When managing credit card debt becomes overwhelming, understanding your options can make all the difference. Many individuals face financial struggles with major institutions like Bank of America due to credit card debt, and finding the right solution is essential for getting back on track. Whether you’re dealing with mounting interest, missed payments, or constant creditor calls, the good news is that Bank of America offers various pathways to settle your debt. Here, we’ll explore the steps you can take to settle debt with Bank of America, discuss the consequences of unresolved credit card debt, and explain how CuraDebt’s expert services can help you achieve financial relief.

Consequences Of Credit Card Debt

Credit card debt can feel like a never-ending cycle. The effects of carrying high balances go beyond just financial strain; they can impact various areas of your life and your future. Here are some of the main consequences:

1. High-Interest Costs

Credit card interest rates are notoriously high, often reaching 20% or more. With Bank of America, carrying a large balance month after month means accruing significant interest, making it harder to reduce your balance and causing your debt to grow quickly over time.

2. Credit Score Damage

Missed or late payments are some of the most damaging factors to your credit score. If you’re unable to make payments, your credit report will reflect those late or missed payments, negatively impacting your credit score. This can affect your ability to obtain loans, mortgages, and even affect job applications in some cases.

3. Risk Of Legal Action

In cases where significant debt remains unpaid, Bank of America may pursue legal action to recover what is owed. Lawsuits could lead to wage garnishments or property liens, which can have lasting financial and legal implications.

4. Emotional And Physical Stress

Beyond financial ramifications, credit card debt can create emotional burdens. Stress related to debt has been linked to anxiety, depression, and even physical health issues, as people worry about their financial stability.

If credit card debt with Bank of America is a concern, taking action sooner rather than later can make a huge difference. Let’s explore the options for settling your debt effectively.

Options To Settle Your Debt

When facing overwhelming debt, it’s crucial to know your options. Here are some approaches for settling debt with Bank of America, each tailored to meet different needs.

1. Debt Settlement

Debt settlement is an option where you negotiate with Bank of America to pay a reduced amount, often significantly lower than the total amount owed. This process typically works best if you’re behind on payments and unable to pay off the entire balance. At CuraDebt, we offer debt settlement services that aim to reduce what you owe. We can help you work with Bank of America to reach a manageable settlement, take our free consultation now!

2. Debt Consolidation

Debt consolidation involves combining multiple debts into a single monthly payment, often with a lower interest rate. While this doesn’t reduce the total debt, it simplifies the payment process and may reduce your overall interest costs.

3. Balance Transfer

A balance transfer may allow you to move your existing balance to a new card with a lower or even 0% interest rate for a promotional period. This can provide temporary relief, giving you time to pay down your debt without the added burden of high-interest charges. Be mindful, however, that promotional rates are temporary and may come with fees.

4. Direct Settlement Program With Bank Of America

Bank of America has its own internal settlement options for those who have fallen significantly behind on payments. While it may take some negotiation, some individuals have managed to reach settlements by directly contacting Bank of America. However, working with professionals, like those at CuraDebt, often leads to more favorable terms since we know the ins and outs of the negotiation process and can represent your best interests.

5. Seeking Professional Debt Relief Assistance

Navigating debt solutions can be overwhelming, especially if you’re dealing with multiple debts or aren’t familiar with financial terminology. At CuraDebt, we offer a free consultation where our experts will analyze your financial situation, explain your options, and guide you in the best direction. We can help you explore debt settlement and other relief programs tailored to meet your needs.

By working with CuraDebt, you’re not just settling debt; you’re creating a sustainable financial plan to ensure you can regain control and peace of mind.

Other Questions And Experiences

Online forums and communities such as Reddit and Quora can provide a wealth of information on others’ experiences with Bank of America debt settlement.

Can Bank Of America Sue You For Credit Card Debt?

One user answers by confirming that, yes, Bank of America can sue if credit card debt remains unpaid. The response explains that the bank has multiple methods of collecting, such as wage garnishment or liens if they win a judgment in court.

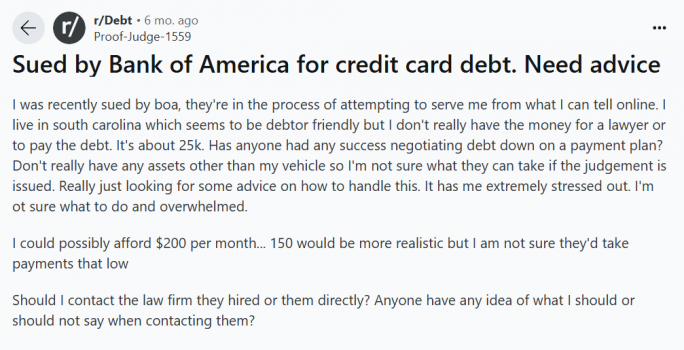

Sued By Bank Of America For Credit Card Debt

Another discussion on these platforms highlights the value of negotiating directly with the bank to potentially reduce the debt. However, negotiating alone can be challenging. At CuraDebt, our experienced team can handle the negotiation process with Bank of America on your behalf, working to secure the best possible settlement based on your financial situation. Let us simplify the process and help you regain control over your finances, start with a free consultation.

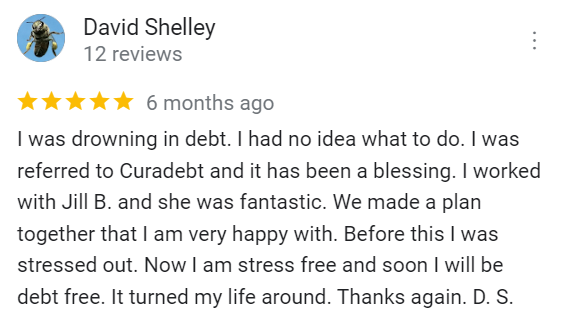

What Our Customers Are Saying

When it comes to debt relief, hearing from people who’ve experienced the journey firsthand can be incredibly reassuring. Many of our customers have shared positive experiences about how CuraDebt helped them regain control of their finances.

Conclusion

Navigating debt with Bank of America is challenging, but with the right approach, you can find a solution that works for you. From debt settlement to exploring alternative payment plans, there are several pathways to consider. Taking action sooner rather than later helps prevent additional consequences, such as credit score damage or legal action.

CuraDebt’s services are here to help you find relief tailored to your situation. With our free consultation, you’ll receive expert guidance to help you choose the best course of action for your debt, allowing you to move forward with confidence. Remember, being debt-free can lead to financial stability and peace of mind, and we’re here to support you every step of the way.