Level One Law Reviews: Everything You Need To Know

Debt can feel overwhelming, and finding the right help can make all the difference. One company that markets itself as a solution for those struggling with financial challenges is Level One Law. But how reliable is this firm? In this guide, we’ll explore Level One Law’s services, customer feedback, and its parent company’s background.

Additionally, we’ll introduce CuraDebt as a trusted alternative for debt relief. If you’re exploring your options, our free consultation can be your first step toward financial stability.

What Is Level One Law?

Level One Law is a debt relief agency and law firm based in Tampa, Florida. The firm provides various services, including bankruptcy filing assistance, debt negotiation, and legal representation for consumers facing creditor lawsuits. Operating under the U.S. Bankruptcy Code, Level One Law positions itself as a federally designated Debt Relief Agency, offering support to clients seeking legal and financial relief from overwhelming debts.

Their services are marketed as comprehensive, but online reviews suggest mixed results regarding effectiveness and customer satisfaction.

How Does Level One Law Work?

Level One Law approaches debt relief through attorney-led strategies. Here’s how their process works:

- Initial Consultation: Clients discuss their financial situation with Level One Law’s representatives to identify the most suitable debt relief option.

- Service Agreement: The firm develops a plan, whether negotiating with creditors to reduce debt or guiding clients through bankruptcy filings.

- Legal Representation: Attorneys represent clients in court if creditors take legal action.

- Debt Negotiation: For qualifying clients, the firm attempts to reduce the overall debt amount through negotiations with creditors.

Consequences Of Being In Debt

Debt doesn’t just affect your wallet—it impacts many aspects of your life. Here are some common consequences:

- Collection Harassment: Persistent calls and letters from debt collectors can create additional stress.

- Legal Risks: Creditors may initiate lawsuits, leading to wage garnishments or asset seizures.

- Emotional Toll: Living with debt often results in anxiety and strained relationships.

The good news? Solutions are available. Watch our informative video on managing debt, and don’t hesitate to take advantage of CuraDebt’s free consultation to regain financial control.

Level One Law Reviews

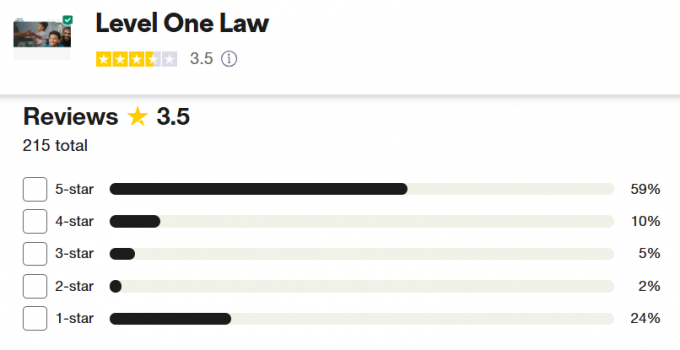

Trustpilot

On Trustpilot, Level One Law holds an average rating of 3.5 stars. Positive reviews praise the firm for its helpful attorneys and successful negotiations. However, negative reviews highlight slow responses and unfulfilled promises.

- Positive Review: “Everyone at Level One Law that help me through this process were amazing. Understanding and compassionate of what I was going through.”

- Positive Review: “Level One Law Firm has been an excellent decision for my family and I. They have reduced my stress around keeping up with the payments of multiple credit cards and loans.”

- Negative Review: “Level One collected fees and 10 months worth of payments without acting on our behalf at all. They have a court injunction against them and are unable to do any business.”

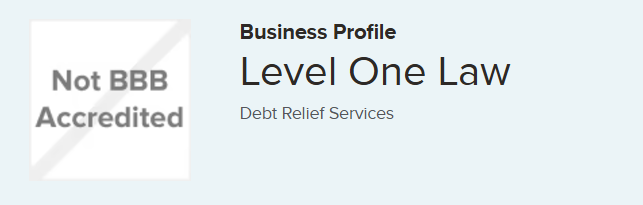

Better Business Bureau (BBB)

Customer feedback on BBB reflects dissatisfaction, with an average rating of 1.3/5 stars. Common complaints include lack of communication and fake relief.

- Complaint: “This company led me to believe that I was getting a loan with them to pay off my creditors, and charged me ungodly for it. I have texts and emails reiterating to them that this was my assumption. Then I asked them to refund my money because they did nothing for me, they gave me back a very small percentage of it.”

- Complaint: “They have been taking over $1400 a month from my account for 7 months and there is no way to contact them. They have not contacted any of my creditors as agreed. This company is a total scam!”

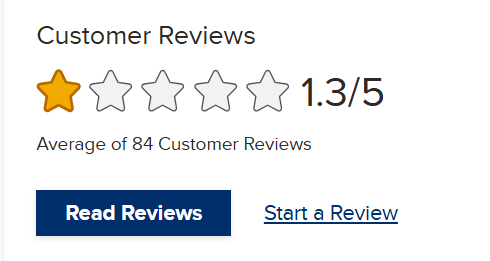

Yelp

Yelp reviews are particularly harsh, with Level One Law averaging 1 star. Customers often cite mismanagement and unmet expectations:

- Negative Review: “They will take your money and do absolutely nothing for you except feed you lies and continue to take your money.”

- Negative Review: “Basically, if you agree to an amount of $823 each month that they supposedly put in an escrow account to pay off your creditors. They take $773 in fees each month, so you’re basically paying almost double what you owe in credit card debt, and your credit is destroyed. Please stay away from this company.”

Other Experiences

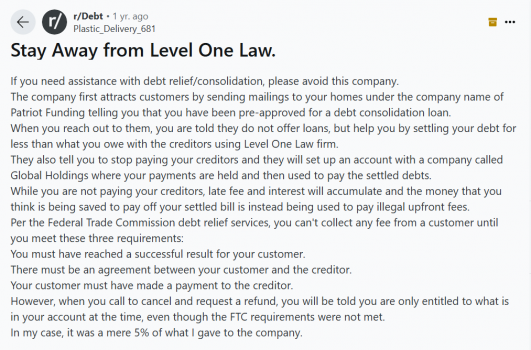

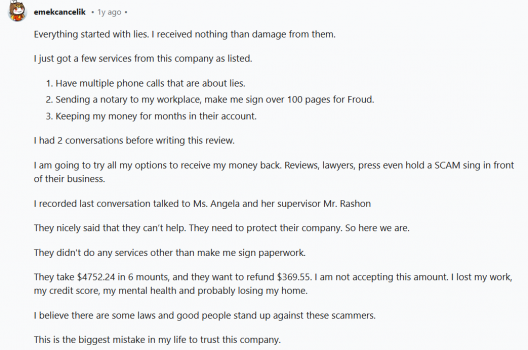

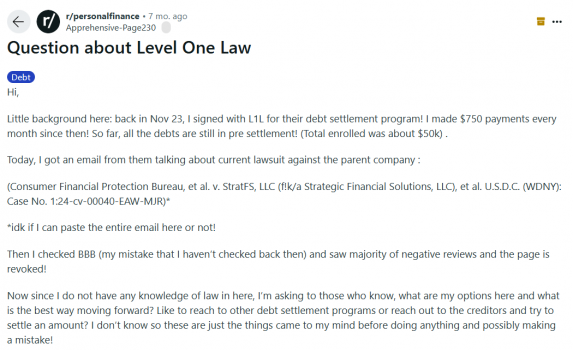

Consumers often share their experiences on forums like Reddit. Some users accuse Level One Law of deceptive practices, aligning with concerns about its parent company, Strategic Financial Solutions. For example:

Posts from these forums highlight frustrations, including claims that the company focuses more on collecting fees than delivering results. Additionally, Strategic Financial Solutions has faced a lawsuit alleging deceptive practices, which may concern potential clients

Strategic Financial Solutions Lawsuit

Strategic Financial Solutions (SFS), the parent company of Level One Law, has been involved in a class-action lawsuit alleging fraudulent practices. The lawsuit claims that SFS used affiliate law firms to improperly charge clients for debt relief services while providing minimal assistance. These allegations include fee-sharing violations and lack of transparency in managing client funds.

The legal challenges against SFS raise questions about the reliability of its affiliates, including Level One Law. Transparency and client trust are critical when choosing a debt relief provider.

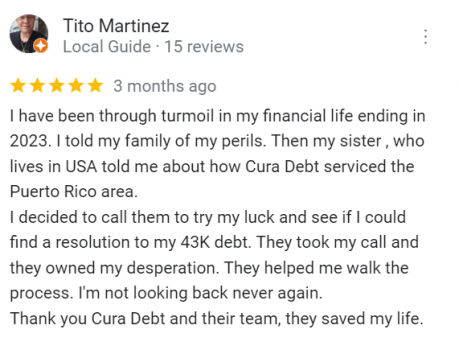

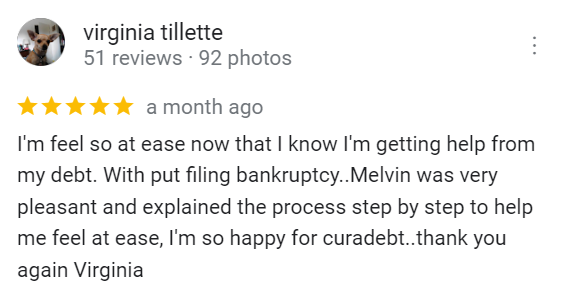

CuraDebt Reviews

If you’re considering debt relief, CuraDebt stands out as a reputable provider. Here’s what clients say:

With CuraDebt, you can expect personalized support and proven results. Book a free consultation today to learn how we can help.

Conclusion: Is This Company The Right Choice?

While Level One Law offers legal expertise, mixed reviews and concerns suggest that it may not be the best choice for everyone. CuraDebt provides a reliable alternative, offering personalized, transparent, and cost-effective solutions.

Ready to take control of your financial future? Contact CuraDebt today for a free consultation and explore how we can help you achieve lasting debt relief.