What Is Debt Settlement?

Debt settlement (also known as a debt settlement program, debt negotiation, arbitration, or debt forgiveness) is a program that is designed to help you save as much money as possible, as quickly as possible, based on your unique financial situation. CuraDebt has an in-house performance based debt settlement program. This means that if you qualify for this program, you will only pay fees to CuraDebt as each one of your accounts is resolved and you ACCEPT the resolution. The program also has integrated creditor defense to maximize the capture of creditor violations which could result in better settlements and/or cash rewards for clients.

There are many factors that come into play in the debt negotiation process in order to get you the best possible reductions. These factors include the age of debt, type of debt, your income, the state you live in, your age, and many other factors.

Helping People Nationwide Since The Year 2000

CuraDebt has one of the most experienced teams in the industry. Starting in 1996, the founders of CuraDebt were helping individuals locally in California. In 2000 CuraDebt was formed to help individuals and small business owners nationwide.

CuraDebt is licensed and bonded in numerous states with a physical office in Hollywood, Florida. If you are in the area, call ahead of time and schedule a face-to-face counseling session.

Experience is extremely important because it means you get better results, a smoother process, and that the company is going to be around for the life of your program and beyond.

How The CuraDebt Debt Settlement Program Works

Debt settlement works by you placing an agreed-to amount into a special purpose account on a monthly basis. If you have a lump sum amount to get started or have access to a lump sum, it would accelerate the speed of the program.

As money accumulates, CuraDebt starts working the FDCPA and TCPA violation process. What this means is that using the debt collection laws, the CuraDebt team does everything possible to identify violations on behalf of the creditors or collectors. Violations that are pursued and won have resulted in as high as 5-figure cash awards for the client as well as dismissal (100% reduction) of the debts.

This element of the program is extremely important and all the internal processes are designed around making this happen. Keep in mind that no company can promise you will get your debts dismissed, but CuraDebt does everything possible at each step of the program to make it happen, and results have been phenomenal and getting better daily.

For the remaining debts, the extremely experienced in-house CuraDebt negotiations team finalizes resolutions with the creditors one at a time with the goal of saving you as much money possible on each account as quickly as possible. As each offer is near to be finalized, you will receive notification to approve it. Once you approve, the account is settled in full and only then are CuraDebt fees paid. The process continues until all the accounts are resolved.

Compared To Debt Consolidation

There are two types of debt consolidation. One type of debt consolidation is a debt consolidation plan that you would get through a credit counseling agency, which normally helps bring interest rates from the 20% range to about 8-10% on average. In comparison, debt settlement is a program where the amount paid back is the lowest negotiated amounts off the balances, so it is designed to save you much more money than just adjusting interest rates.

The second type of debt consolidation is a loan, either secured or unsecured, where your debts are combined. In this, you are paying a new loan, often with the loan origination fees incorporated as well as interest. In the case of a loan where the collateral for the loan was property or something you own, the risk is that the item can be repossessed if the loan isn’t made on time. In comparison, by negotiating on your balances, debt negotiation is designed to save you as much money as possible without linking the debts to your property.

With a debt settlement program, the goal is to pay back a reduced amount and resolve your debts as quickly as possible based on the funds available.

Compared With Consumer Credit Counseling Programs

Other people may consider a debt management plan provided (another name for the debt consolidation plan mentioned previously) by a consumer credit counseling company. These programs are sponsored by creditors and are designed to make you repay all your debt plus interest. In fact, you will pay a greater amount than your original debt, while your credit report may indicate that you have been repaying your debt through a third party. Some lenders may look at this as equivalent to a chapter 13 payment plan bankruptcy.

Ultimately, for people who are not making any or very little headway and especially anyone with any type of hardship, debt settlement and debt negotiation are programs to seriously be considered.

EXAMPLE

A young women had been struggling with her debt for the past 2 years. She had made payments into her accounts on a monthly basis, but the debt just did not seem to come down. She had been told that a debt consolidation loan would help with her debt. She did not like the idea of having to shift her debt to another lender and start over paying them. Because of this, she did some research and contacted CuraDebt, speaking with one of our debt relief counselors.

She was able to ask him all the questions she needed to help her understand the debt settlement program, how it was structured, what the benefits were, how the creditors get paid, what she had to do, what her reduced payment was going to be and what the implications were if she enrolled in the program. After a few days of research and consideration, she decided to enroll.

She followed the guidelines for the program that were easily laid out by the CuraDebt counselor. She was able to save money on a monthly basis, and settled all the unsecured debt she had within 28 months. By enrolling into the CuraDebt Debt Settlement Program, she settled on her debts in less time than if she were to have continued making minimum payments. She also learned valuable lessons on how to manage her money.

She was happy that the CuraDebt counselor that helped her was so patient in answering all her questions and available to her at any time to help and guide her through the process during the program.

Your First Step Towards Financial Recovery

Your best first step would be to speak to a CuraDebt counselor for a no-obligation confidential consultation. The counselor will provide you with more information on the program and advise you as to which program would fit your unique and specific needs. CuraDebt’s in-house debt settlement program could be the best option for you or we could inform you of other options that could assist you.

Your first step is to contact us on 1-877-850-3328 or get a free savings estimate by completing this debt consultation request to see if a debt settlement, debt negotiation or debt arbitration program will be best to meet your and your family’s financial goals.

If you are here reading this, you are not just sitting around waiting for your debt problems to go away. By getting informed you have taken the first step to solve the financial situation you may have found yourself in. Now is time to take action. Do not be one of those people, who because of fear, do not take the next step. You have some good information on ways to solve your debt problems now. What happens next is your choice.

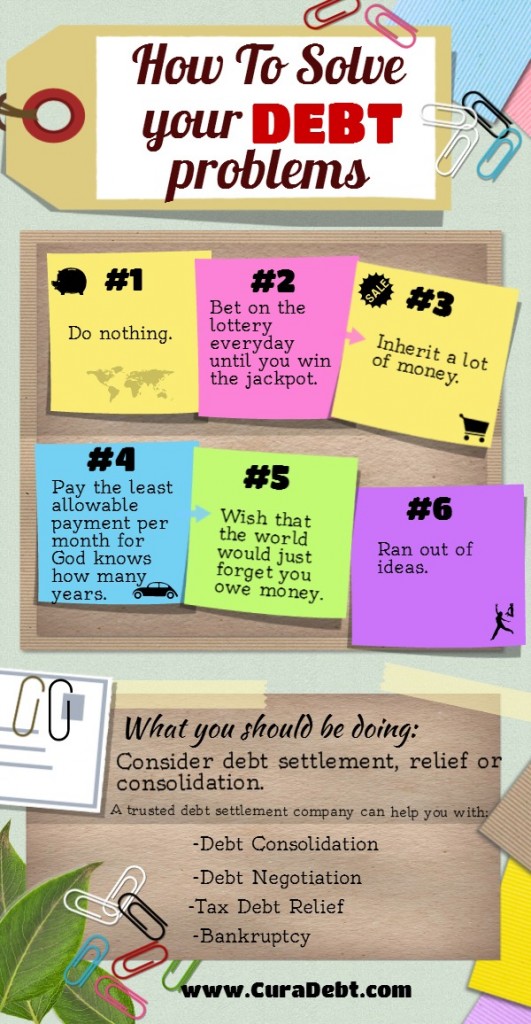

This is an infographic to give you ideas of debt relief options before starting with debt settlement company: