Can The IRS Seize A Financed Car? What You Need To Know

Yes, the IRS can seize a financed car if you owe back taxes and have not made arrangements to pay your debt. However, the process is not as simple as it sounds. The IRS will assess the value of the car and calculate whether it will provide significant value after paying off any remaining loan balance. If the car is not worth enough to make a difference in covering your tax debt, the IRS might not move forward with the seizure.

Do you need tax help? CuraDebt is here for you.

What Assets Can The IRS Seize?

The IRS has broad authority to seize assets if you have unpaid tax debts. Assets they can seize include:

- Real estate: Your home, land, or other properties.

- Vehicles: Cars, boats, and RVs, even if they’re co-owned.

- Bank accounts: Checking and savings accounts.

- Wages: Through wage garnishment.

- Investment accounts: Stocks, bonds, and retirement accounts (within limits).

- Business property: Equipment, tools, and other assets.

What Assets Can’t The IRS Seize?

While the IRS has wide-reaching power, there are limits. Some assets they cannot seize include:

- Essential household items: Furniture, appliances, and clothing necessary for living.

- Unemployment benefits: Protected under federal law.

- Certain pensions: Social Security benefits (to an extent) and some retirement accounts.

- Public assistance payments: Including welfare or disability income.

- Children’s assets: Such as college savings accounts not tied to the debtor.

What Happens If The IRS Wants To Seize Your Financed Car?

If the IRS decides to seize your financed car, the process is more complex compared to seizing a fully owned vehicle because of the existing loan tied to the car. Here’s how it typically works:

1. The IRS Pays Off The Loan

Before the IRS can seize and sell a financed car, they must first address the loan balance with the lender. The IRS will pay off the remaining debt owed to the bank or financing institution to obtain full ownership of the car.

2. The IRS Sells The Car

Once the car is paid off, the IRS will sell it at auction or through another sale process. They aim to recover as much money as possible to apply toward your tax debt.

3. The IRS Keeps The Remaining Proceeds

After the car is sold, the IRS subtracts the amount used to pay off the loan and other sale-related costs. The remaining proceeds are applied to your tax debt.

Example Scenario

Imagine you owe $5,000 on your financed car, and its current market value is $10,000. If the IRS seizes and sells the car for $10,000:

- $5,000 will go to the lender to pay off the loan.

- $5,000 (minus administrative costs) will go toward your tax debt.

If the car’s value is lower than the loan balance (upside-down loan), the IRS is unlikely to seize it, as there would be no financial benefit for them after paying off the lender.

How To Protect Your Assets From The IRS

If you’re facing the possibility of asset seizure, there are steps you can take to protect your property:

1. Negotiate A Payment Plan

Work with the IRS to create an installment agreement. This allows you to pay your debt over time and can prevent seizures.

2. Request Offer In Compromise

An Offer in Compromise (OIC) lets you settle your tax debt for less than what you owe if you meet specific financial hardship criteria.

3. Apply For Currently Not Collectible (CNC) Status

If paying your debt would cause extreme financial hardship, the IRS might pause collection efforts.

4. Seek Professional Help

Tax professionals can guide you through the process and negotiate with the IRS on your behalf. CuraDebt specializes in resolving tax debts and can help you find the best solution. Take our free consultation today!

More Questions And Experiences

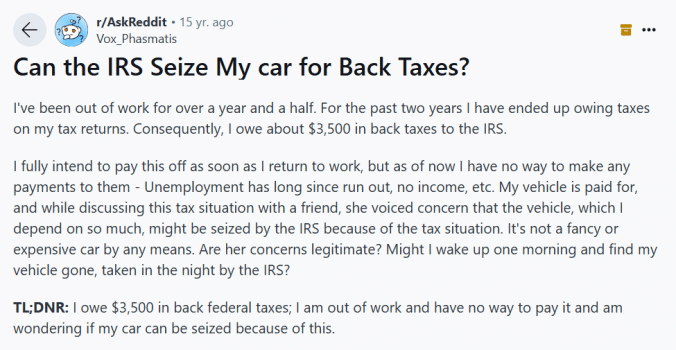

Can The IRS Seize My Car?

In this Reddit thread, a user shared concerns about the IRS taking their car. Respondents encouraged them to contact the IRS immediately to discuss payment plans or settlements, emphasizing the importance of proactive communication. He was also informed that the IRS must send several warnings first before doing that.

Can The IRS Seize A Co-Owned Car?

Another Reddit user asked about a car co-owned with their father. The advice? Remove the father’s name from the title as soon as possible to protect his share of the asset.

These examples highlight the importance of seeking advice from others and acting quickly to address IRS concerns.

Do You Have Tax Debt?

If you have tax debt, don’t worry—CuraDebt is here for you. We’ve helped countless individuals just like you find relief from their tax burdens, and you could be next!

Our expert team has experience negotiating with the IRS, preventing asset seizures, and creating manageable payment plans. We’ve already made a difference in the lives of many clients, and soon, we’ll be sharing their reviews right here.

Take the first step today with our free consultation. Let us help you navigate your tax challenges and regain control of your finances.

Conclusion

Facing tax debt and the risk of asset seizure can be daunting, but you don’t have to face it alone. From protecting your assets to negotiating settlements, there are solutions available to you.

CuraDebt offers a free consultation to help you explore your options and take the first step toward resolving your tax debt. Call us today and regain control of your financial future!