MASSIVE BENEFITS FROM GETTING IRS/STATE TAX DEBT SOLVED

You have likely heard of IRS/State tax debt relief and that the IRS is one of the most powerful collection agencies in the world. They can garnish your wages, levy your bank account or place liens on your property without ever having to file a lawsuit. They can refer cases for criminal proceedings. And laws have been expanded to allow them to cause the revocation of your passport if tax debts exceed a certain amount.

By getting tax debt solved, not only do you sleep better at night, but you can live your life again knowing that things will be fine tomorrow.

AVOID DOING IT YOURSELF

You may have heard that doctors often will not even treat their own families. There is an emotional factor involved. So, even if you are a CPA or EA, which most people are not, we don’t recommend doing it yourself.

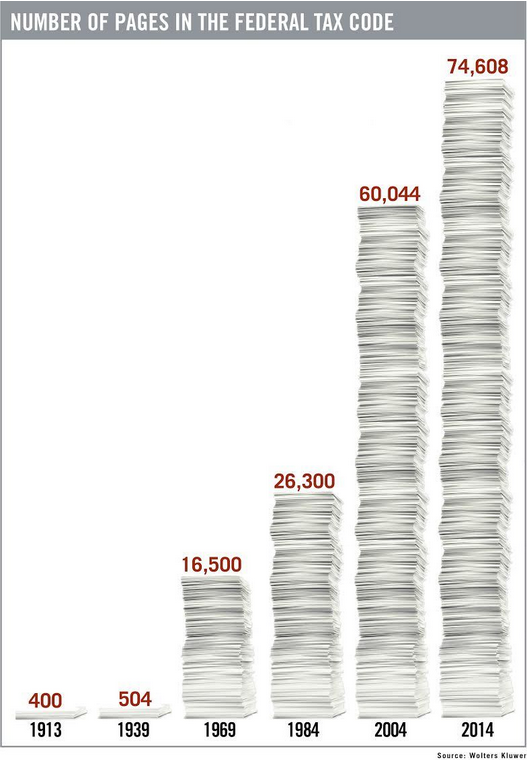

First, there is an enormous amount of continually changing tax laws to understand.

Second, one mistake could mean that the IRS excludes you from much better resolutions you rightfully would have qualified for. The IRS/State holds individuals to the standard of a tax professional and assumes what they are saying or submitting is 100% accurate.

We’ve had numerous cases where people trying to save money ended up saving in tax professional fees, but causing issues that caused them to pay much more than they saved in additional tax debts. We fortunately were able to unravel the issues they had caused and save them more money even after paying our fees.

THE EFFECT OF NOT SOLVING TAX ISSUES PROPERLY

You’ve likely seen the horror stories of people who paid a tax relief company many thousands of dollars, nothing was done, and their issue snowballed into bigger and bigger ones. Not to mention, the sleep lost and stress were never compensated for.

The goal is to let you sleep peacefully at night knowing that what you are investing in tax professional services gets you the best solution, the first time.

NOT ALL TAX RELIEF COMPANIES WILL GIVE YOU THE SAME BENEFITS

With so many different tax relief companies out there, which is going to give you the best solution as well as the greatest peace of mind the fastest? And which options must you avoid because they could actually cause you to pay much more than you actually owe for taxes (or worse yet, not do anything for you)?

The good news is that we’ve done the research for you. The bad news is that a limited number of clients are accepted each month so hopefully it’ll be available when you take action.

Can you remember when you could wake up in the morning, feeling great, and knowing things were set financially? With no need to dodge the IRS/State revenue officer, or check your bank account to make sure it hadn’t been levied. And you could go to work not concerned if your employer had received a garnishment notice. I believe that this is not only possible, but is your right, and the goal is to make it so now when you choose the best tax relief company.

CRITERIA FOR TAX DEBT RELIEF COMPANY EVALUATION

There are some key criteria to keep in mind when choosing a tax debt relief company:

- Does an investigation before quoting fees for work. If you call around and speak with tax relief companies, you’ll find many that try to pre-qualify you for an offer in compromise or other very attractive resolution over the phone in minutes. Then they quote fees, usually in the thousands to solve the tax issue. If only it were that easy. If you google their company name and complaints you’ll likely find numerous upset customers. Why? Because the guidelines that the IRS uses to qualify for excellent resolutions such as an offer in compromise (or similar where you don’t pay anything until the debts expire) are complicated, vary per state and have many variables involved. The other issue is that the government agencies CFPB and FTC are very aggressive against companies charging fees and suggesting an individual will get a certain resolution. They have closed numerous companies over the years. The last thing anyone wants is to pay a company and have it go out of business. You may also find companies that will start to bill you hourly for work

- Does a thorough investigation. About 8 years ago, the standard price for an investigation was $947. Then one company started charging $500. Another big player in the industry started charging $495. Their goals as I quote one of the founders of one of these companies was to “dominate the entire market by getting people in the door and then raising the fees on the back end.” If you google their company names and complaints you’ll see many complaints about their $500 or $495 investigations. For example, that the sales rep called back in 2 days telling them what they qualified for. Then they went ahead with it but they didn’t really qualify for it and had to go with another resolution. You see, the investigation is like doing the planning for the foundation of the building of a building. If the foundation is just done quickly without proper planning, the entire building could fall down. Additionally, if the investigation isn’t done as detailed as it should, then you could potentially find yourself receiving collection notices from the IRS some years later on the same issue you thought you had “solved.” Most of these companies will refuse to even quote fees for their resolution work- you only get this when the low cost investigation is done- often seeing that they are much higher than the industry norm.

- 11 points for a proper investigation. The investigation to ensure you pay the lowest legal amount and everything has been fully investigated so that you can sleep well at night must have these components:

1) Total amount of taxes owed per year.

2) The reasons the IRS and/or State has for the assessment of taxes.

3) Details of the taxes owed, interest, and penalties assessed.

4) By what dates each year’s liabilities will be exempt based on the statute of limitations.

5) Identify any missing or substitute filed returns.

6) Identify the status of all collection activity, including liens, levies, holds and pending enforcement action.

7) Determine if a revenue officer or other tax collection agent is pending to be assigned soon.

8) Determine the financials as per income, IRS valuation of assets, and what the IRS has for allowable expenses.

9) Identify what is needed to become tax compliant that must be done prior to starting the resolution.

10) Recommended a resolution plan or several options with the reasoning why, and target timeframes for accomplishment of each.

11) Verify eligibility for potential relief programs, such as penalty abatement, innocent spouse relief, or offers in compromise, to reduce the overall tax burden.

- Best possible resolution internal policies. Ask about this when you speak with tax relief companies, what internal checklist and process they have where they work with you to go to action on your financials to do all possible to qualify for the best resolution. Many companies with the bargain investigations do a cursory financial profile over the phone and others ask the client to fill it in. Some lead the client into believing they’ll qualify for a better resolution than they really do – but then when it’s submitted the IRS/State rejects it. The issue is that often assets and income are overstated and expenses are missed when a client does their financials at first. Also, there are often allowable exemptions that most people don’t even know they have available. The key is that the company you choose has internal training and checklists where all case managers work with you one-on-one to make your financials accurate and structured in the best way to qualify for the best resolutions.

- Solid company but not the biggest or smallest. When you contact companies, you’ll often hear claims about saving millions of dollars or being the biggest with over 500 employees. Here’s the unfortunate truth: the bigger a company gets in the service industry, the more prone to mistakes. Just search their company name and complaints in Google to see. If the company only has a few people, that company is going to reach a point where the individual with the greatest skill is so occupied with different aspects of running the business that they will be more prone to make mistakes. Look for a company that has around 50+ people in their team and has the ability to scale their enrolled agent or tax attorney team as needed. And ask if the company has at least a 2-phase checklist process to review the work of their enrolled agents and tax professionals on at least two levels to ensure accuracy and consistency. Think about it like this: would you rather go to a surgeon who talks about the thousands of surgeries he does monthly (where you start feeling like another number), or one who is highly rated with a good team and very personalized service?

- Credits a portion of the investigation to the resolution work. Make sure the company credits at least a portion of what you have paid for the investigation toward the resolution work. Keep in mind that unlike widgets at Walmart, tax work is very specialized. It’s not about being the cheapest, but getting you the best result. However, at least a portion of the investigation means the company has their focus on your best interests.

- Written guarantee. Make sure the company stands behind their resolutions with a written guarantee that they will resolve your tax issue.

- At least 24 years in business. We have seen time and time again that companies come and go, leaving their customers high and dry. Even numerous major companies in the industry have been closed down by the CFPB and FTC. Often the biggest are the most likely to be sued and fined because they serve as examples to the other companies in the industry. By knowing the company has helped hundreds of thousands of people over the last 20 plus years, you can be assured they likely will be around to complete your case!

- Top Rated By Top Consumer Reviews for tax relief companies. This is one of the premier company rating sites and ensure that any company you speak with is highly rated, ideally #1 by this 3rd party rating organization.

- Over 1000 five-star reviews from prior customers. And, google their company name and complaints. While happy customers are important, the most important thing is to make sure there are very few unhappy ones. If you have the option to choose between 3 companies, instead of focusing on who has the most reviews, choose the one that has the fewest complaints. You want to make sure that if anything happens, the company will do all possible to ensure you are happy and taken care of.

- Licensed and bonded in various states. This ensures that the company is taking your protection seriously, essential when you choose at tax relief company.

THE ONE COMPANY THAT MEETS ALL 11 REQUIREMENTS (IN DETAIL):

The company does an investigation before suggesting certain resolutions. This ensures that what you qualify for is accurate, giving you the greatest savings and peace of mind.

The company does a thorough investigation. You’ll never just be given a phone call or a brief report. You’ll receive a detailed multi-page PDF report where you case manager will go step by step with you showing the options, dates of expirations of the debts, why the debts are being assessed.

The company in their thorough investigation includes all 11 points for a proper investigation and requests a stay of enforcement if needed to help protect you. By doing these 11 points you can rest assured that the current tax issue is solved best for you and anything else that could potentially be out there lurking is solved as well.

The company also has policies to extensively work with you to make sure your financials are the best possible to qualify you for the best resolutions. There is a 2-layer checklist procedure internally and training for each account executive and tax professional.

The company is a solid company with over 23 years of helping hundreds of thousands of people nationwide. The company, instead of focusing on being the biggest or on INC 500, is focused on making sure you as a client are number one and are extremely happy with the results.

The company credits a percentage of what is paid for the investigation to resolution work. The company is dedicated to helping you through the entire process.

The company’s contract has a written guarantee where they promise to get the resolution proposed in the investigation and selected by you as the client.

The company has been helping people nationwide for over 23 years and has helped hundreds of thousands of people.

The company is #1 rated by Top Consumer Reviews for Tax Debt Relief in 2024. The company and the tax division also has over 1500 five-star reviews on Customer Lobby, an independent review site, Shopper Approved and other sites.

HOW TO WORK WITH THE ONE COMPANY THAT MEETS ALL 11 REQUIREMENTS

Click here to request a free consultation.

So, in summary, when you take charge of your tax issues, you are practically guaranteed to save the most money, qualify for the best solution, and have the greatest peace of mind.The only bad news is that only limited clients are accepted each month, so you may click on the link and find that new clients aren’t being accepted until the next month. Hopefully you can get one while it is.