Earning income through royalties can be a great opportunity, whether it’s from a book, music, or patents. However, knowing how royalties are taxed is key to managing your money wisely. In this guide, we’ll tackle the important question: Are royalties taxable? The answer is yes—and we’ll explain why and how.

Do you need tax help? CuraDebt is here for you.

What Are Royalties?

Royalties are payments made to someone for the use of their work or property, like books, music, patents, or natural resources such as oil or gas. They are usually agreed upon in contracts and based on a percentage of the money earned from the asset.

The IRS sees royalties as taxable income, so you need to include them on your tax return. Whether you’re a writer, musician, or inventor, the royalties you earn are taxed like any other income.

Types Of Royalties

There are several types of royalties, each with unique tax implications:

1. Book And Publishing Royalties

Authors often receive royalties when their books are sold or published. These royalties are taxable as income, reported under Form 1099-MISC, if they exceed $10 in a year.

2. Music And Performance Royalties

Musicians and songwriters earn royalties whenever their music is played, performed, or sold. These royalties are also taxable and must be reported on your tax return.

3. Patent Royalties

Inventors who license their patents to others receive royalties. This income is taxable and is typically reported as “other income” on tax forms.

4. Natural Resource Royalties

If you own land with natural resources, such as oil or minerals, you may earn royalties when companies extract these resources. These payments are considered taxable income.

5. Twitch Or Digital Platform Royalties

Creators on platforms like Twitch may earn royalties through partnerships or use of licensed content. The IRS requires these royalties to be reported as income.

Knowing the type of royalties you receive helps you prepare for how the IRS will tax them.

Royalty Payment Processing

The process of handling royalties for tax purposes changes based on your residency status:

For U.S. Residents

If you’re a U.S. resident, the payer typically reports royalty payments on Form 1099-MISC. You must include these amounts as part of your gross income when filing taxes.

For Non-Residents

Non-residents earning royalties in the U.S. have some extra rules to follow. The IRS usually withholds a 30% tax from their royalties, but a tax agreement between the U.S. and their home country may lower this rate. Non-residents must report their royalty income using Form 1040-NR.

Keeping accurate records and following the rules is important to avoid fines or paying too much.

Tax Tips For Royalties

Earning royalties is rewarding, but taxes can feel burdensome. Here are some tips to manage the tax implications:

- Keep Detailed Records

Maintain organized records of all royalty payments, contracts, and related expenses.

- Deduct Related Expenses

You can reduce your taxable income by deducting costs like marketing, legal fees, or equipment expenses tied to generating royalties.

- Consider Tax Credits

Explore available tax credits for creators or small businesses, which can offset your tax burden.

- Consult A Tax Professional

A tax expert can help ensure compliance while finding opportunities to minimize your tax liability.

By staying informed, you can make strategic decisions to reduce the impact of taxes on your royalties.

More Questions And Experiences

It’s common to have questions about royalties and taxes. Here’s what others have shared on public platforms:

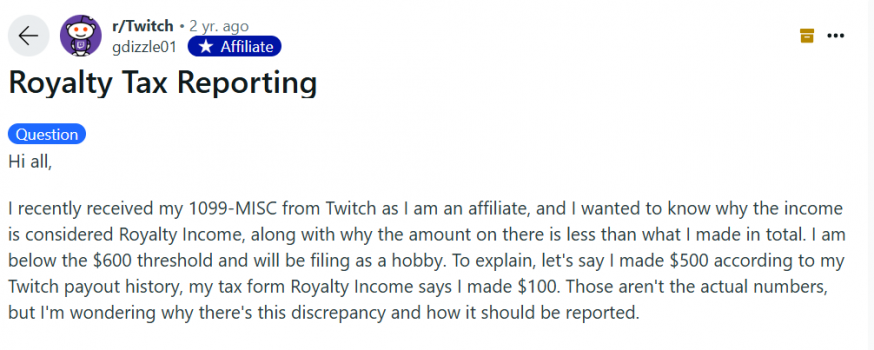

Royalties On Twitch

A Reddit user asked about how royalties from Twitch work. The answers explained how this income is collected by the IRS.

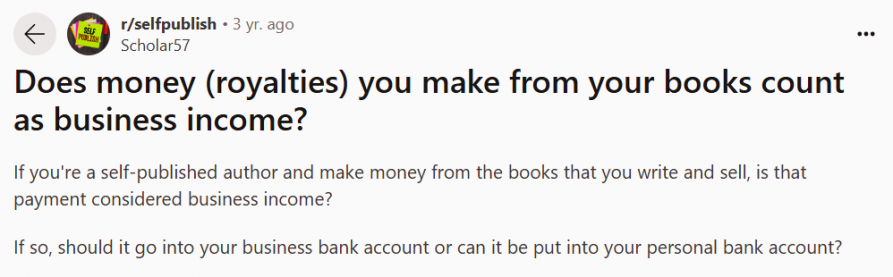

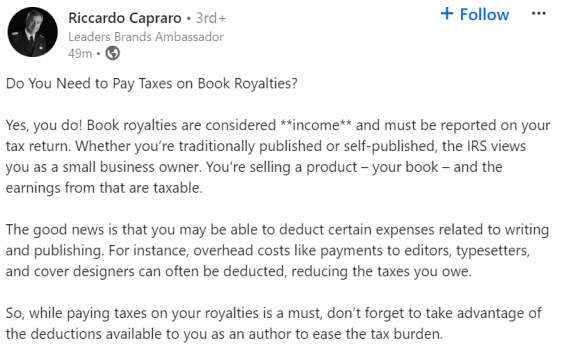

Book Royalties

An author asked if it’s better to deposit book royalties into a personal or business bank account. Users indicated that it is not actually necessary to put this income into a business account.

On LinkedIn, a user reaffirmed that book royalties are indeed taxable.

Learning from others’ experiences can provide clarity as you navigate your own tax situation.

Do You Need Tax Help?

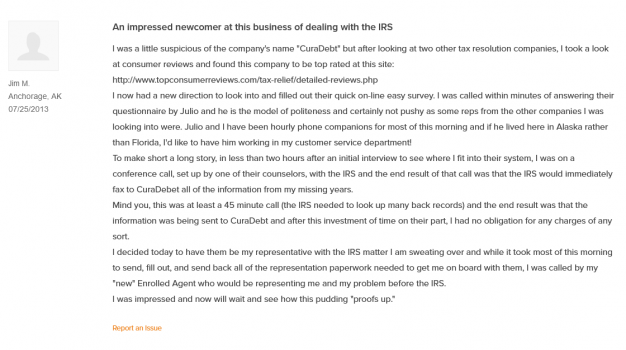

Handling taxes on royalties can be tricky, especially if you have other financial responsibilities. At CuraDebt, we help individuals and businesses manage tax debt with ease. Whether you need help understanding your taxes or solving tax problems, we’re here for you.

Our free consultation allows you to explore your options with no risk. We’ve helped countless individuals reduce their tax burdens, and you could be next.

Conclusion

Royalties are an exciting source of income but come with tax responsibilities. In this article, we explored the types of royalties, how they are processed for residents and non-residents, and tips to manage their tax implications. Remember, if you need help with tax-related issues, CuraDebt offers professional assistance and a free consultation to guide you through.

Let us help you explore the complexities of tax debt—call today for your free consultation!