Coast Funding Reviews: What You Need To Know

When you’re seeking financial solutions for your business, the options can feel overwhelming. From traditional bank loans to alternative financing companies, finding the right partner to help your business thrive is crucial. In this article, we’ll explore Coast Funding, a company known for providing working capital and tailored financing solutions to businesses across the United States. We’ll review their services, operational model, and customer feedback to help you make an informed decision about whether they are the right choice for your financial needs.

What Is Coast Funding?

Coast Funding is an alternative financing company dedicated to helping small and medium-sized businesses access the funding they need to grow and succeed. Founded in 2020 and headquartered in San Diego, California, Coast Funding specializes in offering flexible funding solutions tailored to meet the unique challenges faced by businesses in various industries. Their mission is to simplify the funding process, ensuring businesses can secure the necessary capital quickly and efficiently.

Unlike traditional banks, Coast Funding focuses on speed and flexibility. They aim to provide funding with minimal paperwork and quick turnaround times—qualities that have made them a popular choice for business owners seeking fast financial support.

How Does Coast Funding Work?

Coast Funding offers a straightforward application process designed to provide businesses with rapid access to capital. Here’s a step-by-step breakdown of how their funding process works:

- Application Submission: Businesses can start by filling out an online application. The process is simple and doesn’t impact personal credit, making it accessible to many business owners.

- Initial Consultation: After submitting an application, a dedicated funding advisor contacts the applicant. This step ensures that Coast Funding understands the specific financial needs and goals of the business.

- Approval and Offer: Once the application is reviewed and approved, the business receives a tailored financing offer. This offer outlines the terms, repayment schedule, and funding amount.

- Funding Disbursement: Upon agreement, the funds are disbursed directly to the business, often within 24 hours. This quick turnaround is one of Coast Funding’s key selling points.

- Flexible Repayment: Repayment terms are structured based on the type of financing chosen and the business’s cash flow. Coast Funding aims to keep repayments manageable and aligned with the financial realities of the borrower.

This efficient process makes Coast Funding an appealing choice for businesses that need funding quickly and without the complexities of traditional loans.

Coast Funding Services

This company provides a variety of financing options to cater to diverse business requirements:

- Business Loans: Financing ranging from $10,000 to $1,000,000, suitable for specific business investments or large purchases.

- Business Line of Credit: Programs from $10,000 to $500,000, offering flexibility to draw funds as needed, with monthly rates starting at 2.99%.

- Working Capital: Funding from $5,000 to $2,000,000 to bridge cash flow gaps, ideal for financing new projects or significant expenditures.

- Equipment Financing: Amounts between $10,000 and $5,000,000 for purchasing business equipment, with terms spanning 2 to 5 years and fixed monthly payments.

- Receivables Financing: Converting future sales into immediate cash, with funding from $10,000 to $1,000,000, providing unrestricted use of funds.

Coast Funding Reviews

Customer reviews provide valuable insight into a company’s performance. Below is a summary of feedback on Coast Funding from Trustpilot and Google Reviews.

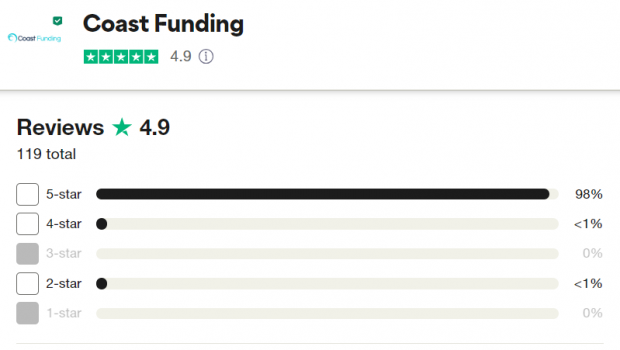

Trustpilot

Coast Funding has earned an impressive 4.9 out of 5 stars on Trustpilot, with many customers praising their fast service and personalized approach.

- Positive Review: “Great to work with Coast! Easy going process with the correct agent!”

- Positive Review: “This is my second time working with Coast Funding. Katie S. and team worked really hard to meet financing needs for me while finding a competitive above board rate for a very small business like mine with unique needs”.

- Negative Review: “I found them to be very, very pushy and extremely unprofessional when told I wanted to take a day to review their loan and see if it was a good fit for my business.”

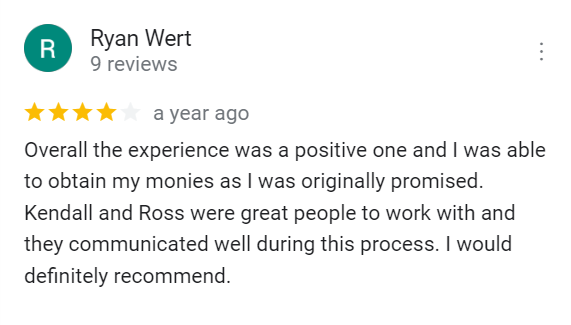

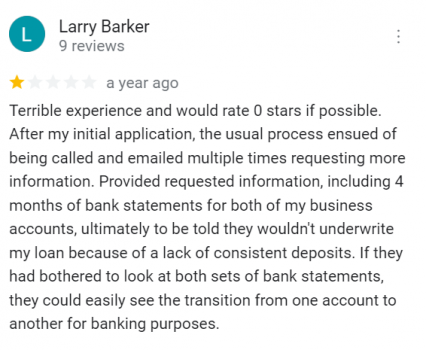

Google Reviews

On Google Reviews, Coast Funding holds an average rating of 4.6 out of 5.

- Positive Review: “This was one of the best experiences in obtaining funding for our business that I have had. I will definitely keep in touch!”

- Positive Review: “Coast Funding was very professional and the process, was very smooth. We will use this agency again in the future for our business.”

- Negative Review: “Was called repeatedly then no response, once I called the company I was declined by email with 5x the amount needed for approval!”

More Reviews

CuraDebt Reviews

At CuraDebt, we take pride in providing comprehensive debt relief services to help individuals and businesses regain control of their finances. Our personalized approach ensures that each client receives solutions tailored to their unique circumstances. Here’s what some of our clients have said:

Conclusion: Is Coast Funding the Right Choice?

Coast Funding offers various financing options and has mostly positive reviews from customers. People appreciate their fast service and how they tailor solutions to meet individual needs. However, some customers mentioned that communication and clear explanations of terms could be better. It’s important to think about your specific business needs and compare different funding providers to find the best option for you.

Managing business finances can be challenging, especially when debt starts to weigh you down. If you’re looking for a trusted partner to explore your best options, CuraDebt is here to help. Schedule a free consultation today and take the first step toward financial relief with expert guidance tailored to your situation.