For anyone dealing with overwhelming debt, choosing the right debt relief company is a critical decision. DebtHammer has gained attention for its debt settlement services and customer-focused approach, earning high ratings across multiple platforms. But does it live up to the hype? More importantly, is it the right fit for your financial situation?

In this article, we’ll take a deep dive into DebtHammer reviews, exploring its services, customer experiences, and how it compares to other debt relief options. If you’re weighing your choices, this guide will help you make an informed decision.

What Is DebtHammer?

DebtHammer is a debt relief company that focuses primarily on debt settlement, a process that involves negotiating with creditors to reduce the total amount owed. Their goal is to help individuals struggling with unsecured debt—such as payday loans and credit card balances—by settling accounts for less than what’s originally owed.

Unlike some debt relief companies that offer a variety of financial services, DebtHammer is strictly focused on settlement. Clients are guided through a structured process that involves making monthly deposits into a dedicated savings account, which is later used to pay off settlements once agreements with creditors are reached.

With a strong emphasis on customer support and transparency, DebtHammer positions itself as a solution for those looking to reduce debt and regain financial stability. But how does their process actually work?

How Does DebtHammer Work?

DebtHammer’s approach is straightforward: instead of keeping up with impossible payments, they negotiate with creditors to reduce what you owe. Here’s what that process looks like:

- Free Consultation: They start by reviewing your financial situation to see if their program is a good fit. This is where they determine if debt settlement is the right path for you.

- Dedicated Savings Plan: If you move forward, you’ll begin setting aside money in a dedicated savings account. Instead of making monthly payments to creditors, this account builds up funds to use for settlements later.

- Negotiation with Creditors: Once there’s enough saved, DebtHammer steps in to negotiate. The goal is to get creditors to agree to settle your debt for less than the original amount.

- Finalizing Settlements: When a settlement is reached, the money from your savings account is used to pay it off. This process continues until your enrolled debts are resolved.

Debt settlement can be a helpful strategy, but it’s not the only option. It’s important to fully understand how it works, what it means for your financial future, and whether it aligns with your goals. Exploring multiple options before making a decision ensures you’re choosing the best path forward.

Debt Settlement Vs. Debt Consolidation

When looking for debt relief, two common options are debt settlement and debt consolidation, but they work in very different ways.

- Debt Settlement: Focuses on reducing the total amount you owe. A company negotiates with your creditors to lower your debt, often allowing you to pay a lump sum that’s less than the original balance. This can be a good option if you’re struggling with large amounts of unsecured debt and need significant relief.

- Debt Consolidation: Doesn’t reduce your debt but makes it more manageable. It combines multiple debts into one new loan, ideally with a lower interest rate. This simplifies your payments and may save you money on interest over time, but you’re still paying off the full amount.

Choosing between these options depends on your financial situation and long-term goals. If you want to dive deeper into which strategy might be best for you, check out our educational video where we break everything down in more detail.

DebtHammer Reviews

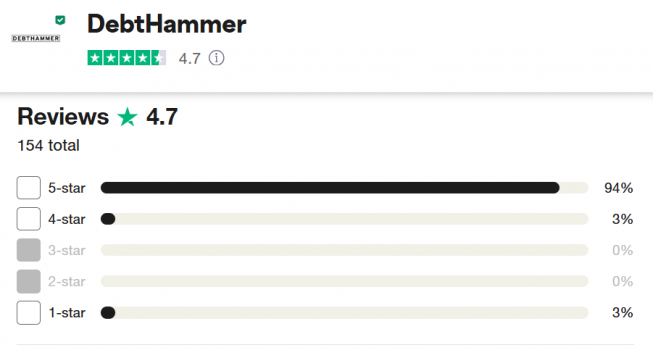

Trustpilot

DebtHammer holds an impressive 4.7-star rating on Trustpilot, reflecting a majority of positive reviews. Here’s a breakdown of customer sentiments:

- Positive Review: “I really appreciate Jaybee at Debthammer and helping me want to reach my goal of becoming debt free.”

- Positive review: “I felt comfortable with Marvin from the beginning. He was patient and easy to communicate with. We went over a number of issues that my previous lender had me so confused about.”

- Neutral Review: “It is so awesome to deal with a company who is helping you and understands that things come up. The only reason it is not 5 stars is that they do not try to negotiate with these loan people for a lower price.”

- Negative Review: “This company advertise that the loan companies listed in their website works with people that have filed bankruptcy and had a discharge, well with a little investigation every last one of the companies listed don’t work with a person that have filed bankruptcy.”

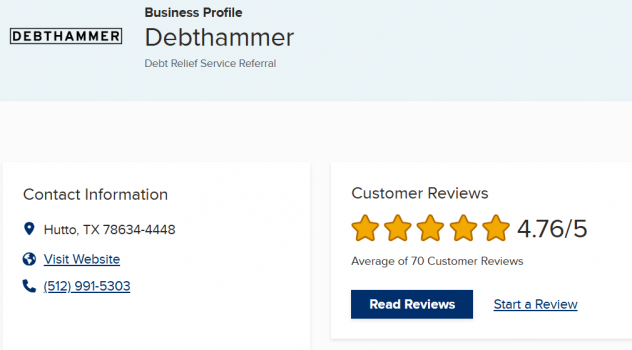

Better Business Bureau (BBB)

On the BBB website, DebtHammer has earned a 4.76 out of 5 rating, and customer experiences are generally favorable.

- Positive Review: “Very personable telephone presence, very helpful, polite. Helped attain the best solution for debt issue.”

- Positive review: “The man that went through everything was very complete in explaining things and answering all my questions.”

- Neutral Review: “Aggressive scam tactics. Calling incessantly and sending misleading text messages as if I made appointments or requested assistance.”

- Negative Review: “This company advertised to help with payday loans. They make you do all the work to get “enrolled”, charge 20% of what you owe and the calls or harassing texts don’t stop despite my multiple inquiries for an update on when this will stop.“

Despite its strong ratings. There are some recurring complaints from clients about receiving persistent follow-up calls, even after initial inquiries, and concerns over unclear terms regarding the debt relief process. These issues have caused frustration for some clients who expected clearer communication.

Pros And Cons Of DebtHammer

Customer feedback gives us a clear picture of what DebtHammer does well and where it falls short. Here’s a balanced look at their strengths and weaknesses based on real reviews.

✅ Pros

- Supportive and Patient Customer Service: Many clients praise DebtHammer’s representatives for being helpful, patient, and easy to communicate with.

- Clear Guidance Through the Process: Customers appreciate that the company takes the time to explain debt relief options, especially for those confused by previous lenders.

- High Ratings on Review Platforms: DebtHammer holds a 4.7-star rating on Trustpilot and a 4.76 on BBB, showing that many users have had positive experiences.

❌ Cons

- Limited Negotiation Efforts: Some clients feel DebtHammer could be more aggressive in negotiating lower amounts.

- Persistent Follow-Ups: There are complaints about excessive calls and messages, even if the person is not interested.

- Unclear Expectations for Bankruptcy Cases: Some reviews mention misleading claims about working with individuals who have filed for bankruptcy.

- High Fees: DebtHammer charges around 20% of the enrolled debt, which some clients feel is expensive.

Real Stories From People Who Took Control Of Their Debt

When you’re dealing with debt, it can feel like you’re facing it alone. But the truth is, countless people have been in your shoes and found a way forward. The journey to financial freedom isn’t easy, but it’s possible—and real people are proving that every day.

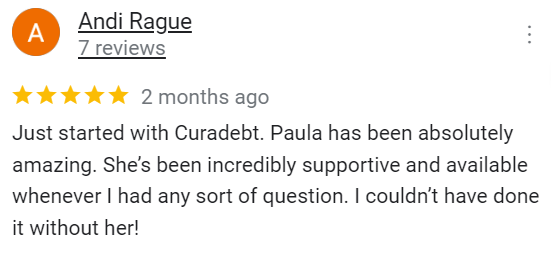

At CuraDebt, we’ve helped thousands of individuals regain control of their finances through debt settlement and tax resolution. Our approach is personalized, transparent, and focused on getting results. But don’t just take our word for it, here are real testimonials from people who took action and started their journey toward a debt-free life.

Final Thoughts: Finding The Right Path For You

Choosing a debt relief company is a big decision, and DebtHammer has helped many people negotiate their way out of overwhelming debt. Their process is straightforward, and their customer reviews reflect both success stories and areas where some have faced challenges—like persistent follow-ups and concerns about fees.

Debt settlement isn’t a one-size-fits-all solution. For some, it provides much-needed relief, while for others, the terms may not be the right fit. The most important thing is finding a solution that works for you, one that aligns with your financial goals and gives you real peace of mind.

If you’re still weighing your options, CuraDebt offers a free consultation to help you explore different debt relief strategies. Talking to an expert can give you clarity and help you take the next step toward financial freedom.