Dealing with collection calls can feel like a never-ending battle. The constant ringing, the pressure, the uncertainty—it’s enough to make anyone feel overwhelmed. But here’s the good news: you don’t have to live this way. Whether you owe money or believe the debt isn’t yours, there are simple, effective ways to stop the calls and take back control of your life.

This article is here to guide you through practical steps to stop the calls, protect yourself, and find relief.

What Are Collection Calls?

Collection calls can feel like an unwelcome interruption in your day, but understanding where they come from and why they happen can help you take control of the situation. These calls are essentially repayment requests made by creditors or debt collectors over the phone. If you’ve fallen behind on payments or have unpaid debt, these calls are often the first step in the debt recovery process.

Here’s a breakdown of where these calls typically come from and what to expect:

1. Your Primary Lender

When you miss a payment or fall behind on your debt, your original creditor (like a credit card company or loan provider) is usually the first to reach out. At this stage, the calls are often more straightforward and less aggressive. Your lender may simply remind you of the overdue payment and work with you to find a solution.

This is often the best time to negotiate. You can discuss repayment plans, adjust due dates, or even request a temporary pause on payments. The key is to communicate openly—many lenders are willing to work with you if you’re proactive.

2. Collection Agencies Working for the Lender

If your lender isn’t able to recover the debt, they may hand it over to a collection agency. These agencies are hired to collect the debt on behalf of the lender, and they often take a more persistent approach.

Unlike your original creditor, collection agencies are typically paid a percentage of what they recover, which can make them more aggressive in their tactics. You might notice an increase in calls, stricter demands, or even pressure to pay the full amount immediately.

3. Debt Collection Agencies That Buy Debt

In some cases, your lender may decide to sell your debt to a third-party debt collection agency. This usually happens when the lender believes they’re unlikely to recover the money themselves. These agencies purchase debt for a fraction of its value—sometimes just pennies on the dollar—and then try to collect the full amount from you.

Because these agencies stand to make a significant profit if they succeed, they can be the most relentless in their efforts. Their tactics may feel overwhelming, but it’s important to remember that you still have rights and options.

Start With These Simple Steps

1. Ask Them To Stop Calling

Sometimes, all it takes is a polite but firm request. Let the collector know you’d prefer not to be contacted by phone. While this isn’t a guaranteed solution, many agencies will respect your request and reduce the frequency of calls. It’s a simple first step that can make a big difference in easing the stress of constant interruptions.

2. Send A Cease-And-Desist Letter

If the calls continue, you can take it a step further by sending a cease-and-desist letter. This formal request tells the agency to stop contacting you. Under the Fair Debt Collection Practices Act (FDCPA), once they receive your letter, they’re legally required to comply—except to notify you of specific actions, like legal proceedings.

How To Send A Cease-And-Desist Letter:

- Clearly state your request to stop all communication.

- Include your account information for reference.

- Send the letter via certified mail with return receipt requested so you have proof they received it.

Sample Wording:

“I am writing to request that you cease all communication with me regarding the debt associated with account [Account Number]. As per the Fair Debt Collection Practices Act, please do not contact me by phone or any other means moving forward.”

Keep a copy of the letter and the receipt for your records. This documentation can be crucial if the agency continues to contact you.

3. Know Your Rights Under the FDCPA

The Fair Debt Collection Practices Act (FDCPA) is your shield against harassment. Here’s what it protects you from:

- No Harassment: Debt collectors cannot call you repeatedly or use abusive language.

- No Calls at Inconvenient Times: They cannot call before 8 a.m. or after 9 p.m., unless you agree to it.

- No Threats: They cannot threaten you with violence, harm, or legal action they don’t intend to take.

If a collector violates these rules, you have the right to file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state attorney general.

Are your debt collectors crossing the line? If you’re dealing with aggressive or illegal behavior, our detailed guide can help you understand your rights and take action. Learn more here.

4. Dispute The Debt if It’s Not Yours

If you believe the debt is incorrect, already paid, or not yours, you have the right to dispute it. Send a written dispute letter within 30 days of the first contact, requesting validation of the debt. This temporarily stops the collection process while the agency investigates.

Sample Wording for A Dispute Letter:

“I am writing to dispute the validity of the debt in question. Please send me written verification that this debt is accurate and that I am responsible for it.”

5. Pay The Debt—But We Know It’s Not Always Easy

The most straightforward way to stop collection calls is to pay the debt. However, we understand that this isn’t always an option. Financial struggles can make it difficult to settle what you owe, and that’s okay.

If paying the debt in full isn’t feasible, there are still ways to resolve the situation. A debt settlement company or consumer rights attorney can help you negotiate with creditors to reduce the amount you owe or set up a manageable payment plan. These professionals can also ensure that collection agencies follow the law and stop harassing you.

You don’t have to face this alone. Whether it’s negotiating a settlement or finding a payment plan that works for you, help is available to guide you through the process and bring you closer to financial peace of mind.

Real-Life Example: When Collection Calls Go Wrong

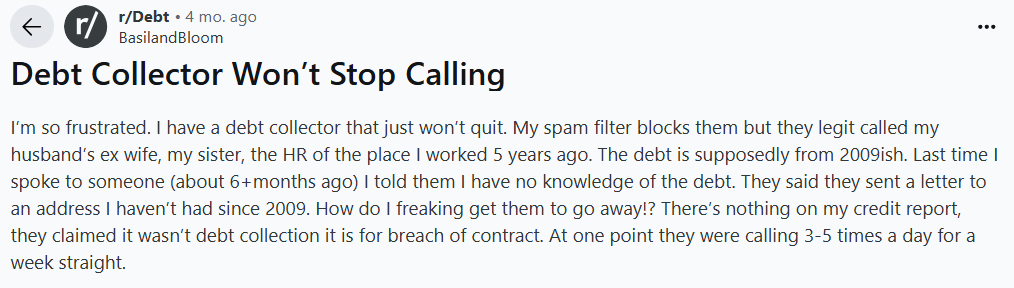

Sometimes, the best way to understand how to handle collection calls is by hearing from others who’ve been through it. Take this example from a Reddit conversation, where someone shared their experience with relentless calls over a debt that wasn’t even theirs.

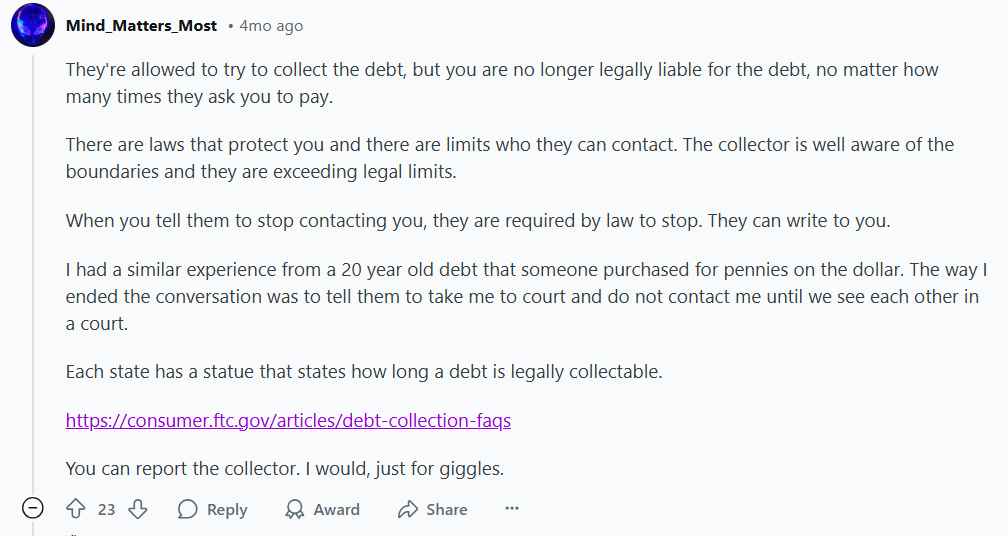

In the comments, someone suggested reporting the creditor to the appropriate authorities and shared a helpful link about the statute of limitations for debts. This legal timeframe limits how long a creditor or collection agency can sue you for an unpaid debt, and it varies by state. Understanding this can be a game-changer when dealing with aggressive collectors.

You Have The Power To Stop Collection Calls

Whether the debt is yours or not, whether the calls are relentless or just starting, there are steps you can take to protect yourself and regain control. From sending a cease-and-desist letter to disputing the debt or seeking professional help, you have options—and rights—that can put an end to the harassment.

Understanding where the calls are coming from, knowing your rights under laws like the FDCPA, and learning from real-life examples (like the Reddit story we shared) can empower you to take action. And if the debt isn’t yours or is past the statute of limitations, you have even more tools to fight back.

If you’re feeling stuck or unsure where to start, we’re here to help. Our team offers a free, no-obligation consultation to review your situation, answer your questions, and help you find the best path forward. Whether it’s negotiating with creditors, disputing a debt, or simply understanding your rights, we’re here to support you every step of the way.