Should You Consider Five Lakes Debt Relief?

Dealing with overwhelming debt can be stressful, and finding the right company to help manage it is crucial. Five Lakes Debt Relief has positioned itself as a solution for those who need help consolidating or settling their debts. But is it the right choice for you? In this article, we’ll dive deep into Five Lakes Debt Relief, reviewing customer experiences, their services, and how they compare to other debt relief programs.

Looking for personalized guidance? CuraDebt offers a free consultation to help you explore the best debt relief options for your financial situation.

What Is Five Lakes?

Five Lakes Debt Relief specializes in providing debt settlement services to individuals struggling with unsecured debts, such as credit card debts, medical bills, and personal loans. Their team works by negotiating with creditors to reduce the amount owed, helping clients potentially pay less than the original balance.

Their services aim to help people in financial distress by reducing the total amount owed over time. However, like many debt settlement companies, it’s important to understand the potential risks, including the impact on your credit score.

Looking for a reputable debt relief company? Here’s a guide on how to choose the best debt relief option for your needs.

Is It Trustworthy?

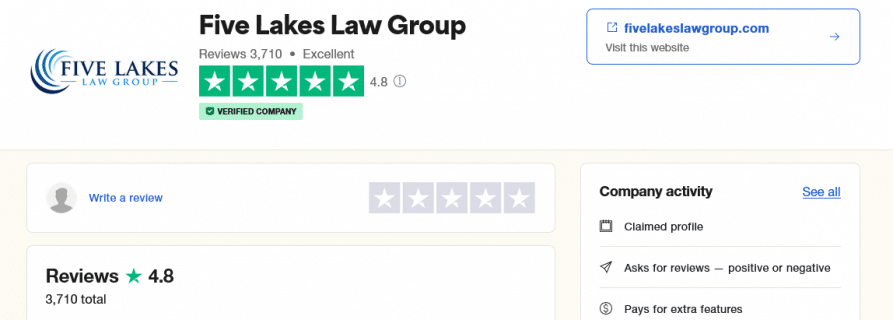

When considering any debt relief company, trustworthiness is a major factor. Five Lakes Debt Relief has garnered mixed reviews across various platforms. On Trustpilot, the company holds a decent rating of 4.8 stars, with some customers praising the effectiveness of their debt settlement services. For instance, one user stated, “Five Lakes helped me reduce my debt by almost 50%, and their team was always available to answer my questions.”

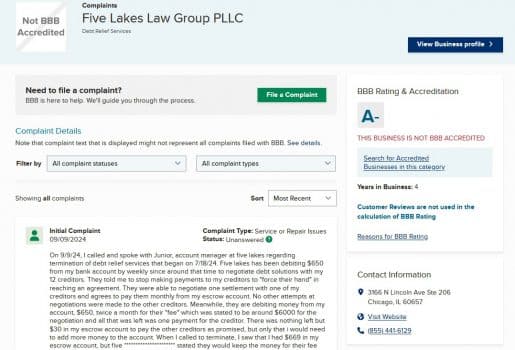

However, not all feedback is positive. Many customers on BBB have raised concerns about transparency and communication issues. One user shared, “I was charged fees that weren’t disclosed upfront, and it was difficult to get clear answers from their team when I had questions.” The BBB gives Five Lakes an A+ rating, but it’s important to note they are not BBB-accredited.

Five Lakes Debt Relief vs. Other Debt Relief Programs

Comparing Five Lakes Debt Relief to other debt relief programs is crucial to determining if it’s the best option for your needs. Here’s how they stack up against alternatives:

• Debt Settlement: Five Lakes focuses primarily on debt settlement, where they negotiate with creditors to reduce the total amount owed. This method can be effective, but it often comes with credit score impacts and potential fees that aren’t fully explained upfront.

• Debt Consolidation: If you’re considering debt consolidation, other companies may offer better rates. Debt consolidation combines all your debts into one loan with a lower interest rate, helping you manage payments easier. While Five Lakes does offer some consolidation options, reviews suggest that clients are often pushed towards settlement, which may not always be the best fit.

If you’re unsure which option is best for you, CuraDebt can help by offering a free consultation to explore alternatives like debt consolidation or debt management plans.

A Brief History of Five Lakes Debt Relief

While many debt relief companies have been around for decades, Five Lakes is relatively new. According to records from the Wayback Machine, their website first appeared in December 2021, which suggests they’ve been operating for just a few years. Despite being newer to the industry, they have gained traction quickly, likely due to aggressive marketing and partnerships with other financial institutions.

Real Testimonials from Trusted Sources

Here’s what real customers have to say about their experiences with Five Lakes Debt Relief across trusted platforms:

• Trustpilot: Five Lakes holds a 4.8-star rating, with some clients sharing positive outcomes. One user wrote, “They reduced my debt by 40% and were helpful throughout the process. I would recommend them if you’re struggling with high-interest debt.” However, others raised concerns about the length of time it took to see results.

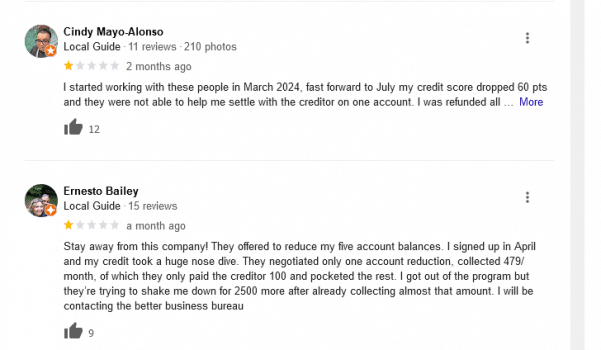

• Google Reviews: On Google, Five Lakes has mixed reviews. Positive reviewers often praise the helpfulness of the team, but others expressed frustration. One review mentioned, “I felt like I wasn’t given all the information upfront, and communication could have been better.”

• BBB Complaints: Although Five Lakes maintains an A+ rating, many customers have lodged complaints. One customer said, “I felt misled about how much I would actually save, and it was hard to get anyone on the phone when I had questions.” These kinds of complaints indicate that while the company may offer effective services, transparency remains an issue for some.

Conclusion: Is Five Lakes Debt Relief the Right Choice?

Based on reviews and the services offered, Five Lakes Debt Relief can be a viable option for some people dealing with unsecured debt. They have successfully helped many clients reduce their debts through settlement, and their customer service receives praise from those who experienced positive outcomes. However, concerns about transparency and hidden fees should make potential clients cautious.

If you’re considering Five Lakes, make sure to ask questions and get all the details before signing up. Alternatively, CuraDebt offers a free consultation where you can explore other debt relief options, including debt consolidation and tax debt relief, that might be a better fit for your financial situation.