If you’ve been researching debt relief options, you might have come across Lighthouse Finance Solutions, a company that provides debt settlement services. For individuals overwhelmed by mounting debt, choosing the right financial service can make all the difference. But is Lighthouse Finance Solutions the best option for you? In this article, we’ll dive into their services, reviews from trusted sources, and how their offerings compare to other debt relief solutions.

What Is Lighthouse Finance Solutions?

Lighthouse Finance Solutions is a company specializing in debt settlement services. They help customers negotiate with creditors to reduce the amount of debt owed, typically aiming for clients to pay less than what they originally owe. The service is designed to give individuals a way out of debt without resorting to bankruptcy. They work with clients to develop a customized settlement plan and provide financial guidance throughout the process.

If you’re looking for a reputable debt relief company, here’s a guide to help you choose the best option for your needs.

Is Lighthouse Finance Solutions Trustworthy?

When it comes to assessing trustworthiness, Lighthouse Finance Solutions has a mixed record across various review platforms:

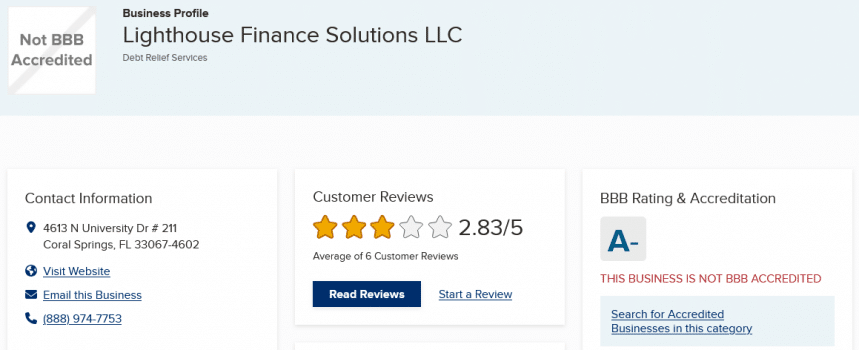

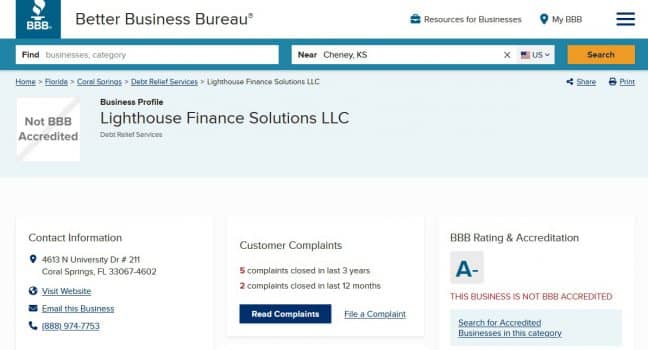

• Better Business Bureau (BBB): According to their BBB page, Lighthouse Finance Solutions has an A+ rating, but the customer reviews tell a different story. With an average rating of 2.83 out of 5 stars, many complaints focus on the clarity of service terms and slow follow-up by customer service (BBB Business Bureau).

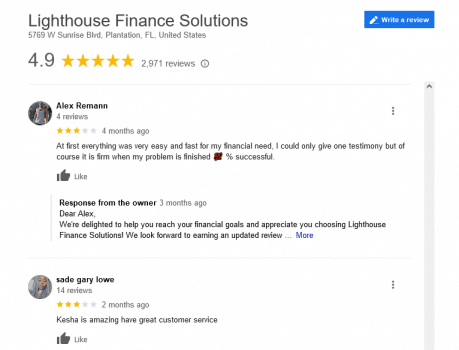

• Google Reviews: On the other hand, Lighthouse’s Google reviews paint a much more positive picture, with over 1,800 reviews averaging 4 stars. Customers often praise the helpfulness of the staff and the ease of the debt relief process.

It’s crucial to carefully evaluate the details and terms before committing to their services. While some customers have had excellent experiences, others have encountered frustrations.

Lighthouse Finance Solutions vs. Debt Relief Programs

While Lighthouse Finance Solutions focuses on debt settlement, there are other types of debt relief programs available, such as debt consolidation or debt management plans. Here’s a quick comparison:

• Debt Settlement (offered by Lighthouse): This involves negotiating with creditors to reduce the total debt. You’ll typically make monthly deposits into a dedicated account, which will be used to settle your debts over 24-48 months.

• Debt Consolidation: With debt consolidation, you combine multiple debts into one monthly payment, often with a lower interest rate. This method may not reduce your overall debt amount but can simplify repayment.

• Debt Management Plans: These plans involve working with a credit counselor to create a repayment plan that fits your budget.

A Brief History Of Lighthouse Finance Solutions

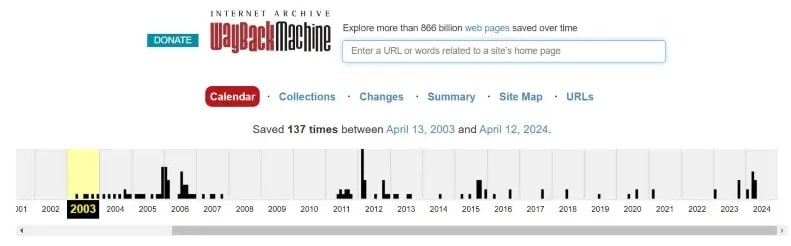

Lighthouse Finance Solutions has been providing debt relief services for several years, and a quick check on the Wayback Machine shows that their website has been active since at least 2018. The company’s focus has consistently been on helping individuals find relief from debt through certified debt settlement programs. They are accredited by the American Association for Debt Resolution, ensuring that they adhere to industry standards.

Real Testimonials From Trusted Sources

Here’s what customers are saying about Lighthouse Finance Solutions across different platforms:

• Google Reviews

Positive Reviews: On Google, Lighthouse Finance Solutions has a rating of 4 out of 5 stars based on over 1,800 reviews. Many customers appreciate the professionalism and friendliness of the team. One reviewer mentioned, “The staff at Lighthouse made me feel comfortable throughout the process, and they answered all of my questions clearly. I felt like I was in good hands.” Another user praised their ability to help with debt settlement, stating, “Lighthouse helped me settle my debts quickly, and I felt a huge sense of relief.” These reviews highlight the company’s strong customer service and ability to deliver on their debt relief promises.

Complaints: However, not all reviews are positive. Some customers have raised concerns about the cost of the services and the clarity of the terms. One reviewer shared, “The service worked, but the fees were higher than I expected. Make sure you fully understand the terms before signing anything.” Another mentioned delays in communication, saying, “I had to follow up a few times to get updates on my settlement. They should be more responsive.” These complaints suggest that while the service can be effective, it’s important to clarify costs and maintain consistent communication.

• Better Business Bureau (BBB) Reviews

Positive Reviews: On the BBB website, Lighthouse Finance Solutions has received an A+ rating, which reflects the company’s commitment to ethical business practices. While customer feedback on BBB is limited, there are some positive comments. One customer noted, “The staff at Lighthouse was professional and guided me through the debt settlement process with clear communication. I felt supported throughout the process.” Other clients have praised the team’s helpfulness and willingness to answer questions, which helped them better understand their financial options.

Complaints: However, several reviews on BBB also express concerns. The most common issues include slow customer service response times and dissatisfaction with the clarity of fees. One complaint stated, “The settlement process worked, but I had to follow up multiple times to get updates. The communication could have been better.” Other complaints pointed out hidden costs that were not made clear during the initial consultation, causing frustration later in the process.

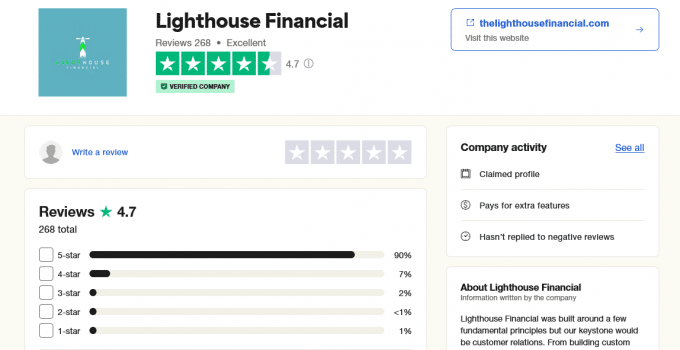

• Trustpilot Reviews

Positive Reviews: On Trustpilot, Lighthouse Finance Solutions has mixed feedback with a 4 out of 5 stars rating. Some customers have had positive experiences, appreciating the guidance from their representatives. One user commented, “I felt uneasy about the verification process with the credit card companies. However, my rep, Kori, reassured me and helped me understand the steps. So far, I’ve trusted the process, and it’s going as planned.” This review highlights how Lighthouse Financial’s representatives can provide clarity and support when customers feel uncertain.

Complaints: On the other hand, some users have raised concerns about the company’s services, particularly regarding tax filings. One reviewer stated, “I used them to file my taxes, and they messed up both my federal and state returns. I ended up with penalties and notices for lack of payment. I paid as much in penalties as I did to pay them for their services.” This feedback points to some significant issues with their tax-related services and emphasizes the importance of ensuring accuracy in financial matters.

Conclusion: Is Lighthouse Finance Solutions The Right Choice?

Lighthouse Finance Solutions provides comprehensive financial services with a focus on professionalism and ease of use. However, as with any financial decision, it’s essential to carefully review all terms and conditions before committing to a service.

If you’re exploring other debt relief options or need personalized advice, consider CuraDebt’s free consultation. We offer tailored solutions that match your unique financial needs and help you achieve debt relief in the most efficient way possible.