The mere mention of a “tax levy” can send shivers down the spine of any taxpayer. This powerful collection tool used by the Internal Revenue Service (IRS) can have devastating consequences, freezing your bank accounts, garnishing your wages, and disrupting your financial well-being. But fear not – this comprehensive guide is here to empower you with the knowledge and strategies to navigate the complexities of tax levies and regain control of your financial future.

Read on to learn about tax levy release and how CuraDebt can help you get out of tax debt and regain control of your finances.

What Is A Tax Levy?

A tax levy is a legal seizure of your property or assets by the IRS to satisfy an outstanding tax debt. This action is taken when you have failed to pay your taxes or respond to the IRS’s attempts to collect the money owed. The IRS can target a wide range of assets, including your bank accounts, wages, retirement accounts, and even your home.

The Consequences Of A Tax Levy

The consequences of a tax levy can be far-reaching and devastating. When the IRS levies your bank account, they can completely freeze your funds, leaving you without access to your own money. This can disrupt your ability to pay essential bills, make critical purchases, or even meet your basic living expenses. Similarly, a wage garnishment can drastically reduce your take-home pay, making it even more challenging to make ends meet.

Beyond the immediate financial impact, a tax levy can also have long-lasting repercussions on your credit score and overall financial well-being. This negative mark on your credit report can make it harder to secure loans, rent an apartment, or even find employment in the future.

Stopping A Tax Levy: Your Options

Fortunately, there are steps you can take to stop a tax levy and regain control of your financial situation. The key is to act quickly and proactively, as the IRS is often unwilling to lift a levy once it has been implemented.

One of the most effective ways to stop a tax levy is to request a Collection Due Process (CDP) hearing. This formal process allows you to present your case to the IRS and potentially negotiate a resolution, such as an installment agreement or an offer in compromise. During the CDP hearing, the IRS must cease all collection activities, including the tax levy, until a decision is reached.

Another option is to request a hardship withdrawal from your retirement accounts. This can provide you with the funds needed to pay off your tax debt and prevent the IRS from seizing these important assets. However, it’s important to carefully consider the long-term implications of this approach, as it can have a significant impact on your retirement savings.

However, the most straightforward way to release a levy is by paying the debt in full. This action stops the levy and prevents additional penalties or interest from accumulating.

How To Get Out Of Tax Debt

For an in-depth guide, watch our video on “How to Get Out of Tax Debt,” where we explain practical solutions for dealing with IRS debt.

How To Prevent A Tax Levy

The best way to avoid the headaches and hassles of a tax levy is to take proactive steps to prevent it in the first place. This starts with ensuring that you file your tax returns on time and pay your taxes in full each year. If you are unable to pay the full amount owed, it’s crucial to communicate with the IRS and work out a payment plan or other arrangement before the situation escalates.

Additionally, staying vigilant and responsive to any IRS notices or correspondence can help you stay ahead of potential tax issues. If you receive a notice of intent to levy, it’s essential to act quickly and respond to the IRS within the specified timeframe to protect your rights and explore your options.

More Questions

If you’re looking for more insights, checking online forums can be a helpful way to connect with others facing similar challenges. Many people share their experiences, ask questions, and receive advice from peers.

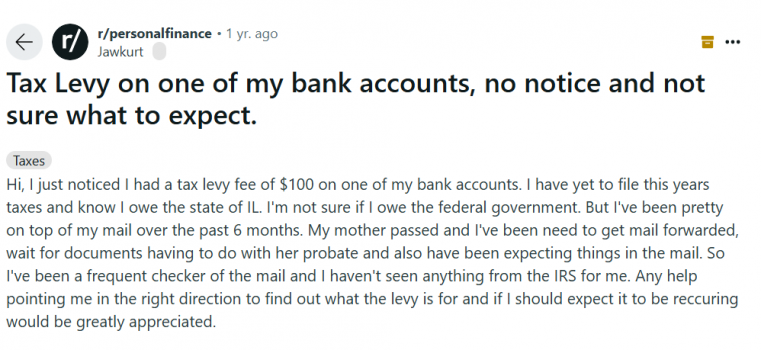

In this case, a Reddit user shared that they experienced a sudden tax levy on their bank account without prior notice. This individual was confused as to why the IRS didn’t warn them first. Another user explained that notifying someone about a levy could allow them to empty the account, so the IRS avoids advance warnings for bank levies.

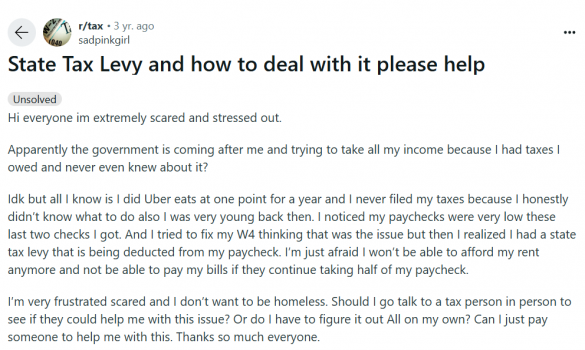

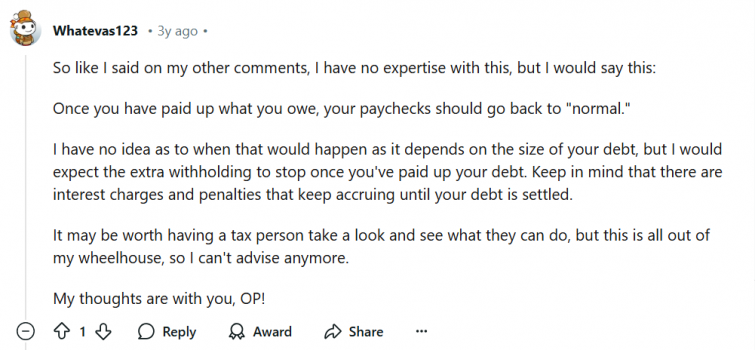

Another user posted about receiving a tax levy on their paycheck. They asked for advice on handling the situation, and a response recommended consulting a professional tax advisor. If you’re in a similar situation, CuraDebt’s tax relief services can assist. We specialize in helping individuals resolve their tax debt and find lasting solutions. Reach out to us for a free consultation to discuss how we can help with your tax concerns.

How CuraDebt Has Helped Others

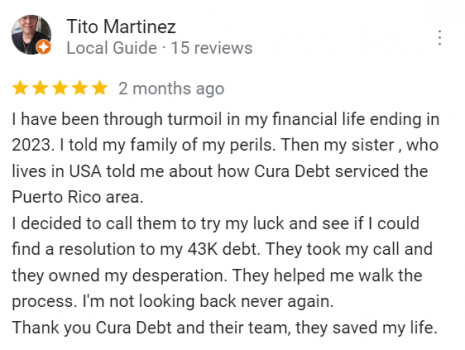

Don’t just take our word for it – hear from the people who have experienced the life-changing impact of CuraDebt’s tax relief services:

Conclusion: Act Now To Release Your Tax Levy

A tax levy can feel like a weight crushing your financial well-being, but it doesn’t have to be the end of the road. By understanding your rights, exploring your options, and seeking the guidance of professional tax relief services like CuraDebt, you can stop a tax levy, prevent future issues, and reclaim your financial freedom.

Don’t let the IRS’s powerful collection tools leave you feeling helpless. Take the first step towards a brighter financial future by contacting CuraDebt today for a free consultation. Their team of tax experts is ready to help you navigate the complexities of tax debt and guide you towards a resolution that works for your unique situation.