When it comes to financial services, choosing the right company can feel overwhelming—especially when you’re trying to make the best decision for your business or personal finances. BHG Financial has made a name for itself by offering tailored loan solutions, but is it the right fit for your needs? With so many options out there, it’s important to weigh the pros and cons carefully.

In this article, we’ll break down what BHG Financial offers, what customers are saying about their experience, and whether this company is a good option for you. We’ll also explore some key considerations to keep in mind as you evaluate your choices. After all, finding the right financial partner is about more than just getting funding—it’s about finding a solution that aligns with your goals and helps you move forward with confidence.

What Is BHG Financial?

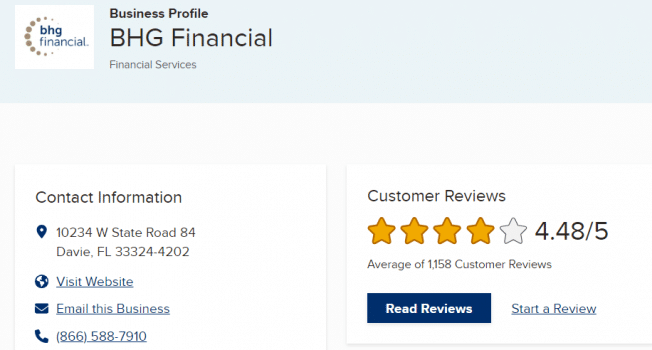

Founded in 2001, BHG Financial began with a focus on serving healthcare professionals but has since grown to offer loans across a wide range of industries. Over the years, they’ve funded over $15 billion to more than 150,000 clients, helping individuals and businesses alike achieve their financial goals. Known for their personalized loan options and an A+ rating from the Better Business Bureau (BBB), BHG Financial has built a strong reputation for providing tailored solutions that meet the unique needs of their clients.

Originally operating as BHG Money, the company has expanded its services to include personal loans with fixed rates, available in all states except for North Dakota and Montana.

What Does BHG Financial Offer?

BHG Financial provides a variety of loan products designed to meet the unique needs of both individuals and business professionals. Here’s what they offer:

Personal Loans

- Loan Amounts: Ranging from $20,000 to $200,000.

- Use Cases: Ideal for debt consolidation, major purchases, or other personal financial needs.

- Repayment Terms: Flexible terms up to 12 years.

Business Loans

- Loan Amounts: Ranging from $20,000 to $500,000.

- Use Cases: For working capital, payroll, business expansions, or startup funding.

- Repayment Terms: Up to 12 years.

Specialized Loans

- Medical Loans: Tailored for healthcare practitioners.

- Debt Consolidation Loans: To help consolidate high-interest debts or merchant cash advances.

One of their standout features is their streamlined application process, which uses soft credit inquiries, so your credit score won’t be affected. Once approved, funds are typically disbursed within 3–5 days, making it a quick option for those in need of fast cash.

However, it’s important to note that their loans often come with higher interest rates compared to traditional bank loans. While their concierge-style service is a plus for many, the cost of borrowing can add up over time.

What Does It Take To Qualify For A BHG Financial Loan?

If you’re considering a loan from BHG Financial, it’s natural to wonder what it takes to qualify. While they don’t share all their requirements upfront, here’s what we know:

To be eligible, you’ll need a minimum credit score of 660. However, their average borrower tends to have a FICO score of 744, no history of bankruptcies or collections, and an annual income of around $241,000. This gives you an idea of the profile they typically work with, but don’t let these numbers discourage you—every application is unique, and they consider more than just your credit score.

If you’re unsure where your credit score stands or how it might impact your eligibility, check out our article, Is 639 a Good Credit Score? It’s a helpful resource to understand how credit scores work and what steps you can take to improve yours.

One thing to keep in mind is that BHG Financial doesn’t offer joint loans, meaning you can’t apply with a co-borrower. You’ll need to qualify on your own, so it’s important to ensure your financial profile is strong enough to meet their criteria.

BHG Financial Reviews

When considering a financial partner, hearing from real customers can make all the difference. BHG Financial has garnered a mix of praise and criticism across platforms like Trustpilot, the Better Business Bureau (BBB), and Google. While many clients highlight their professionalism and efficient loan process, others point out challenges with communication and customer service. Let’s take a closer look at what people are saying.

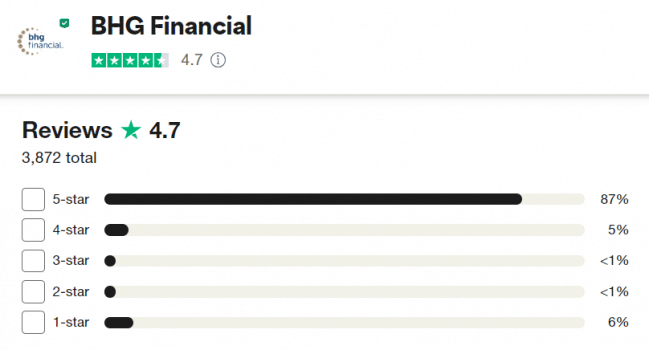

Trustpilot Reviews

BHG Financial has a 4.7/5 rating on Trustpilot, with clients praising their professionalism and loan process. Let’s look at some of them:

- Positive Review: “I came across BHG via mail. Initially, I thought it was a joke as I had not heard from them. After a few weeks I gave them a ring and from that call, it took less than a week to get approved for a six figure loan.”

- Positive Review: “The entire team provided excellent feedback and insight. They were very responsive to questions and complete in their answers. They were extremely helpful and very knowledgeable.”

- Negative Review: “Do NOT do business with this company. Very shady and almost impossible to get hold of someone after you sign. They have no website to check your balance or make a payment, everything has to go through email.”

BBB Reviews

The BBB rating for BHG Financial is 4.48/5, reflecting high customer satisfaction. Positive reviews commend their efficient service, while some complaints focus on bad customer service.

- Positive Review: “Hands down the absolute best to work with. Fast, friendly, convenient, truly happy with this company and will use them if need be in the future.”

- Positive Review: “Easy to work with and talked over needs and requirements.“

- Negative Review: “Terrible customer service. Ghosted us! We went through the initial application process and were connected to one of the Finance Managers to review the terms of the loan. She set up an appointment with us and no-showed at our agreed-upon time. I sent an email, which was never returned.”

Google Reviews

Google rates BHG Financial at 4.6/5. Customers appreciate the ease of applying for loans, though some note dissatisfaction with communication.

- Positive Review: “What a nice and stress-free experience getting a loan from BHG”

- Positive Review: “They were very easy to work with. After my approval, I had additional questions that almost made me back out (nothing they did, just me second guessing). I received a follow-up call that further outlined the current offer, and they also had a counter that directly addressed my concerns.”

- Negative Review: “We have had 2 loans with them. Good service when they want to get our business but when we need to resolve an issue where they have to pay us back, they are very slow to resolve the issue, sadly.”

Overall, BHG Financial has earned strong ratings on Trustpilot (4.7/5), the BBB (4.48/5), and Google (4.6/5), with many customers praising their quick approvals and helpful service. However, some reviews highlight issues with communication and post-approval support.

If you’re considering BHG Financial, it’s worth weighing these experiences to see if they align with your needs. And if you’re exploring other options, remember—there are always alternatives to help you achieve your financial goals.

The Pros And Cons Of BHG Financial Loans

Based on the information we’ve gathered and the reviews shared by customers, here’s a balanced look at the pros and cons of BHG Financial loans. This way, you can make an informed decision that aligns with your financial goals.

Pros

- High Loan Amounts: BHG Financial allows you to borrow up to $200,000, making it a great option for those needing significant funding.

- Flexible Repayment Terms: With terms ranging from 3 to 10 years, you can choose a plan that fits your budget and reduces your monthly payments.

- Fair Credit Consideration: Even if your credit isn’t perfect, BHG Financial won’t automatically deny you, giving more borrowers a chance to qualify.

- Quick Approval Process: Many customers appreciate the streamlined application and fast approval times, often within a few days.

- Specialized Options: They offer tailored loans for professionals, like healthcare practitioners, which can be a big plus if you’re in a specialized field.

Cons

- High Minimum Loan Amount: Loans start at $20,000, which might not be ideal if you’re looking for a smaller amount.

- Higher Interest Rates: While they accept fair credit, their rates start at 11.96%, which can be higher than other lenders, especially if you have excellent credit.

- Origination Fees: BHG Financial charges an origination fee of 3% to 4%, which can add to the overall cost of your loan.

- Customer Service Challenges: Some customers have reported difficulties with communication, including slow responses and difficulty reaching support after signing up for a loan.

- Funding Time: While approvals are quick, it may take up to 5 days to receive your funds, which could be a drawback if you need money immediately.

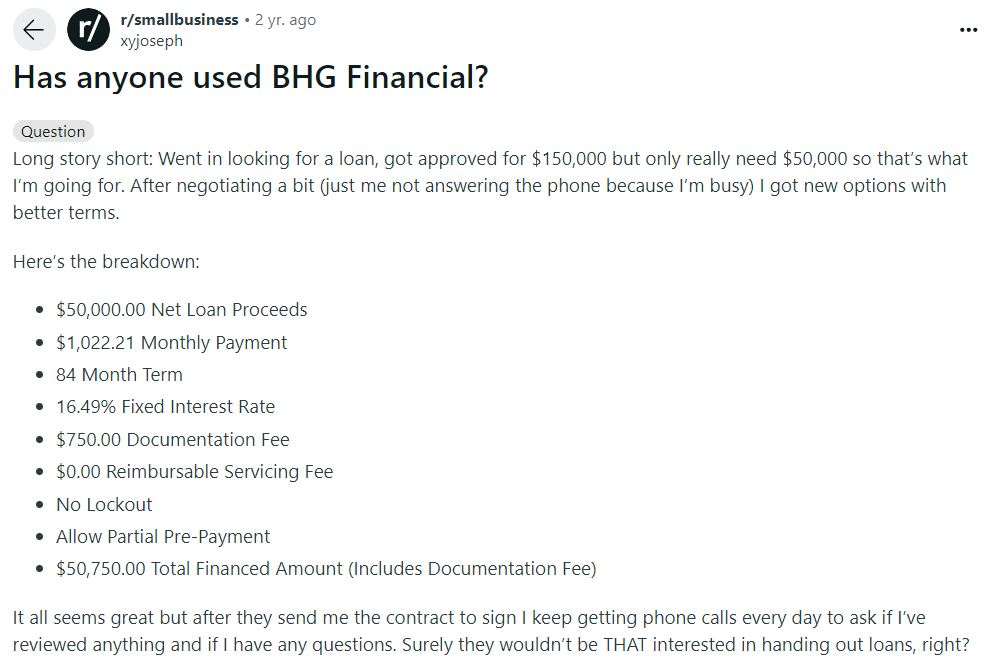

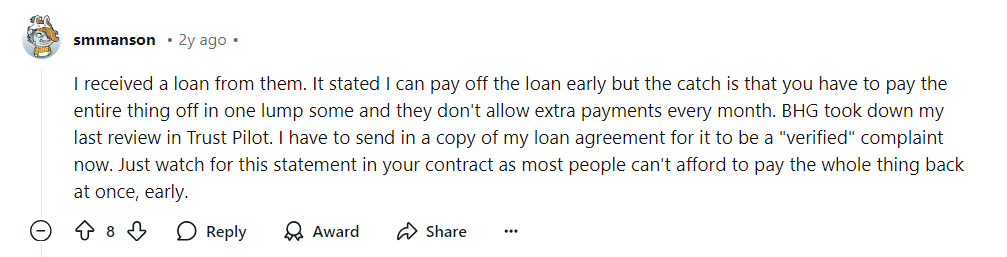

What People Are Saying Across Platforms

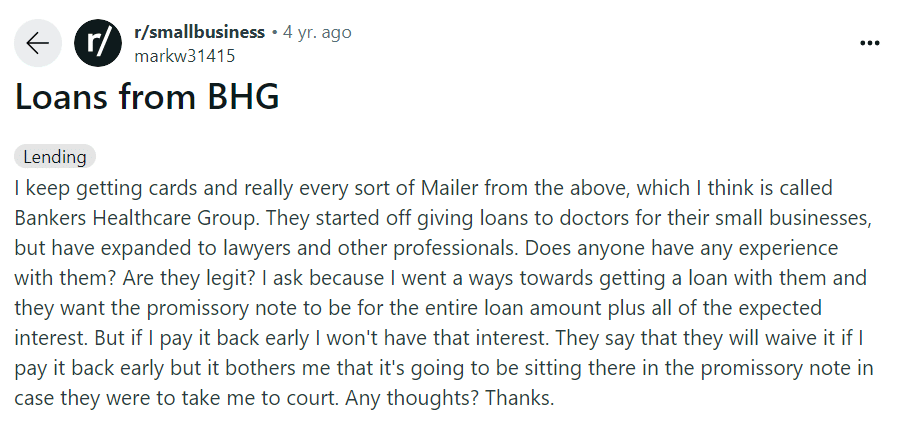

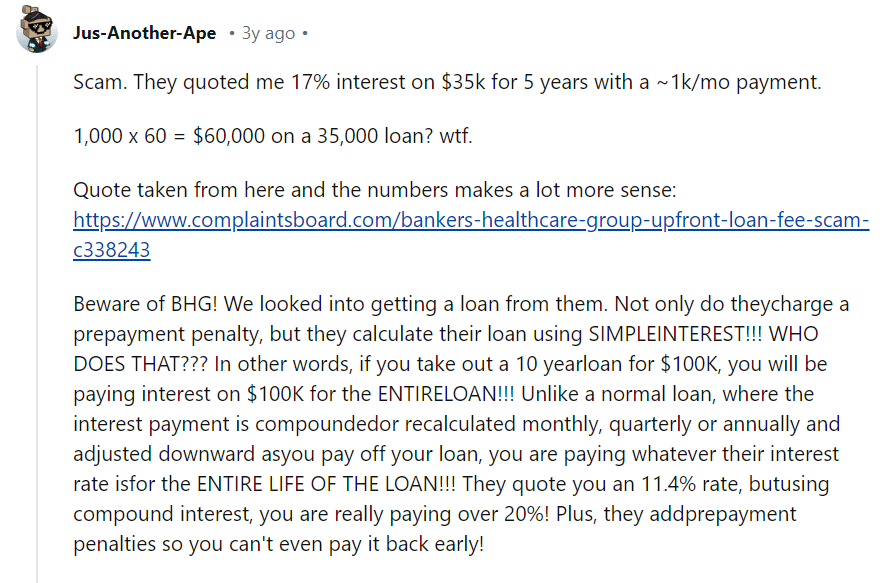

Reddit discussions about BHG Financial reveal a variety of opinions. Some users appreciate that their loans do not appear on personal credit reports, offering a level of financial flexibility. However, others express concerns over high-interest rates and prepayment penalties, which can significantly increase the cost of borrowing.

People Who Got Out Of Debt With CuraDebt

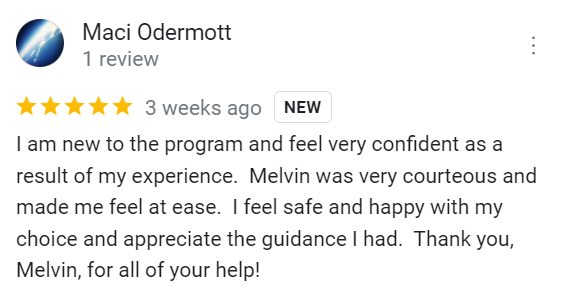

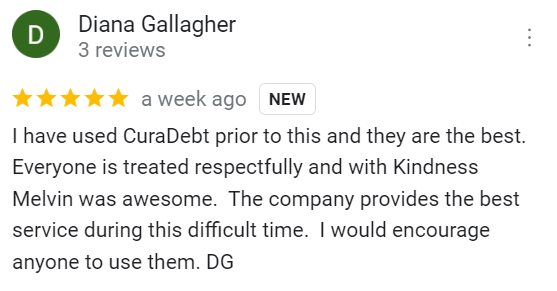

At CuraDebt, we’ve helped thousands of individuals and small business owners take control of their finances and find relief from overwhelming debt. Our clients’ stories are a testament to the power of personalized debt solutions and the difference it can make in their lives.

Take a look at what some of our clients have to say about their experience with CuraDebt—and see how we’ve helped them turn their financial situations around.

Conclusion: Finding The Right Financial Partner For You

Choosing the right financial solution is a big decision—one that can have a lasting impact on your financial well-being. BHG Financial offers legitimate loan services with decades of experience and high customer ratings, making them a solid option for those in need of specialized funding. However, their higher interest rates and occasional customer service challenges may not be the right fit for everyone.

If you’re exploring alternatives or feeling overwhelmed by debt, know that you don’t have to face it alone. At CuraDebt, we specialize in helping individuals and small business owners find relief from financial stress. Your financial freedom is within reach. Take the first step today by reaching out for a free consultation.

Let’s work together to create a plan that works for you and helps you move toward a brighter, more stable future.