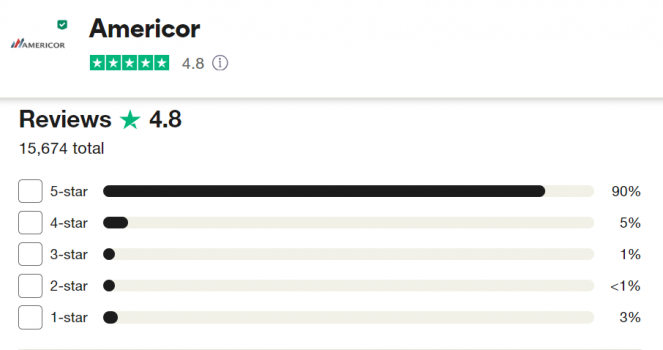

Trustpilot

Americor has an average rating of 4.8 out of 5 stars on Trustpilot, based on over 15,000 reviews. Below are some notable reviews from Trustpilot:

- Positive review: “Exceptional service and professionalism. From start to finish, the process was seamless, thanks to the amazing team who guided me through every step.”

- Positive review: “Very Helpful, Informative & worth the time & money. Get your credit back straight!”

- Negative review: “I do not recommend it. I have been working with them for 11 months. They made me many promises and when I finally called to ask about things that were said at the time of accepting the program, it turns out that the person who spoke to me lied to me and no longer works at Americor. Then I checked my account statements and saw that I actually paid the same amount of my debt but in 3 years for all the fees that Americor charges me for the service.”

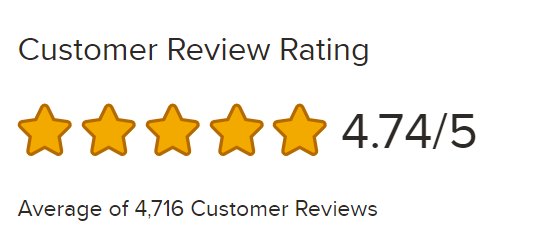

Better Business Bureau (BBB)

The BBB rates Americor 4.74 out of 5 stars, with over 4,000 customer reviews. Here’s a look at the feedback:

- Positive review: “Good clear communication and good answers to questions. Would recommend them.”

- Positive review: “Im glad they help me with my debt and learn at the same time about my finances!”

- Negative review: “They do not settle your debt in the time they say. They often ask for more money for the settlement. The number they quote you is more than what they settle for and do not disclose their fees. Stay away from this company.“

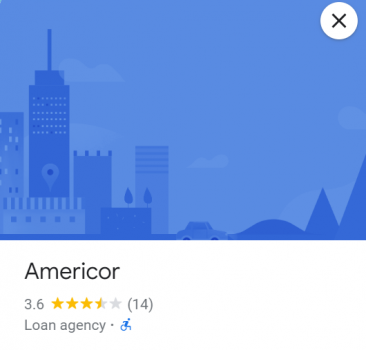

Google Reviews

On Google, Americor holds an average rating of 3.6 out of 5 stars. Here’s a snapshot of what customers are saying:

- Positive review: “The team has been extremely helpful guiding me through the debt consolidation process.”

- Positive review: “I definitely recommend you use Americor before filing bankruptcy.”

- Negative review: “At first this company was great to work with. Over the past 5 months on the other hand have been absolutely miserable. In the course of the last 5 months this company has gotten me sued over not negotiating accounts in a timely manner and dropping my credit score 20 points and has now came to me and said they need to extend my contract another 6 months at $456 a month or drop the account and me get sued for a second time.”

What People Are Saying Across Platforms

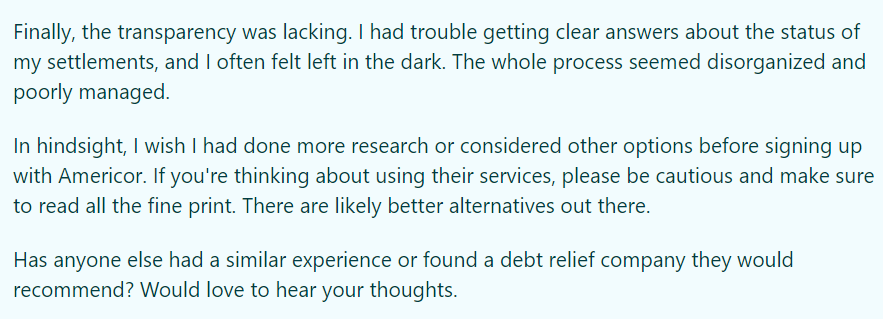

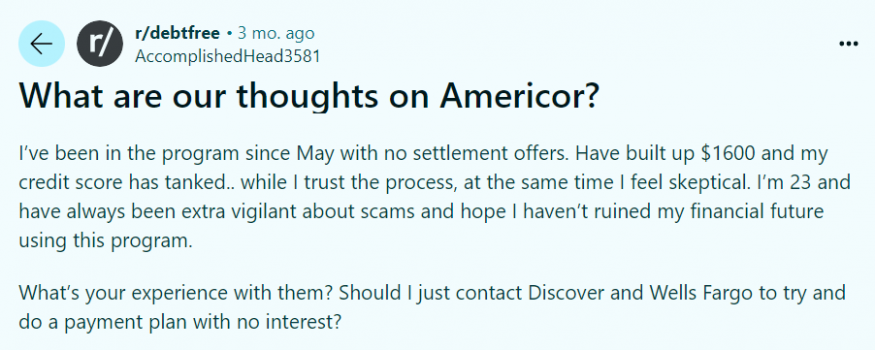

Customer feedback on platforms like Reddit and Quora provides additional insights into Americor’s services. For example, a user shared a frustrating experience with Americor, highlighting the following challenges:

Another user inquired about Americor’s services, with responses suggesting trust in the process and optimism about debt resolution.

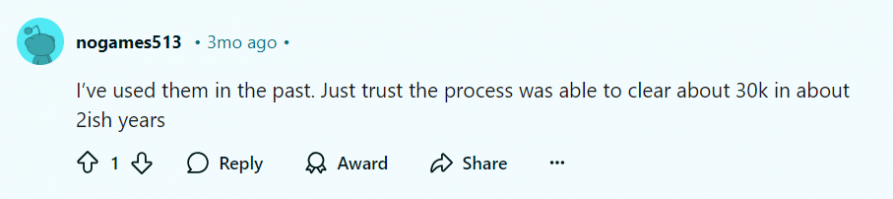

A third post detailed a negative experience, with commenters advising the individual to consider alternative debt settlement options.

These discussions underscore the importance of thoroughly researching and considering customer experiences when selecting a debt relief company.

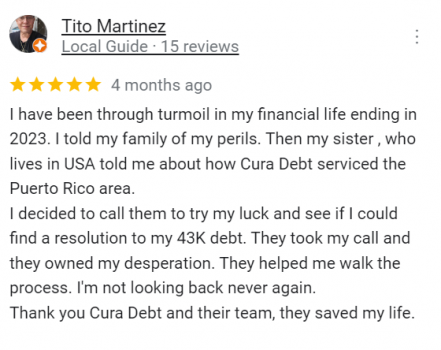

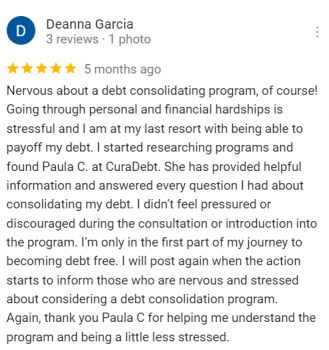

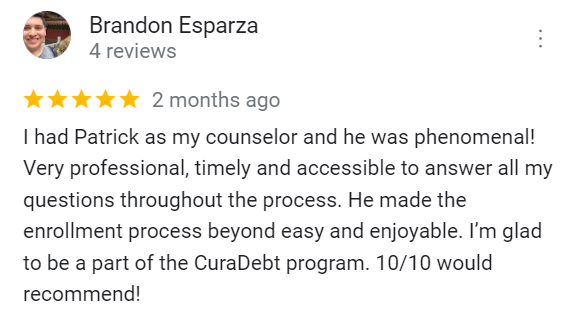

CuraDebt Reviews

If you’re seeking a reputable debt relief company, consider CuraDebt. We have assisted thousands of people in resolving their debts through personalized strategies. Here is what our clients have to say.

Conclusion: Is This Company the Right Choice?

When evaluating Americor, it’s essential to consider both positive and negative customer reviews. While many clients report satisfactory experiences, some have encountered challenges. If you’re looking for a reputable debt relief company, CuraDebt offers personalized solutions with a focus on customer satisfaction. Take advantage of their free consultation to explore how they can assist you in achieving financial freedom.