OnDeck Capital Reviews: What You Need To Know

In today’s competitive financial market, business owners seeking funding have more options than ever. With accessible lending platforms like OnDeck, small and medium-sized businesses can secure loans quickly and conveniently. In this review, we’ll explore what OnDeck Capital has to offer, including its lending services, customer feedback, and alternatives for businesses that may need debt relief rather than a new loan.

Is your business in debt? Request a free consultation from CuraDebt for help.

What Is OnDeck Capital?

OnDeck Capital is a financial technology company that specializes in providing business loans and lines of credit to small and medium-sized enterprises. Headquartered in New York City, the company was founded in 2007 with the goal of offering quick and convenient access to capital for businesses that may not qualify for traditional bank loans.

OnDeck Capital’s lending model relies on a proprietary algorithm that assesses a business’s creditworthiness based on a variety of factors, including cash flow, industry, and online presence. This allows the company to provide funding to a broader range of businesses, including those with lower credit scores or shorter operating histories.

How Does OnDeck Capital Work?

OnDeck provides funding solutions tailored to businesses with annual revenue of at least $100,000 and at least one year of operational history. The company requires a minimum credit score of 625 and allows businesses to borrow between $5,000 and $250,000 for term loans, while lines of credit range from $6,000 to $100,000. APRs for term loans can range between 29.94% and 97.34%, depending on the borrower’s qualifications.

OnDeck’s loan terms are flexible, with repayment periods up to 24 months for term loans and up to 12 months for lines of credit.

Understanding OnDeck’s Fees and Interest Rates

OnDeck’s fee structure includes both origination fees and interest rates, which can vary significantly depending on creditworthiness and loan type. For instance, their term loans have APRs ranging from 29.94% to 97.34%, while lines of credit have rates between 29.9% and 65.9%. Additionally, repeat customers can benefit from reduced origination fees over time. Understanding these costs is crucial, as high rates may affect a business’s cash flow. Comparing rates with other lenders or consulting financial experts can help businesses make informed borrowing decisions.

Why Debt Relief Might Be Better Than Taking Another Loan

For businesses facing mounting debt, taking another loan may not always be the best answer. While loans can provide immediate relief, they can also add more financial pressure with additional repayments and interest rates. Instead, debt relief through services like those provided by CuraDebt can help you reduce your total debt, allowing your business to regain financial control without adding to your liabilities.

Debt relief options such as settlement or consolidation can ease cash flow problems, improve your credit rating over time, and offer a fresh start without the burden of high-interest loans. CuraDebt’s expert team can work with your creditors to reduce your payments and create manageable repayment plans, giving your business a chance to recover and thrive again. Take advantage of CuraDebt’s free consultation to learn how debt relief can be a smarter, more sustainable option than taking on additional loans.

OnDeck Capital Reviews

OnDeck has mixed reviews across major platforms, with some services rated highly and others rated lower. Here’s a breakdown of customer feedback on Trustpilot, the Better Business Bureau, and Google.

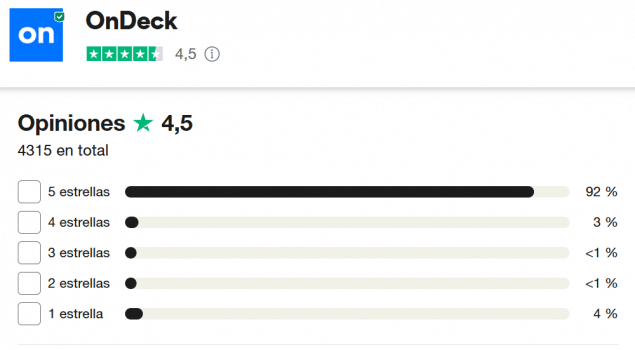

Trustpilot

OnDeck has a Trustpilot rating of 4.8 out of 5, based on numerous reviews. Good feedback often highlights the fast application and approval process, with clients appreciating the simplicity and speed of funding.

Positive review: “Great service, good offers and everything very fast.”

Positive review: “I was lucky to have the best help at OnDeck. In these difficult times, there are no words or actions to thank them for such attention and professionalism. Thank you so much.”

Negative review: “They are a deceitful company. They tell you that their rate is 19%, but when calculating the weekly payments, their true annualized rate is 36%.”

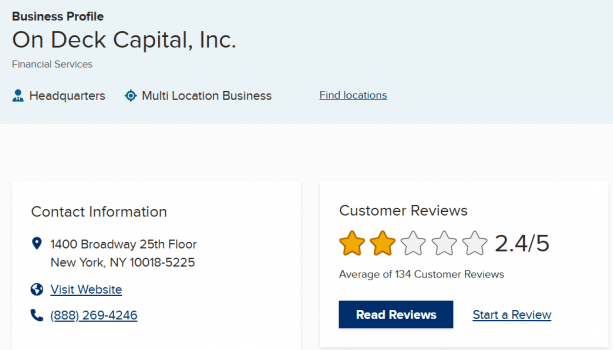

Better Business Bureau (BBB)

OnDeck Capital’s customer reviews on the Better Business Bureau (BBB) site show a mixed picture, with an average rating of 2.4 out of 5 stars. Many negative reviews mention problems with customer service, surprise fees, and trouble getting loan changes or extensions.

Positive review: “Very helpful company! Willing to give small businesses a chance.”

Negative review: “Worst decision I ever made. This inflated interest rate and weekly payments are leading businesses down the road to failure.”

Negative review: “I was told that my payment this month would set the invoice date for next month. However, that is not the case. They immediately charged and invoiced for the same month it was in within a few days. This company lacks integrity and lies to their customers.”

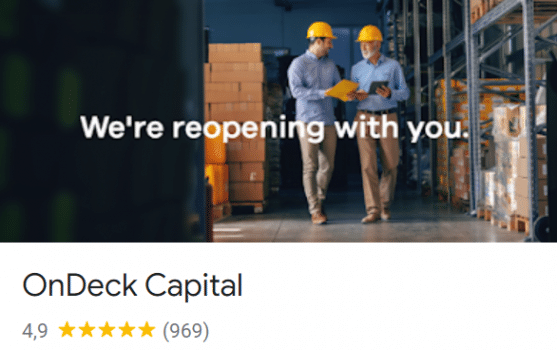

Google Reviews

On Google, OnDeck Capital has a positive average rating of 4.9 out of 5 stars from over 1,000 reviews. Customers frequently praise the company’s fast funding, flexible repayment options, and helpful staff.

Positive review: “My experience with OnDeck Capital was great. They like to keep things simple, and it was easy and a fast loan. If you need funds quickly, give them a call.”

Positive review: “Professional and thorough. Worked well with our small business, as far as exploring options and terms. Our first loan as a business and it went pretty smooth. Thank you.”

Negative review: “Not a happy customer. Everything seemed to be going well for a $25,000 line of credit loan, then at the moment of closing my quote of 41% interest went to 49%.”

More Experiences

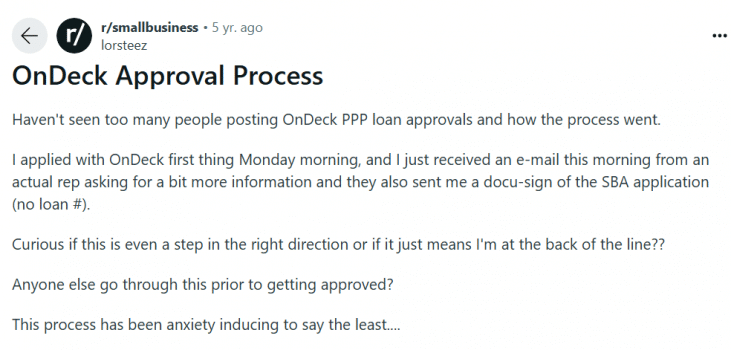

Browsing online forums like Reddit can provide additional insights into customer experiences with OnDeck Capital.

A user asked about OnDeck’s loan approval time, and several responses echoed concerns about delays, with some users sharing stress over their experiences.

In another conversation, users focused on OnDeck’s legitimacy as a lender. One commenter noted that, while OnDeck is indeed legitimate, it often charges high fees. This can be especially challenging for small businesses that may lack other financing options.

CuraDebt Reviews: A Helping Hand For Businesses In Debt

CuraDebt has helped numerous businesses and individuals navigate debt issues effectively. By offering free consultations, CuraDebt helps clients understand their debt relief options and find a plan that aligns with their financial goals. If your business is in debt, don’t hesitate to explore CuraDebt’s services as a valuable resource for debt settlement and financial guidance.

Conclusion: Is OnDeck Capital The Right Choice?

OnDeck offers quick funding options with a simple application and flexible terms for business loans. However, high interest rates and fees may be a downside for some borrowers, especially those with lower credit scores. If you’re considering a loan to consolidate business debt, OnDeck may work, but understand the costs involved.

For businesses struggling with overwhelming debt, CuraDebt’s relief services provide an alternative to taking on new loans. With a free consultation, CuraDebt can guide you toward the best path for your financial situation, helping your business find stability and relief.