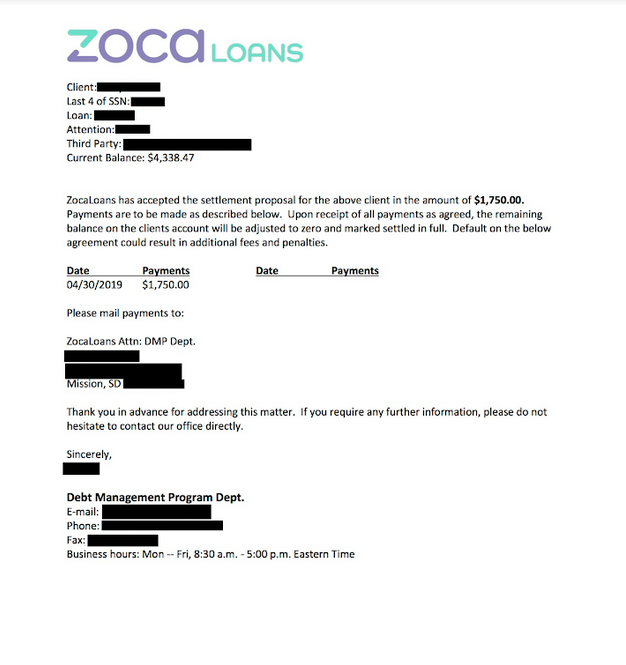

Zoca Loans Debt Settlement Letter From March 2019

Debt can feel like a never-ending cycle, but real success stories show that relief is possible. This Zoca Loans debt settlement letter from March 2019 is proof that debt settlement can lead to significant savings. By working with experienced negotiators, this client reduced their balance by 60%, paying only $1,750 on a total balance of $4,338.47.

If you’re dealing with high-interest loans or overwhelming debt, understanding how debt settlement works can help you decide if it’s the right path for you.

How Debt Settlement Works

- Evaluate Your Situation

Every debt relief journey starts with assessing your total debt, interest rates, and financial situation. The goal is to determine whether debt settlement is a good fit for your needs. - Stop Making Payments to the Creditor

In most cases, creditors are unwilling to negotiate unless they see that you are struggling to make payments. Stopping payments may allow you to build up savings for a settlement, but it can also temporarily affect your credit score. - Negotiate a Settlement

A professional debt settlement company reaches out to your creditor to negotiate a lower balance. Companies like CuraDebt have years of experience handling these negotiations, ensuring you pay as little as possible. - Make Your Final Payment

Once an agreement is reached, you’ll make a one-time lump sum payment (or structured payments, depending on the agreement), and the remaining balance is forgiven.

Is Debt Settlement Right For You?

✅ You have high-interest debt that keeps growing despite making payments.

✅ You’re struggling to make monthly payments and need a more manageable solution.

✅ You’re considering bankruptcy but want an alternative.

✅ You have unsecured debt (like payday loans, credit cards, medical bills) that could qualify for negotiation.

If you’re feeling stuck, the best way to know if debt settlement is the right option for you is to talk to an expert.

If you’re looking for a way forward, schedule a free consultation today. No pressure, just honest guidance to help you explore your best options.