When debt feels overwhelming, finding a reliable debt relief provider becomes critical. One of the most recognizable names in the industry is JG Wentworth, a company renowned for its structured settlements and debt settlement services. But how does it compare to other debt relief options? This article dives into what you need to know about JG Wentworth, including its offerings, how it works, and customer reviews.

If you’re exploring options, CuraDebt‘s free consultation can help you find the best debt relief solution tailored to your needs.

What Is JG Wentworth?

JG Wentworth is a financial services company specializing in purchasing structured settlements, annuities, and providing personal loans. It also offers debt settlement services, helping individuals reduce debt by negotiating with creditors. Known for its long-standing presence in the industry, JG Wentworth boasts over 20 years of experience.

How Does JG Wentworth Work?

JG Wentworth provides multiple financial services, but its debt settlement program is a prominent offering. Here’s how it works:

- Free Initial Consultation: Clients discuss their financial situation with a representative to determine eligibility.

- Debt Enrollment: Accepted clients enroll in a program where JG Wentworth negotiates with creditors to settle debts for less than owed.

- Monthly Savings: Clients deposit funds into a dedicated account, which is later used to pay settlements.

- Fees: The company charges a percentage (typically 15-25%) of the settled debt amount.

For those with structured settlements or annuities, JG Wentworth offers lump-sum payments in exchange for future payouts. This can be helpful for immediate financial needs but comes with its own costs.

If you’re exploring debt relief, CuraDebt can help you navigate the complexities with personalized support and a free consultation.

Debt Consolidation Loan Vs. Debt Settlement

Understanding the differences between debt consolidation loans and debt settlement is vital:

- Debt Consolidation Loan: Combines multiple debts into one loan with a fixed interest rate. While it simplifies payments, it doesn’t reduce the overall debt amount and often requires good credit for approval.

- Debt Settlement: Negotiates directly with creditors to lower the debt amount owed. It can provide significant savings and is particularly beneficial for those struggling with large unsecured debts.

Debt settlement often yields more savings and faster results than consolidation loans. At CuraDebt, we specialize in debt settlement to help clients reduce their financial burden. Watch our video on debt settlement to learn more, and take advantage of our free consultation today!

JG Wentworth Reviews

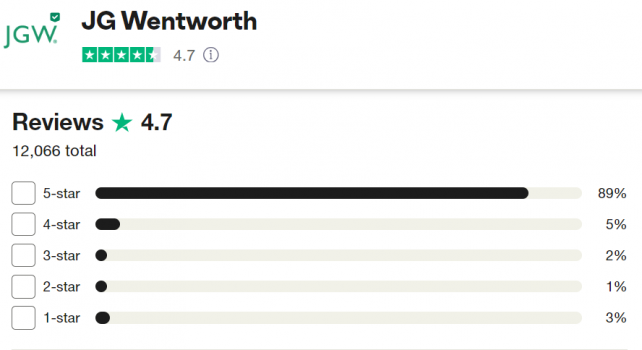

Trustpilot

JG Wentworth has a 4.7/5 rating based on over 1,000 reviews. Positive feedback highlights their responsive customer service and quick payouts:

- Positive Review: “Everyone has been honest, sincere and believe they truly want to help me get out of this constant circle of debt.”

- Positive Review: “The experience was pleasant and easy, and my agent couldn’t have been more empathetic and friendly!”

- Negative Review: “They didn’t even get my first payment correct, the amount and date to withdraw all wrong. I cancelled immediately. If you don’t start right, I can’t trust you.”

Better Business Bureau (BBB)

With an A+ rating, JG Wentworth has an average customer review score of 3.36/5. Positive reviews mention professionalism:

- Positive Review: “Terrific customer service. And slowly settling my debts. Thank you.”

- Positive Review: “I’m truly happy to know that you are having success in helping me bring down and eliminate my outstanding debts. Thank you so much.”

- Negative Review: “They rate your payment on the sum of what you owe, then negotiate hundreds off the debt. You pay the full debt, but they get the money the companies wrote off. Hundreds, if not thousands.”

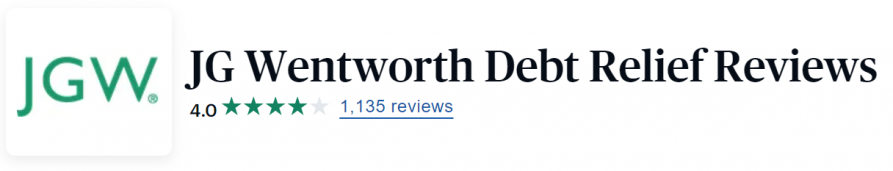

Consumer Affairs

JG Wentworth scores 4.0/5, with clients praising their transparency:

- Positive Review: “So far, my experience with JG Wentworth has been very helpful, informative, and I’m doing really well with it. The enrollment process went very well.”

- Positive Review: “I was looking for a debt consolidation service and JG Wentworth was willing to help me reduce debt without a higher interest rate.”

- Negative Review: “So I did the math, and I’m paying more than what I enrolled in with. I do not see how this is helping with my debt, they are putting me in more debt.”

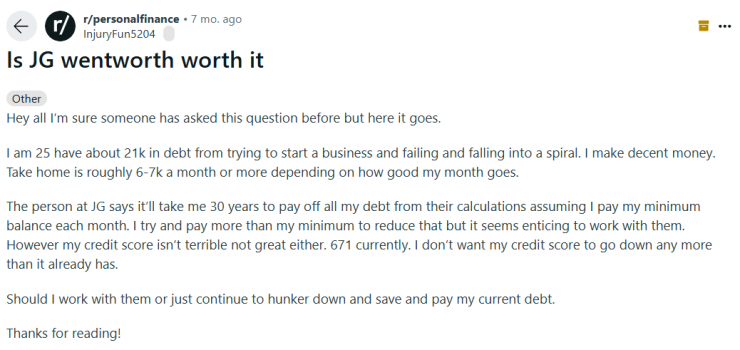

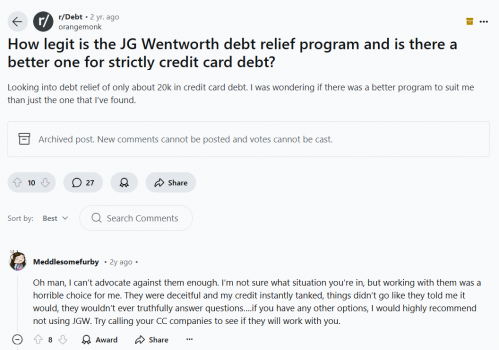

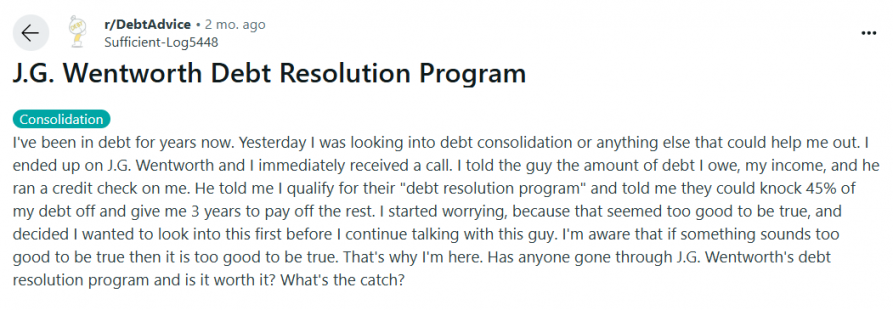

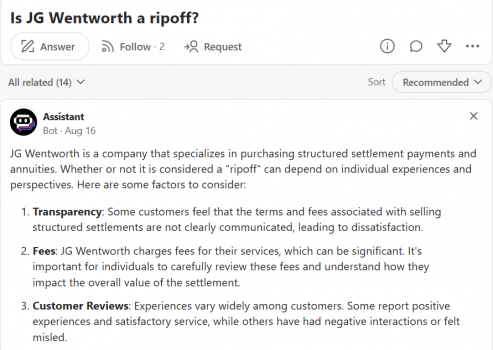

What People Are Saying On Forums

Discussions on platforms like Reddit and Quora reveal mixed opinions. While some users share positive experiences, others express concerns about fees or delays. Remember, individual experiences can vary based on personal circumstances.

These mixed reviews suggest that while JG Wentworth works well for some, others may find aspects of the service less satisfactory. As with any debt relief decision, researching thoroughly and consulting with experts is essential.

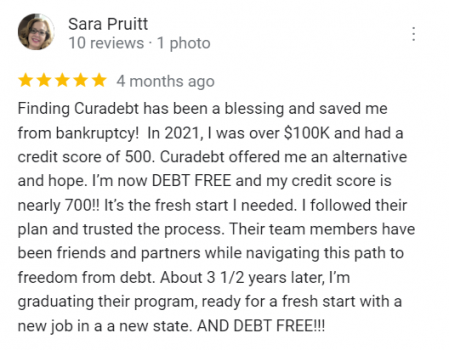

CuraDebt Reviews

At CuraDebt, we pride ourselves on delivering personalized debt relief solutions that help clients regain financial freedom. Whether you’re dealing with credit card debt, tax debt, or other unsecured obligations, our experienced team has the tools and expertise to negotiate significant savings.

Our clients frequently praise our transparency, responsiveness, and results. Want to learn more? Schedule a free consultation today and see how CuraDebt can help you achieve financial peace of mind.

Conclusion: Is This Company The Right Choice?

JG Wentworth is a reputable option for debt relief and structured settlement services, with generally positive reviews. However, some clients report concerns about communication and fees. If you’re considering debt settlement, CuraDebt offers a personalized, results-driven approach with no upfront costs. Take advantage of our free consultation to discover how we can help you reduce your debt and take control of your financial future!