Greenwise Financial Reviews: What You Need To Know

If you’re considering debt relief options, you’ve likely come across Greenwise Financial, formerly known as Greenwise Debt Relief, which has rebranded itself as Greenwise Financial Solutions. In this article, we’ll explore Greenwise Financial reviews, their services, and how they compare to other debt relief options. By the end, you’ll have a comprehensive understanding of whether Greenwise Financial is a good choice for your debt relief needs.

Looking for a reputable debt relief company? Take our free consultation today!

What Is Greenwise Financial?

Greenwise Financial, previously known as Greenwise Debt Relief, provides debt relief solutions tailored to individuals dealing with high levels of unsecured debt. The company focuses on debt settlement and negotiation, aiming to help clients settle their debt for less than the total amount owed. With a client-centered approach, Greenwise Financial offers solutions for those struggling to keep up with debt payments, specializing in unsecured debts like credit card debt, medical bills, and other personal loans.

The rebranding to Greenwise Financial Solutions reflects their commitment to providing comprehensive financial relief services. Although they still offer debt settlement services, the company aims to support clients with a holistic approach to managing debt and improving financial well-being.

Looking for a reputable debt relief company? Click here to read a guide on how to choose.

How Does Greenwise Financial Work?

Greenwise Financial operates primarily through debt settlement, a process in which they negotiate with creditors to reduce the total amount of debt owed. Here’s a step-by-step look at how they work:

- Free Consultation:

Greenwise Financial begins with a free consultation to understand your financial situation. During this consultation, they assess your debt levels, types of debts, income, and other financial details. Based on this information, they outline a debt relief plan that aligns with your financial goals.

- Enrollment In Debt Settlement Program:

Once you agree to their plan, Greenwise Financial will enroll you in a debt settlement program. This program is designed to help you save funds that will be used to negotiate settlements with your creditors over time.

- Monthly Payments To A Dedicated Account:

Clients make monthly payments into a separate account, which will eventually be used to settle debts once agreements are reached. Greenwise Financial manages this account, ensuring that it accumulates enough funds for negotiation purposes.

- Negotiation With Creditors:

After accumulating sufficient funds, Greenwise Financial’s team of negotiators will approach creditors on your behalf. They aim to negotiate a reduced payoff amount, ideally allowing you to settle each debt for less than what you originally owed.

- Completion And Debt Resolution:

Once settlements are reached, your debts are considered resolved, and Greenwise Financial supports you in transitioning to a debt-free future.

Greenwise Financial offers an alternative approach to traditional debt repayment, potentially saving clients both time and money in reducing their debt load.

Consequences Of Being In Debt

Being in debt can create significant challenges, affecting both finances and personal well-being. Here are some key consequences to consider:

- Financial Strain: High monthly debt payments can limit your ability to cover essential expenses and build savings.

- Accumulating Interest And Fees: Debt that isn’t managed quickly can spiral due to interest and late fees, making it harder to pay off.

- Mental And Emotional Stress: Debt-related stress can affect mental health, relationships, and quality of life.

- Hindered Long-Term Goals: Staying in debt can delay financial goals like homeownership, retirement savings, and investments.

These are just a few impacts of unmanageable debt. For a deeper look into the consequences and how they might affect you, watch our video, where we discuss this topic in detail.

Are you struggling with debt? CuraDebt can help you! Take our free consultation here.

Greenwise Financial Reviews

Let’s take a closer look at what customers are saying about Greenwise Financial across popular review platforms.

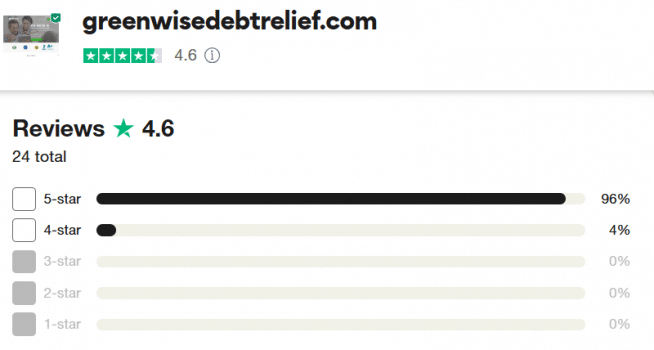

Trustpilot

Greenwise Financial has an average rating of 4.6 out of 5 stars on Trustpilot, based on 24 reviews. Here’s a glimpse of the feedback from satisfied customers.

- Positive Review:

“Excellent program. They are always so friendly and helpful.”

- Positive Review:

“They are very helpful and efficient, help you with through the whole process. Highly recommended.”

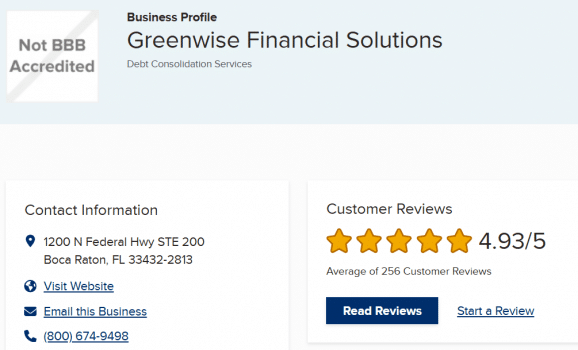

Better Business Bureau (BBB)

Greenwise Financial holds an impressive rating of 4.93 out of 5 stars on the Better Business Bureau website. Customer reviews highlight positive experiences, but there are also occasional complaints regarding the process:

- Complaint:

“When I initially was contacted from the company, they seemed to care. Later in the phone call, the man got really short with me. He asked if I had questions which I did, but then he said, we’ve been on here for a while if he didn’t want to answer my questions why did he ask?”

- Complaint:

“The company appears to make loans at a low interest rate, then they tell you they don’t make loans but are a debt relief company. Then they use call spoofing to call you using fake phone numbers from all around the country.”

Overall, Greenwise Financial maintains a strong reputation, with most customers reporting positive outcomes despite a few critiques around communication and customer service.

Google Reviews

On Google, Greenwise Financial holds an average rating of 4.8 out of 5 stars. Most clients appreciate the assistance they received, although there are occasional concerns:

- Positive Review:

“I had a very lovely and easy experience. They were very kind and thorough with the explanation of the whole process. I highly recommend!”

- Positive Review:

“I highly recommend Greenwise Financial Solutions for anyone in need of help paying off their debt.”

- Negative Review:

“if I could give this company 0 stars, I would. Not only did they promise that they reached an agreement with all three companies, they continued to make false promises that everything was going according to plan. As they withdrew my money from my account, they said all payments were happening accordingly. I am now facing a lawsuit from a company because of the lack of payments, and they said that there was never any contact attempts with them.”

CuraDebt Reviews

If you’re struggling with debt, CuraDebt is here to help. We’ve assisted numerous clients in successfully resolving their debt and rebuilding their financial health through tailored debt settlement programs. Here’s what a few of our clients have said:

If you’re looking for a debt relief company that prioritizes your unique needs, CuraDebt’s free consultation can help you determine the right path forward.

Conclusion: Is This Company The Right Choice?

Greenwise Financial Solutions has garnered positive feedback from many clients, with strong reviews on platforms like Trustpilot, the Better Business Bureau, and Google. However, like any debt relief company, there are mixed reviews, with some customers expressing concerns around communication and fees.

If you’re considering Greenwise Financial, it’s wise to weigh both the positive and critical reviews to determine if their approach aligns with your needs. Additionally, if debt settlement sounds like the best option, CuraDebt is another reputable company that offers personalized debt relief solutions tailored to your financial situation.

Still unsure? Contact CuraDebt for a free consultation and start exploring your options for a debt-free future today!