Managing debt on a low income can feel challenging, but with the right steps, you can take control and work towards financial stability. If you’re looking for ways to get out of debt on a low income, this guide will walk you through practical, step-by-step strategies to reduce debt while making the most of your financial resources.

No matter your situation, there are solutions to help you move forward. Let’s explore how you can take the first steps toward a debt-free future.

Need a loan or help with debt relief?

Know Exactly What You Owe

Before you can start paying off debt, you need to have a clear picture of what you owe. This will help you create a plan that works for your financial situation. Follow these steps:

- Gather all your bills, loan statements, and credit card balances.

- Write down each debt, the total amount owed, the interest rate, and the minimum monthly payment.

- Identify which debts have the highest interest rates and which ones should be paid off first.

Having this information organized will make it easier to set realistic goals and take control of your finances.

Create A Budget That Works For You

A budget is a powerful tool that helps you manage your money more effectively. With a structured plan, you can ensure that every dollar is working toward reducing your debt. Here’s how to create a budget that supports your financial goals:

- List your income sources – Include your salary, side gigs, or any extra earnings.

- Track your fixed expenses – Rent, utilities, groceries, and transportation.

- Identify areas to cut back – Small changes, like reducing takeout meals or canceling unused subscriptions, can make a big difference.

- Prioritize debt payments – Allocate as much as you can toward paying off your balances while covering essentials.

For more practical tips, check out our article “How To Reduce Debt By Changing Your Lifestyle”, where we share simple lifestyle adjustments that can help you pay off debt faster.

Avoid Adding New Debt

One of the most effective ways to gain control over debt is to stop accumulating more. While credit cards and loans might seem like quick fixes, they can make it harder to move forward.

Using cash or a debit card whenever possible can help you stay within your means and avoid interest charges. Even if it’s just a small amount, building an emergency fund can provide a safety net for unexpected expenses, reducing the need to rely on credit.

Before making a purchase, take a moment to ask yourself: Do I really need this, or can it wait? Being mindful of your spending choices will help you focus on reducing debt instead of adding to it.

If you’re considering using a personal loan to pay off existing debt, we encourage you to read our article “Should You Use A Personal Loan To Pay Off Debt?” to help you understand if it’s the right option for your situation.

Choose The Best Debt Repayment Strategy

There are different strategies to pay down debt, and the best one depends on your financial situation. Consider these three popular methods:

- Debt Snowball Method – Pay off your smallest debts first, while making minimum payments on larger ones. This provides quick wins to keep you motivated.

- Debt Avalanche Method – Focus on debts with the highest interest rates first, which saves money in the long run.

- Debt Snowflake Method – Make small extra payments whenever possible, using savings from everyday expenses or extra income.

Pick a method that works for you and stay committed to your plan. Over time, these small steps will lead to big progress.

Explore Debt Relief Options

If debt payments are becoming difficult to manage, there are options that can help.

Debt Consolidation Loan

A debt consolidation loan allows you to combine multiple debts into a single loan with a lower interest rate. This can simplify payments into one monthly amount, making it easier to manage. However, it typically requires good credit to qualify for the best rates.

Debt Settlement (A More Flexible Alternative)

Debt settlement allows you to reduce the total amount you owe through negotiations. This option can lower monthly payments, making debt more manageable. It works best for those with high amounts of unsecured debt who need a more flexible solution.

At CuraDebt, we specialize in debt settlement and provide a free consultation to help you explore your best options. If you’re looking for a way to lower your debt and monthly payments, contact us today to see how we can help!

CuraDebt: A Trusted Debt Relief Partner

When looking for debt relief, you need a reliable and experienced team by your side. CuraDebt has helped thousands of individuals and businesses successfully reduce their debt.

Why Choose CuraDebt?

- Over 24 years of experience helping people regain financial control.

- Proven success negotiating debt reductions.

- Free consultation to explore your options with no obligation.

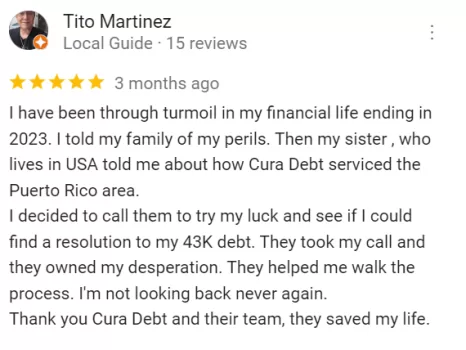

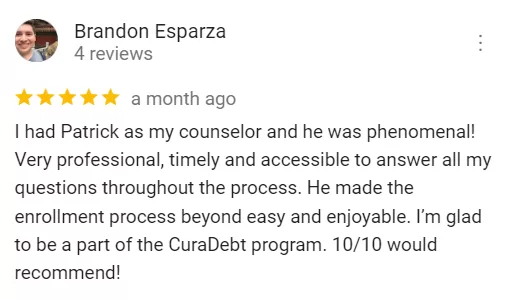

Here are some real client success stories, showing how CuraDebt has helped people just like you find relief. You could be next! Contact us today and take the first step toward financial freedom.

Conclusion: Take The First Step Toward A Debt-Free Life

Managing debt on a low income is possible with the right approach. By organizing your finances, budgeting wisely, and using an effective repayment strategy, you can start making real progress. If you need additional support, debt settlement can provide a flexible solution to reduce your overall balance.

At CuraDebt, we’re here to help. If you’re looking for guidance on the best way forward, we offer a free consultation to discuss your options.

Take action today. Contact us and let’s work together on your path to financial freedom!