Dealing with debt can feel like a heavy weight on your shoulders—but finding the right help shouldn’t add to the stress. If you’ve been searching for ways to take control of your finances, you might have come across Beyond Finance. They’re one of several companies offering debt relief solutions, specifically for those struggling with unsecured debt. In this article, we’ll break down how Beyond Finance works, what services they offer, and what real customers have to say. Whether you’re seriously considering their help or just exploring your options, we’re here to give you the honest insight you need to make a confident choice.

What Is Beyond Finance?

Beyond Finance is a debt settlement company focused on helping people tackle unsecured debt—like credit cards, personal loans, and medical bills. Their approach involves working directly with your creditors to negotiate a lower payoff amount, so you can settle what you owe for less than the original balance.

They create personalized programs that typically run between 24 and 48 months. During that time, you’ll make regular deposits into a dedicated account, which is then used to pay off your settlements. One key thing to know: Beyond Finance only charges a fee after they successfully settle a debt for you—so you don’t pay upfront.

How Does Beyond Finance Work?

Beyond Finance follows a structured process to assist clients with their debt challenges:

- Free Consultation: The journey starts with a free consultation to assess the client’s financial situation and determine whether they qualify for the program.

- Enrollment: Once accepted, the client stops making payments to creditors and instead deposits funds into a dedicated account managed by Beyond Finance.

- Negotiation: Beyond Finance negotiates with creditors on behalf of the client to reach settlements for less than the full amount owed.

- Payment And Resolution: When a settlement is reached, funds from the client’s dedicated account are used to pay the creditor. Beyond Finance charges a percentage of the debt enrolled as their fee after successfully negotiating a settlement.

Beyond Finance’s Fees

This company operates on a performance-based fee model, charging clients only after successfully negotiating a debt settlement. Their fees range from 15% to 25% of the total enrolled debt. For example, if you enroll $10,000 in debt, the fee could be between $1,500 and $2,500, depending on your specific agreement. This fee is in addition to the amount paid to creditors for the settled debt. Importantly, Beyond Finance does not charge any upfront fees; you incur costs only after a settlement is reached and approved.

Now that we’ve gained a better understanding of Beyond Finance’s services and fee structure, let’s delve into real customer reviews to see how their clients perceive their experiences.

Beyond Finance Reviews

Let’s take a closer look at how Beyond Finance is rated by real customers across trusted review platforms like the Better Business Bureau (BBB), Trustpilot, and Google Reviews. These insights can help you get a clearer picture of what to expect from their service based on actual client experiences.

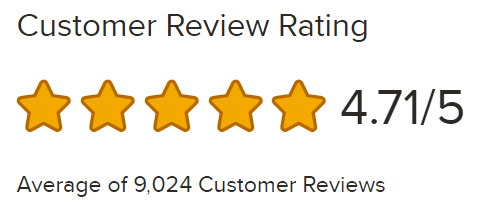

Better Business Bureau (BBB)

- Average Rating: 4.71/5 based on 9,024 reviews.

- Positive Review: “Great experience and this process has been able to move quickly and efficiently. They have been very helpful.”

- Positive Review: “I believe you are lifesavers to me and others who are in debt.“

- Negative Review: “Promising so much but getting very little results! If you have big debt, do not recommended this company!”

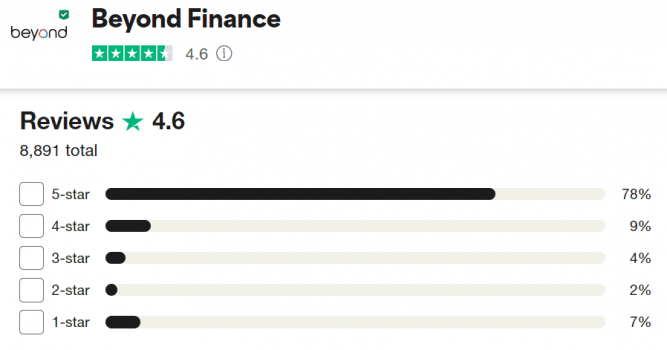

Trustpilot

- Average Rating: 4.6/5 based on 8,891 reviews.

- Positive Review: “When I first called, the representative walked me slowly through the entire process, making sure I understood everything. It’s so simple and so easy.“

- Positive Review: “TI wouldn’t be able to resolve the credit card debt I created if it wasn’t for Beyond Finance. I’m learning to manage my finances.”

- Negative Review: “I’m very disappointed by this company called Beyond Finance. They got me to sign up with them using a bait and switch offer. The 25 percent interest they charge defeats the purpose of reducing your debt. Basically, you are paying them the money you are supposedly saving after they supposedly negotiate an offer for you.”

Google Reviews

- Average Rating: 4.6/5 based on 7,350 reviews.

- Positive Review: “I appreciate and am thankful for the help that I received today. The technician was absolutely wonderful.”

- Positive Review: “They were so helpful and made me excited to go on my debt consolidation journey!”

- Negative Review: “They are good at sales, but they lie. Nothing goes as promised. Everything that goes wrong, they are quick to make an excuse or somehow try to spin why it’s a good thing.“

Overall, Beyond Finance maintains strong ratings across BBB, Trustpilot, and Google Reviews, with many customers highlighting the helpful support and simplified process. While most experiences are positive, some negative reviews point to unmet expectations and concerns about fees—so it’s wise to review the terms carefully before committing.

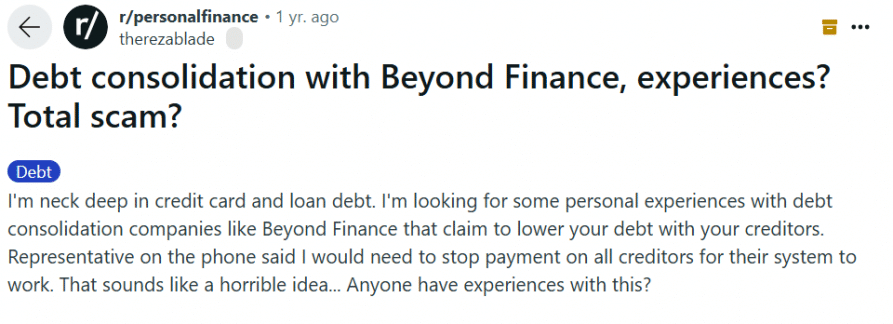

What People Are Saying Across Platforms

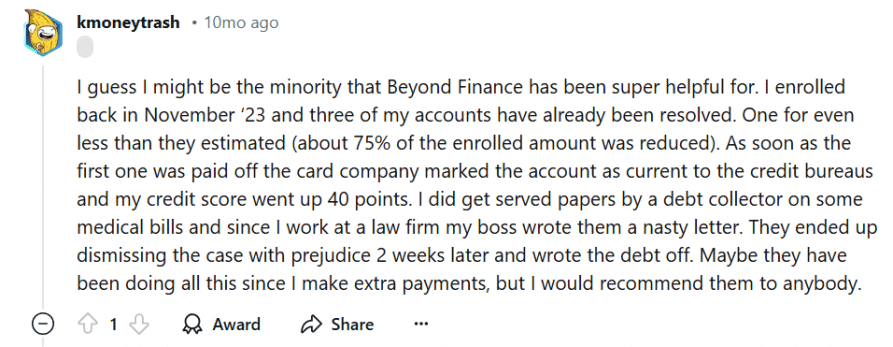

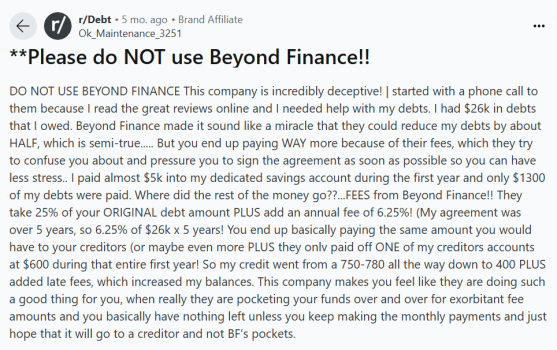

In addition to reviews on major platforms, checking forums like Reddit and Quora can provide unique insights. Users often share personal experiences that reveal the pros and cons of working with companies like Beyond Finance. Exploring these discussions can help you better understand what to expect and decide if this service aligns with your needs.

Conclusion: Is Beyond Finance The Right Choice?

Beyond Finance has received strong reviews for its ability to negotiate debt reductions and provide supportive service. However, choosing the right company is about more than just the program—it’s about finding a team you feel truly understands your situation and is committed to your success.

At CuraDebt, we take pride in offering a personal, hands-on approach. Our experienced team listens, cares, and works with you every step of the way. If you’re looking for a trustworthy partner on your journey to becoming debt-free, we’re here for you.

Schedule your free consultation today—we’d love to help you explore your options and find the best solution for your needs.