Facing a debt lawsuit can be an overwhelming and stressful experience, but you have options. The thought of going to court or facing wage garnishments may seem daunting, but understanding your rights and available defenses can help you take control of the situation.

In this guide, we’ll explore everything you need to know about debt lawsuits and how to get them dismissed. From verifying the validity of the debt to exploring legal defenses and considering debt settlement, you’ll discover actionable strategies to protect yourself.

Also, if you’re looking for help, we offer a free consultation to start regaining control of your finances.

Understanding Debt Lawsuits

Debt lawsuits occur when creditors or collection agencies take legal action against individuals who owe money. Common reasons for debt lawsuits include unpaid credit card bills, medical debts, personal loans, or other unsecured debts.

When you’re sued for a debt, you’ll typically receive a summons and complaint. This document outlines the amount owed and the plaintiff’s reasons for filing the lawsuit. If ignored, the court may issue a default judgment against you, allowing creditors to garnish your wages or seize assets.

Key takeaway: Responding to a debt lawsuit promptly and understanding your rights are critical to avoiding negative consequences.

Verify Debt Validity

Before you can effectively respond to a debt lawsuit, it’s essential to verify whether the debt is legitimate. Creditors must provide evidence that you owe the amount they claim.

Steps To Verify Debt Validity

- Request Debt Validation

Under the Fair Debt Collection Practices Act (FDCPA), you have the right to request verification of the debt. The creditor must provide:- Original account documentation

- Proof of debt ownership if it was sold to a collection agency

- A breakdown of the amount owed, including interest and fees

- Check The Statute Of Limitations

Every state has a time limit, known as the statute of limitations, within which a creditor can sue for unpaid debts. If the debt is time-barred, you may be able to have the case dismissed. - Review For Errors Or Fraud

Mistakes happen. Creditors may sue you for an incorrect amount or even for debts you don’t owe. Identity theft is another factor to consider.

Always document your communications with creditors and keep copies of relevant documents.

Reasons For Dismissal

There are several defenses you can use to have a debt lawsuit dismissed. Here are the most common:

1. Statute Of Limitations

If the debt is older than your state’s statute of limitations, the creditor has no legal grounds to sue.

2. Lack Of Documentation

Creditors must prove their claims with proper documentation. Without it, the lawsuit may not hold up in court.

3. Identity Theft Or Fraudulent Activity

If you believe the debt resulted from fraud or identity theft, you can challenge its validity.

4. Improper Service

Lawsuits must be served according to strict legal guidelines. If the summons wasn’t delivered correctly, the case could be dismissed.

5. Bankruptcy

Filing for bankruptcy can immediately halt most debt lawsuits. Depending on your circumstances, the debt may be discharged entirely.

How To Get A Debt Lawsuit Dismissed

1. Respond To The Lawsuit

File a response with the court to avoid a default judgment. This step is crucial to preserving your ability to defend yourself.

2. Seek Legal Assistance

An attorney with experience in debt cases can assess your situation and identify the best course of action. They may file a motion to dismiss the case on your behalf.

3. Challenge The Plaintiff’s Evidence

Request that the creditor provide proof of the debt. If they can’t, the court may dismiss the lawsuit.

4. Negotiate A Settlement

Debt settlement is an effective way to resolve the lawsuit without going to trial. This involves negotiating a reduced amount to pay off the debt. Let’s explore this option in more detail:

How Debt Settlement Can Help

Debt settlement can be a game-changer if you’re struggling with unpaid debts and facing legal action. By negotiating with creditors, you can often settle for a fraction of the amount owed.

Why Choose Debt Settlement?

- Avoid Court: Resolving the debt through settlement eliminates the need for further legal action.

- Reduce Debt: Creditors are often willing to accept less than the full amount, especially if they believe they might not recover the full sum through a lawsuit.

- Regain Financial Stability: Settling your debts allows you to focus on rebuilding your finances without the looming threat of lawsuits.

CuraDebt Can Help:

At CuraDebt, we specialize in negotiating with creditors on your behalf. Our experts can help you achieve significant savings and avoid the stress of legal battles. Plus, we offer a free consultation to explore your options.

Other Consequences Of Being In Debt

Debt affects more than just your finances. Beyond lawsuits and credit score issues, prolonged debt can lead to:

- Emotional stress and anxiety

- Difficulty in securing housing

- Limited financial freedom

Understanding these challenges highlights the importance of taking action early to regain control of your financial future.

What People Are Saying On Forums

Online forums like Reddit and Quora can be great resources for advice from people in similar situations. For instance, one user asked for advice after being sued for unpaid credit card debt. Responders encouraged contacting creditors to negotiate a payment plan or settlement.

Another user provided helpful advice on handling a debt lawsuit. While they weren’t sharing a personal success story, their insights highlight actionable steps you can take.

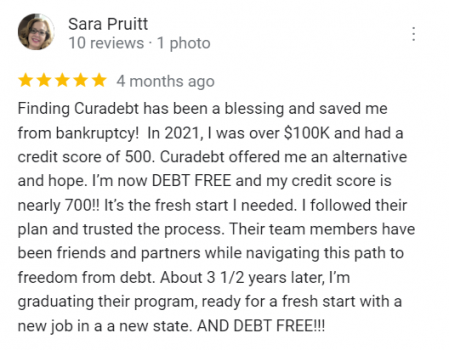

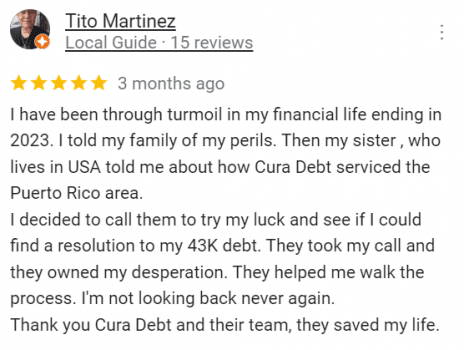

CuraDebt Reviews

If you’re struggling with debt, you’re not alone. CuraDebt has helped thousands of people reduce their financial burden and regain peace of mind.

Here’s what our clients are saying:

Let us help you, too. Contact us for a free consultation and take the first step toward financial freedom.

Conclusion

Facing a debt lawsuit can be intimidating, but with the right approach, you can navigate it successfully. Whether by verifying the validity of the debt, challenging the lawsuit in court, or negotiating a settlement, you have options.

CuraDebt is here to support you. With years of experience and a proven track record, we’re ready to help you tackle your debt challenges. Contact us today for a free consultation and take control of your financial future.