Receiving a notice or call from AllianceOne Receivables Management can be unsettling. Understanding who they are and how to handle their communications is crucial to managing your financial situation effectively. This guide will provide you with the necessary information and steps to take if you’ve been contacted by AllianceOne.

Need a loan or help with debt relief? CuraDebt is here for you.

What Is AllianceOne?

AllianceOne Receivables Management, Inc. is a debt collection agency that offers a range of services, including accounts receivable management, outsourcing, and call center solutions. They cater to various sectors such as automotive, financial services, government, education, healthcare, retail, telecommunications, and utilities.

How Does AllianceOne Work?

AllianceOne operates by partnering with businesses to recover outstanding debts. They contact individuals through phone calls, letters, or emails to inform them of their debt obligations and to arrange payment plans or settlements. Their goal is to recover funds on behalf of their clients while adhering to industry regulations and standards.

AllianceOne Services

AllianceOne provides a comprehensive range of services designed to assist businesses in managing and recovering debts. These services include:

- Accounts Receivable Management: Helping businesses manage outstanding invoices and payments.

- Outsourcing Solutions: Providing businesses with external support for debt collection processes.

- Call Center Operations: Offering customer service and support related to debt inquiries and payments.

These services are tailored to meet the diverse needs of their clients across various industries.

Looking for a reputable debt relief company? Take our free consultation today!

Have You Been Contacted By AllianceOne?

If you’ve been contacted by AllianceOne, it’s important not to panic. Receiving communication from a debt collector can be stressful, but remember that you have rights and options. Stay calm and take the following steps to address the situation effectively.

What Happens If You Don’t Respond

Certainly, ignoring communications from AllianceOne can lead to several consequences:

- Increased Collection Efforts: They may escalate their attempts to contact you, including more frequent calls or letters.

- Credit Report Impact: Unresolved debts can be reported to credit bureaus, negatively affecting your credit score.

- Legal Action: In some cases, the creditor may pursue legal action to recover the debt, potentially resulting in wage garnishment or liens.

It’s crucial to address the situation promptly to avoid these potential outcomes.

What Can You Do?

If AllianceOne has contacted you, consider the following steps:

- Verify The Debt: Request written validation of the debt to ensure its accuracy and legitimacy.

- Understand Your Rights: Familiarize yourself with the Fair Debt Collection Practices Act (FDCPA) to know what debt collectors can and cannot do.

- Negotiate A Settlement: Engage in discussions to potentially settle the debt for less than the full amount owed.

- Seek Professional Help: Consult with a reputable debt relief company to explore your options and receive guidance tailored to your situation.

Debt settlement can be an effective option to reduce the amount you owe and resolve your debts more quickly. At CuraDebt, we offer a free consultation to help you understand your options and develop a personalized plan to achieve financial freedom.

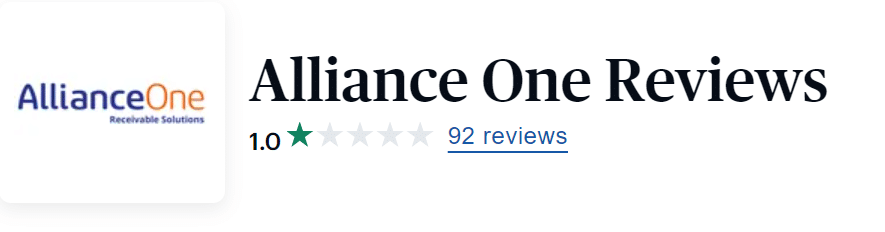

AllianceOne Reviews

Understanding the experiences of others can provide valuable insights into AllianceOne’s practices. Here’s a look at reviews from various platforms:

Consumer Affairs

AllianceOne has an average rating of 1.0 stars based on 92 reviews on Consumer Affairs. Let’s look at some specific experiences.

- Negative Review: “Not sure how and when but ALLIANCE ONE sent me a bill that’s assigned amount $4; but they are charging me $38.16 for their fees? Honestly, there is no explanation.”

- Negative Review: “Their customer service is HORRENDOUS. The lady gave me such attitude over the phone, and I was talking to her so nicely just to explain to me what the cause was etc. But she acted as if she didn’t want to help me at all.”

Yelp

On Yelp, AllianceOne holds an average rating of 1.3 stars based on 15 reviews. Here is what people are saying:

- Mixed Review: “I let a simple fix it ticket go WAY past due for its sign-off. There were complications because I sold the car, and forgot about the ticket. I got a bill from court and Alliance stating that what would have been completely without charge was now $600! I went to court to beg for some relief, hoping to avoid the Alliance window all together. No such luck. As it turned out, it was just a matter of THEM signing me up to see the judge instead of the court’s window. I showed the judge that I had sold the car, (a fact that they confirmed on the spot with the DMV) Explained the hardship that amount would cause me, so the Judge reduced the fine to $50, and a $25 processing fee. Word to the wise, It’s better to face the music, even if you think it’s too late. They were totally willing to listen to my story and help hook me up with the Judge who could change the fine.”

- Negative Review: “Got a call from them saying that I owe 2832.20 for a September 26, 2019, toll in Tampa, Florida. Never even been to Tampa. Where did they get my number or company name?”

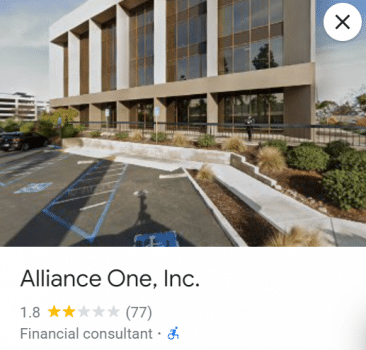

Google Reviews

AllianceOne has an average rating of 1.8 stars based on 77 reviews on Google. These are some opinions:

- Positive Review: “I understand my experience is the minority here, but I think it’s fair to tell people what happened for me. When I called, the phone was answered by Bryan Moe, who handled my case quickly and professionally. The correct amount was given, we handled payment over the phone, and the call didn’t last 5 minutes. I can’t say how they react to discrepancies in payments because I didn’t have any, but overall my experience was as good as it could be, given the circumstances.”

- Positive Review: “I called in and the gentleman who helped me was very polite and helpful. Just shows how much kindness on the phone can go a long way.”

- Negative Review: “I got a letter in the mail saying I owe them money, I only have loans from Actual Banks. Watch out for these scam artists. All they do is spread vicious lies and rumors.”

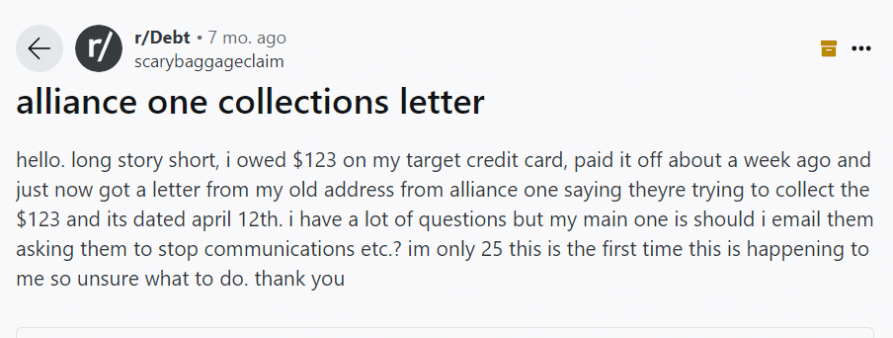

What People Are Saying

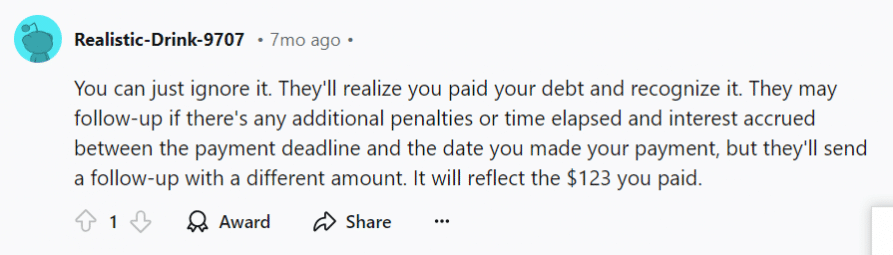

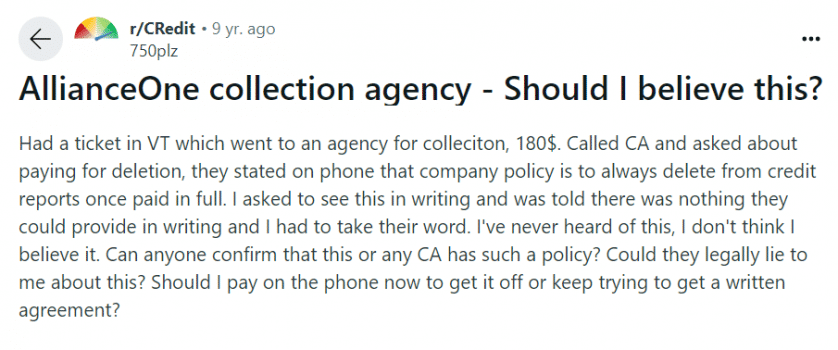

Exploring discussions on platforms like Reddit and Quora can provide additional perspectives on dealing with AllianceOne.

A user shared that AllianceOne was attempting to collect a debt they had already paid. Respondents advised waiting for the company’s records to update, as the payment was recent.

Another individual mentioned that AllianceOne was collecting a debt but couldn’t provide documentation confirming the removal of the debt from their credit report upon payment. Commenters suggested requesting the documentation again or considering payment to the original creditor.

Engaging in such forums can offer practical advice and shared experiences from others who have faced similar situations.

CuraDebt Reviews

If you need help with debt, CuraDebt can assist you. We’ve helped numerous individuals regain financial stability, and you could be next. Our clients have shared positive experiences about our services, highlighting our professionalism and effectiveness in resolving their debt issues.

Take our free consultation now and regain control of your financial life!

Conclusion

AllianceOne Receivables Management is a legitimate debt collection agency with a range of services. However, reviews and complaints indicate that some individuals have experienced challenges in their interactions. If you’ve been contacted by AllianceOne, it’s essential to understand your rights and explore all available options.

At CuraDebt, we offer a free consultation to help you navigate your debt situation and find the best path forward.