Have you come across Liberty Lending’s ads on Facebook or Instagram? With their strong social media presence, many people do. However, when managing your finances, it’s crucial to look beyond the ads and understand the company better.

In this article, we’ll explore what Liberty Lending offers, examine customer reviews, and weigh the pros and cons to determine whether it’s a trustworthy choice. By the end, you’ll have a clearer picture of whether this company is right for you.

Looking for personalized guidance? we’ll introduce you to CuraDebt’s free consultation services, so you can make the best choice for your financial future.

What Is Liberty Lending?

Liberty Lending is a financial service company that provides personal loans, particularly focusing on debt consolidation loans. Debt consolidation allows individuals to combine multiple high-interest debts into a single loan with a fixed monthly payment. This option can attract people struggling to manage multiple bills from credit cards., medical debts, or other forms of unsecured debt.

This company is not a direct lender, Liberty Lending connects consumers to financial institutions that may offer personal loans from $2,000 to $100,000 depending on the applicant’s creditworthiness. Also, They offer a range of loan options, including debt consolidation loans, home improvement loans, medical loans, and business loans.

Recently, the company has changed its image and now operates under the name Reach Financial.

Understanding Liberty Lending Loans VS, Debt Relief Programs

Before deciding whether Liberty Lending is right for you, it’s important to understand the difference between loans like the ones they offer and alternative debt relief solutions.

- Debt Consolidation Loans: A debt consolidation loan, such as what Liberty Lending offers, allows you to pay off multiple debts by consolidating them into one loan. You’ll have a single monthly payment and, potentially, a lower interest rate. However, this doesn’t reduce the total amount of debt you owe; it just reorganizes it. Plus, qualifying for a favorable rate may depend on your credit score.

- Debt Relief Programs: On the other hand, debt relief programs, such as those offered by CuraDebt, aim to reduce the total amount of debt you owe. These programs involve negotiating with creditors to lower the balance or settle for less than what is owed. For people struggling with overwhelming debt, this can be a more effective long-term solution than simply consolidating the debt through a loan.

Looking for a more personalized solution? CuraDebt offers a free consultation to explore your options and help you find the best path forward.

Customer Reviews From Trusted Sources

When it comes to financial services, customer feedback is a key indicator of a company’s reliability. Let’s take a look at Liberty Lending’s reviews from well-known review platforms.

Trustpilots Reviews

On Trustpilot, Liberty Lending holds an average rating of 1.8 stars. This rating suggests that customer satisfaction is below average. Many of the complaints center around customer service and unexpected loan terms.

Although it has a low rating due to negative opinions, 80% of the reviews describe positive experiences. So most people are satisfied with the services.

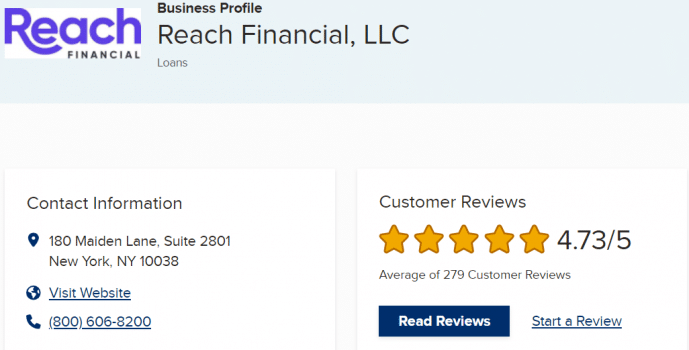

Better Business Bureau (BBB)

This time we have reviews for the new image of Liberty Lending. Customers are satisfied with the services as Reach Financial has a rating of 4.73/5 stars. These reviews highlight that this company has helped people a lot through a simple process.

Consumer Affairs Reviews

Consumers have reviewed Liberty Lending on the platform Consumer Affairs.. Here, the company has an average rating of 3 out of 5 stars. This time the reviews are more balanced, Many users of this platform explain that they had a quick process without major problems, but others present the same complications mentioned on Trustpilots.

Is Liberty Lending Group A Good Choice?

There are mixed opinions and different experiences of this company, but they can be good for you if what you are looking for is to secure a loan. If you decide to go to them, it is important that you make sure that they answer all your questions and that the terms of the agreement are clear from the beginning. However, it’s important to explore other options if debt relief is your priority.

If you’re feeling overwhelmed by debt or unsure if a loan is the best solution, CuraDebt offers personalized debt relief programs that focus on settling, negotiating, and consolidating debt without requiring additional loans.

Take advantage of our free consultation to assess your financial situation and receive a clear, no-obligation recommendation for the best debt relief path forward.