Credit Card Debt Forgiveness For Disabled People

Dealing with credit card debt can be challenging, especially for individuals with disabilities who may face limited income and increased medical expenses. But did you know there are programs specifically designed to offer relief? If you’re wondering whether you qualify for credit card debt forgiveness, keep reading. This article will explore your options, explain the qualification process, and offer tips to reduce financial stress.

Additionally, we’ll discuss strategies for managing debt and how CuraDebt can help you regain control of your finances.

Credit Card Forgiveness For Disabled: Does It Exist?

Yes, credit card forgiveness for disabled individuals is a real option—but it’s not always straightforward. Creditors understand that disabilities can cause financial hardships and are often willing to work with you to find solutions. These solutions may include:

- Debt Forgiveness: Canceling part or all of your debt if your circumstances meet specific criteria.

- Debt Settlement: Negotiating to pay a reduced amount to satisfy the debt.

- Hardship Programs: Temporary relief, such as reduced payments or waived fees, to help you get back on track.

While these options exist, eligibility and terms vary by creditor. It’s essential to understand your rights and be prepared to advocate for yourself or work with a professional, like a debt relief company, to navigate the process.

Do You Qualify?

Eligibility for credit card debt forgiveness often depends on factors such as the type of disability, your financial situation, and the creditor’s policies. Below are key considerations:

1. Permanent Disability

If your disability is classified as permanent and prevents you from working, you may qualify for more comprehensive relief. This includes disabilities recognized by the Social Security Administration (SSA) or Veterans Affairs (VA).

2. Temporary Disability

Even if your disability is temporary, you may still qualify for hardship programs or debt relief if you’re unable to work or your income has been significantly reduced during this time.

3. Income Level

Creditors typically review your financial status to determine whether you qualify for forgiveness or settlement. Individuals with low or fixed incomes (e.g., those relying on Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI)) are often prioritized.

4. Supporting Documentation

To qualify, you’ll likely need to provide evidence, such as:

- SSDI or SSI approval letters.

- Medical records detailing your condition.

- Proof of income and expenses.

Meeting these requirements doesn’t guarantee forgiveness, but it can open the door to negotiating with creditors or accessing specialized programs.

How To Qualify

Qualifying for credit card debt forgiveness involves a combination of preparation, communication, and persistence. Here’s a step-by-step guide to help you through the process:

Step 1: Assess Your Financial Situation

Start by gathering all your financial documents, including credit card statements, proof of income, and a detailed list of monthly expenses. This will help you present a clear picture of your financial hardship to creditors.

Step 2: Contact Your Creditors Or Professionals

Reach out to your credit card companies to explain your situation. Ask if they offer hardship programs or debt forgiveness options for disabled individuals. Be polite but assertive, and don’t hesitate to escalate your request if necessary. You can also contact professionals like CuraDebt, our experts are ready to help you in these difficult times.

Step 3: Provide Documentation

Submit any required documents to support your claim. This may include medical records, disability benefit statements, and financial hardship letters.

Step 4: Follow Up

Creditors may take time to review your case. Be proactive in following up and ensure you understand the terms of any agreement before accepting it.

Are You Judgment Proof?

Being judgment proof means creditors cannot legally collect on your debts because your income and assets are protected by law. This is often the case for individuals whose only source of income is government benefits, such as SSDI or SSI.

Key Points About Being Judgment Proof:

- Creditors Can’t Garnish Protected Income: Disability benefits are typically exempt from garnishment, making it difficult for creditors to collect.

- You’re Still Responsible For The Debt: Being judgment proof doesn’t eliminate the debt—it just limits a creditor’s ability to enforce collection.

- You May Still Face Collection Calls: Creditors may continue to contact you, even if they can’t take legal action.

If you believe you’re judgment proof, consult with a legal or financial advisor to confirm your status and learn how to handle creditor communications effectively.

Consequences Of Being In Debt

Unpaid credit card debt can lead to serious consequences, including:

- Collection Calls: Persistent calls from debt collectors can add stress to an already difficult situation.

- Legal Actions: In some cases, creditors may sue to recover the debt.

- Stress And Anxiety: The emotional toll of debt shouldn’t be overlooked, either. Constant financial strain can lead to anxiety, depression, and even physical health issues.

To avoid these consequences, consider speaking with a debt relief expert. CuraDebt offers a free consultation to help you understand your options and take the first step toward financial stability.

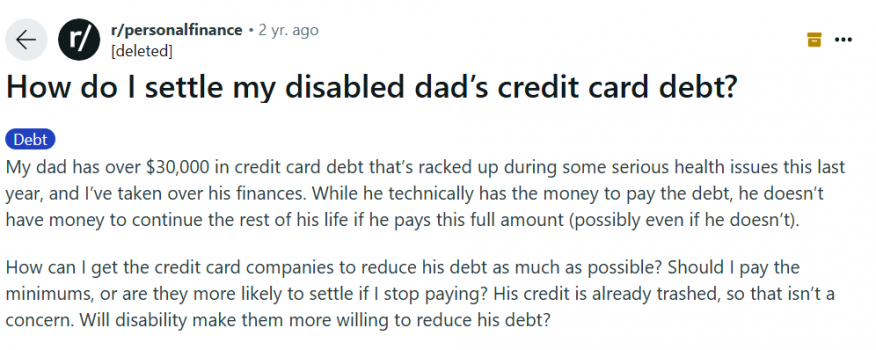

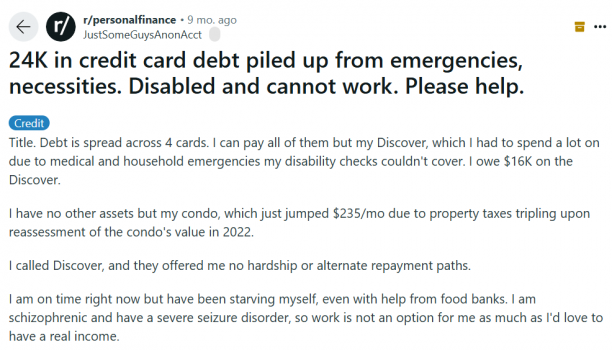

What People Are Saying On Forums

Online forums like Reddit can be a valuable resource for finding advice and support. For example:

A user shared their struggle with credit card debt while facing financial difficulties. Forum members advised them to delay payments to negotiate better settlement terms.

Another user, who was disabled, asked about debt forgiveness programs. Many commenters encouraged them to apply, sharing tips on documentation and communication.

CuraDebt Reviews

CuraDebt has helped countless individuals reduce their debt and regain financial freedom. Here’s what some of our clients have to say:

If you’re ready to take control of your finances, CuraDebt offers a free consultation to explore your options and create a personalized plan.

Conclusion

Credit card debt forgiveness for disabled individuals is a lifeline for those facing financial hardship. From understanding eligibility to exploring additional strategies, taking action today can set you on the path to financial stability.

At CuraDebt, we’re here to help. Schedule your free consultation now to learn how we can assist you in reducing your debt and reclaiming your financial freedom.