Finding the right lender is an important step when exploring personal loans and debt solutions. Heights Finance is a regional lender with over 30 years of experience, offering personal loans and debt consolidation options for borrowers with a variety of credit backgrounds. If you’ve been researching Heights Finance reviews, you’re likely trying to determine whether they’re a good fit for your financial needs.

In this review, we’ll take a closer look at Heights Finance—its loan offerings, customer experiences, and how it compares to other lenders. By analyzing real feedback from platforms like Trustpilot and the Better Business Bureau (BBB), we’ll provide a balanced perspective to help you make an informed decision.

What Is Heights Finance? A Deep Dive Into the Company

Heights Finance is a regional lender that specializes in personal loans, debt consolidation, and refinancing solutions. Headquartered in Greenville, South Carolina, the company has been serving customers for over 30 years. Heights Finance is particularly focused on helping hardworking, everyday people who may face challenges securing loans from traditional financial institutions

The company emphasizes a fast and easy loan process, with a strong commitment to providing a 5-star service experience. This customer-first approach has helped Heights Finance become one of America’s leading consumer finance companies

It offers installment loans and related products tailored to meet the needs of borrowers, including those with less-than-perfect credit, making it a valuable resource for individuals looking to manage their financial challenges effectively.

What Services Does Heights Finance Offer?

Heights Finance provides a range of financial services designed to meet the needs of borrowers, particularly those who may face challenges accessing traditional lending options. Here’s a closer look at the services they offer:

1. Personal Loans

Heights Finance specializes in personal loans that can be used for a variety of purposes, such as managing unexpected emergencies, covering medical expenses, or consolidating debt. These loans are designed to be fast and accessible, with a focus on providing a 5-star service experience to borrowers

2. Debt Consolidation

Debt consolidation is another key service offered by Heights Finance. This option allows borrowers to combine multiple debts into a single, more manageable monthly payment. By consolidating debts, customers can simplify their finances and potentially reduce the overall cost of repayment. This service is particularly beneficial for individuals juggling high-interest credit card debt or multiple loan payments.

3. Refinancing Options

For borrowers looking to improve the terms of their existing loans, Heights Finance offers refinancing solutions. Refinancing can help customers secure lower interest rates, reduce monthly payments, or adjust the loan duration to better fit their financial situation. This service is ideal for those seeking to make their loans more affordable or manageable over time.

4. Credit Insurance

Heights Finance also provides credit insurance, which is designed to protect borrowers in the event of unexpected financial setbacks, such as job loss, illness, or other emergencies. This added layer of security can give borrowers peace of mind, knowing they have a safety net in place if unforeseen circumstances arise.

Heights Finance Loan Options Explained

Heights Finance operates primarily through in-branch loan processing but also provides online and phone application options. Borrowers need to provide proof of income, a valid ID, and collateral for most loans. Loan terms include:

- APR Range: 15.99% to 35.99% depending on creditworthiness.

- Loan Uses: Debt consolidation, unexpected expenses, or home improvements.

- Eligibility: Applicants must meet credit and income requirements, with decisions often made quickly.

This localized and personalized approach appeals to borrowers seeking a straightforward loan process.

Heights Finance: Pros And Cons

| Pros | Cons |

|---|---|

| Personalized Service: In-branch assistance offers a tailored experience for borrowers. | High-Interest Rates: APRs can range from 15.99% to 35.99%, which may be steep for some. |

| Quick Loan Approval: Many customers report a fast loan approval process. | Mixed Customer Reviews: Ratings vary significantly across platforms, with some negative feedback noted. |

| Flexible Loan Uses: Loans can be used for various purposes, including debt consolidation, emergencies, and home improvements. | Limited Online Presence: While they offer online applications, the primary focus remains on in-branch service. |

| Established Reputation: Over 30 years in the industry provides a level of trust for borrowers. | Customer Complaints: Issues such as misclassification of loans and slow response to resolutions have been reported. |

Customer Insights: Heights Finance Reviews on Trustpilot, BBB, and Wallethub

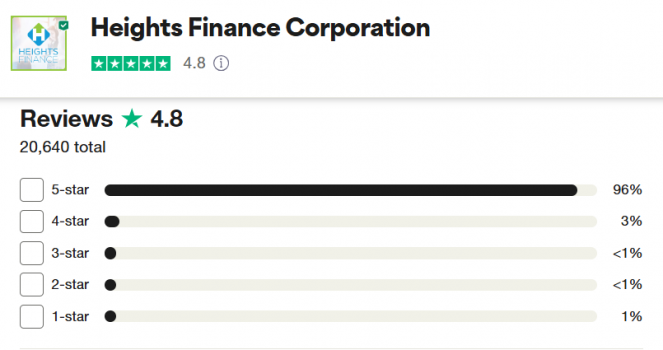

Trustpilot Reviews

Heights Finance has an impressive 4.8-star rating on Trustpilot, with many customers praising their professional service and quick loan approval process.

- Positive Review: “I’ve been with you for a while, and I’ve never had any problems. Every associate has been kind, helpful and understanding.”

- Positive Review: “At the Temple, Texas office, the workers help if you are in need. Makes you feel as family, able to get the job done professionally.”

- Negative Review: “Painful. Endless process for high rate loan. The local office has little or no ability other than to echo the comments from the home office.”

Better Business Bureau (BBB) Reviews

Heights Finance has a 1.17-star customer rating on BBB. Let’s look at some of its complaints

- Complaint: “I refinanced my loan, and it was paying off another loan with another business. The other business has not received the money. Heights says it been cashed, but they won’t share a copy of the deposit with other company for the signature on the back.”

- Complaint: “This company classified my loan as a car loan on my credit report, and it was a personal loan. I ask for this to be remedied by immediately removing it from my credit history.”

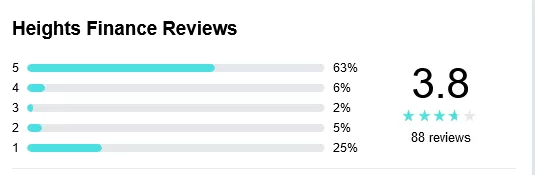

WalletHub Reviews

On WalletHub, Heights Finance scores 3.7 stars, with reviews reflecting a mix of positive and critical experiences:

- Positive Review: “Heights Finance is always helping us when we are low on cash. I recommend you go get a loan from Heights Finance.”

- Positive Review: “First time going, clean place and excellent service. Answered all our questions. Will be using them again. I will also recommend them to other friends.”

- Negative Review: “Applied for a loan and got approved, agreeing to the high rate to try to build my credit back up. However, in the middle of signing the paperwork, they changed their mind after I had been sitting there for seven and a half hours. They called the place back and told them they had changed their mind about giving me the loan. I would never recommend this company to anyone.”

Other Experiences

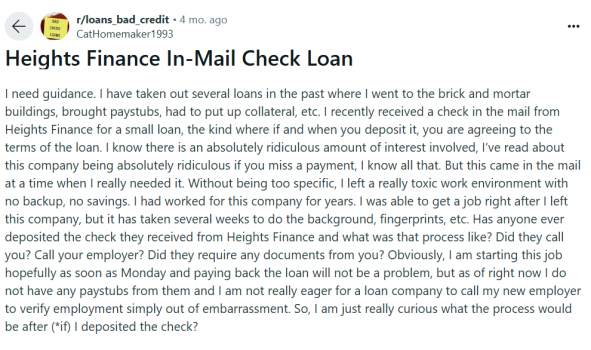

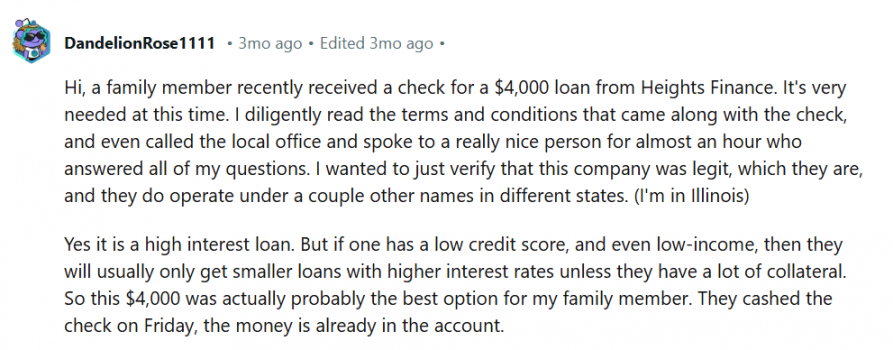

Beyond formal reviews, platforms like Reddit and Yelp offer anecdotal insights.

On Reddit, one user shared receiving a pre-approved loan offer, which another user confirmed was legitimate, praising the company’s transparency. He also mentioned their high fees.

Conversely, on Yelp, a reviewer complained about being charged double the loan amount. This highlights the importance of having a lawyer and keeping every document you can.

CuraDebt Reviews

If Heights Finance’s high-interest rates or mixed reviews leave you uncertain, explore a smarter way to tackle debt. CuraDebt’s expert team has helped thousands reduce their financial burden—see if we can help you too.

Here’s what our clients say:

Conclusion: Is Heights Finance the Right Choice?

Heights Finance offers a range of personal loan options with a focus on localized service and a commitment to providing a 5-star customer experience. However, it’s important to consider the potential downsides. The company is known for its high-interest rates, which can lead to increased repayment costs, and customer feedback on platforms like the Better Business Bureau (BBB) and WalletHub is mixed, with some users expressing concerns about affordability and service transparency.

If you’re looking for a more affordable way to tackle your debt, CuraDebt may be able to help. Our debt settlement services are designed to reduce what you owe and provide a clearer path to financial relief.

Schedule a free consultation today. Our experts will listen to your situation, explore your options, and help you find the best solution for your needs. There’s no obligation, just honest guidance to help you move forward with confidence.