Atlas Debt Relief Reviews: Is It The Right Choice?

Are you struggling with overwhelming debt and looking for a solution? Atlas Debt Relief is one of the companies that promises to help individuals reduce their debt through various relief programs. In this article, we’ll dive into Atlas Debt Relief reviews to give you a comprehensive understanding of the company, its services, and what customers are saying about their experience. This way, you can make an informed decision about whether Atlas is the right fit for you or if you should consider other options.

Looking for a reputable debt relief company? CuraDebt can help you! Take our free consultation today!

What Is Atlas Debt Relief?

Atlas Debt Relief is a company that provides debt settlement services to individuals. They specialize in negotiating and settling unsecured debts such as credit card bills. The goal of the company is to help clients reduce their debt by negotiating with creditors to settle for less than the full amount owed.

Founded with the intention of assisting individuals in overcoming financial hardships, Atlas Debt Relief offers personalized debt management solutions. They are known for their customer-focused approach, working directly with clients to develop strategies for reducing outstanding debt, and also because they ensure that you do not have to pay anything until they secure a negotiation in your favor.

How Does Atlas Debt Relief Work?

Atlas Debt Relief works by using a debt settlement approach to help clients lower their overall debt. Here’s how the process typically works:

- Free Consultation:

The first step is to reach out to Atlas for a free consultation. During this consultation, a debt specialist will review your financial situation, including the amount of debt you owe, your income, and your financial goals. Based on this information, they will develop a customized debt relief plan.

- Debt Settlement Program:

Once you enroll in their program, Atlas Debt Relief begins negotiating with your creditors on your behalf. They try to reach a settlement for less than the amount you owe. This is typically done by offering a lump sum payment or a reduced settlement amount.

- Payments:

Clients are required to make monthly payments to a special account. These funds are used to pay off the settled amounts once agreements are reached with creditors.

- Debt Resolution:

Once a debt is settled, it is considered resolved, and clients can move forward with their financial recovery. Atlas claims to help clients settle unsecured debts by negotiating lower amounts, often saving clients a significant amount.

Debt Consolidation Vs. Debt Settlement

If you’re looking to manage debt, it’s essential to understand the difference between debt consolidation and debt settlement to choose the best option for your financial situation.

Debt Consolidation

Debt consolidation is a way to simplify debt payments by combining multiple debts into one monthly payment. There are two main types of debt consolidation:

- Loan: This option involves taking out a new loan to pay off existing debts. Ideally, the loan comes with a lower interest rate, making payments more manageable. However, you are still responsible for repaying the full debt amount.

- Debt Management Program (DMP): Also known as a form of debt consolidation, a DMP is set up through a credit counseling agency. In this arrangement, you make a single payment to the agency, which then distributes the funds to your creditors, often with negotiated interest rates and waived fees. While it simplifies payments, a DMP does not reduce the total debt.

Debt Settlement

Debt settlement differs from consolidation. It involves negotiating with creditors to settle your debts for less than the original amount owed, potentially providing faster relief from financial stress. Debt settlement can be an effective way to reduce what you owe, although it may impact your credit score.

For those looking to reduce their overall debt, debt settlement could be a better choice, as it can resolve debts more quickly and with potential savings. Both Greenwise Financial and CuraDebt offer debt settlement programs tailored to individual financial needs.

Atlas Debt Relief Reviews

Let’s take a closer look at customer feedback and reviews from several trusted review sites.

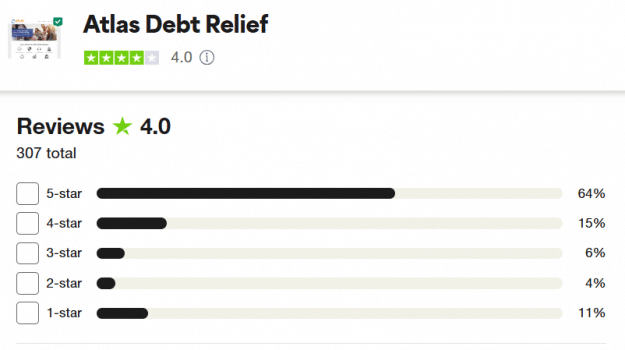

Trustpilot

Atlas Debt Relief has garnered an average rating of 4.0 out of 5 stars on Trustpilot, indicating that most customers have had a positive experience with the company. Here are a few reviews from their Trustpilot page:

- Positive Review:

“It’s been almost a year, and they have started paying my debts off. You have to be patient because you have to build up enough money in your savings account so they can use it to pay off your debts and negotiate for you.”

- Positive Review:

“Atlas is a great program that helps with debts. At first, it is frustrating. Finally, Atlas was able to make my first settlement with a credit card debt”

- Negative Review:

“November 2023 I entered Atlas plan with 6 debts. I have paid each month on time and have never failed. Atlas only negotiated one (1) debt.”

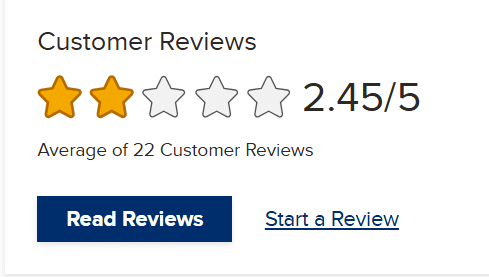

Better Business Bureau (BBB)

On BBB, Atlas Debt Relief has a lower customer review rating of 2.45 out of 5 stars. Several complaints mention poor communication, high fees, and delays in debt settlement. Here are a few examples:

- Complaint:

“Credit now destroyed. They have done nothing. Won’t answer phone calls, or e-mail. I spent considerable time with them on the phone and going over their fraudulent contract. I only lost the initial $50, but have lost my credit because of these evil people.”

- Complaint:

“This debt relief program hasn’t been paying my debt and just increasing it, by now I’ve paid 30 thousand and my credit score is still low”

Despite these complaints, some clients still report positive outcomes, suggesting that Atlas can be a viable option for some, but it’s important to weigh the reviews and understand potential drawbacks.

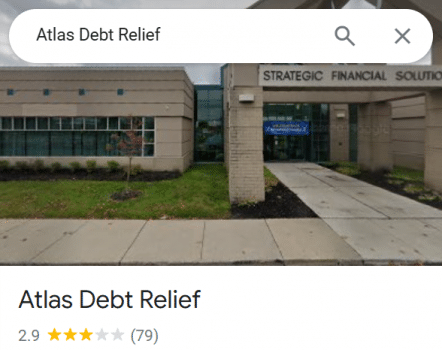

Google Reviews

On Google, Atlas Debt Relief holds an average rating of 2.9 out of 5 stars. Similar to BBB, there are both positive and negative comments:

- Positive Review:

“The company is legit, and they have been helping me for the last 2 years with credit card debt payments.”

- Positive Review:

“Very professional and helpful. Atlas Debt Relief helped me work through my debt, and the team was always there to answer my questions. They really made a difference.”

- Negative Review:

“Never received the welcoming phone call. Atlas collected my money, possibly even keep my funds. Not one of my creditors were paid off.”

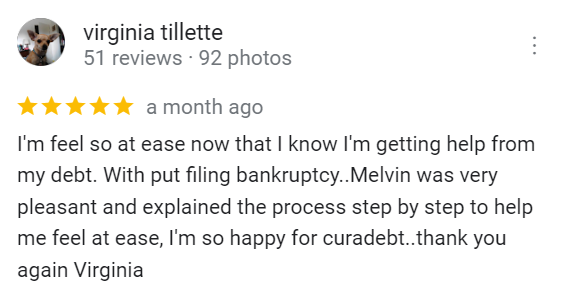

CuraDebt Reviews

If you’re considering debt relief options, CuraDebt is a trusted and reputable alternative to Atlas Debt Relief. With a proven track record of helping thousands of individuals and businesses get back on their feet,

Our clients’ experiences reflect a commitment to making debt relief as simple and efficient as possible. Here are a few of our recent reviews:

At CuraDebt, we offer a free consultation to help you explore your debt relief options. We’ve helped many people in similar situations, and we’d love to assist you too.

Conclusion: Is Atlas Debt Relief the Right Choice?

Atlas Debt Relief may be a suitable option for some individuals looking to reduce their debt through settlement. With positive reviews on platforms like Trustpilot, and a proven track record, it has helped many clients find debt relief. However, it’s important to note that customer reviews vary, and there are some complaints related to the process and fees.

If you’re still uncertain about whether Atlas Debt Relief is the right fit for you, it might be worth exploring other options like CuraDebt. We offer a free consultation to help you find the best debt relief solution tailored to your needs.

Ready to take control of your financial future? Contact us today for a free consultation!