Navigating debt relief options can feel overwhelming, especially when evaluating companies like Option 1 Legal. With various debt relief services promising solutions, it’s essential to investigate each option thoroughly. This article explores Option 1 Legal’s offerings, client reviews, and complaints, helping you decide if they’re the right fit for your needs. Plus, we’ll introduce CuraDebt’s free consultation as a trusted alternative to guide you toward financial stability.

What Is Option 1 Legal?

Option 1 Legal is a debt relief service provider that assists individuals dealing with financial challenges. They focus on helping clients resolve outstanding debts through negotiation and settlement, with the goal of reducing the total amount owed. Operating under the legal framework of consumer protection laws, they aim to provide support for those struggling to manage their financial obligations.

Need a loan or help with debt relief? CuraDebt is here for you.

How Does Option 1 Legal Work?

Option 1 Legal works by partnering with clients to resolve their debt-related challenges. After an initial consultation, they develop a customized strategy based on the client’s financial circumstances. Their process typically includes:

- Debt Evaluation: They assess the client’s financial status and existing debts.

- Negotiation With Creditors: The company negotiates with creditors to lower the total owed or create manageable repayment plans.

- Legal Support: Option 1 Legal may provide legal advice or representation for cases involving debt lawsuits or creditor harassment.

While the process may sound promising, results vary, and client experiences reflect differing outcomes. Transparency and communication appear to be areas where clients report mixed feedback.

Option 1 Legal Services

Option 1 Legal offers services targeting debt relief and legal protection. Their primary services include:

- Debt Settlement: Negotiating with creditors to reduce the overall amount owed.

- Creditor Harassment Defense: Helping clients handle unfair debt collection practices under the Fair Debt Collection Practices Act (FDCPA).

- Consumer Litigation Support: Providing legal advice and representation for debt-related legal disputes.

These services are designed to assist individuals overwhelmed by debt, but it’s vital to weigh their potential effectiveness against client reviews and complaints.

Need trustworthy debt relief services? CuraDebt provides experienced assistance. Book your free consultation today!

Option 1 Legal Reviews

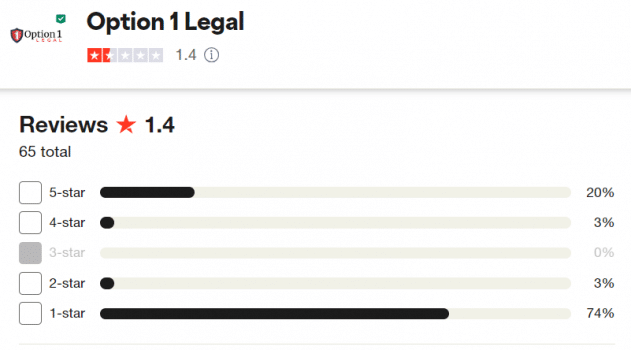

Trustpilot Reviews

Option 1 Legal has an average rating of 1.4/5 on Trustpilot. Here’s a mix of positive and negative testimonials:

- Positive Review: “I am so happy I signed up with Option1 Legal! They have been so helpful.”

- Positive Review: “I have always been treated with the utmost respect by everyone on the Option 1 team. All questions were answered in layman’s terms, so that the answers were thoroughly understood regarding legal matters with creditor’s.”

- Negative Review: “Option 1 does not even deserve 1 star. We have been calling them for 7 months regarding our accounts, and we get the run around every time. No follow up, keep asking for more money, but they haven’t done anything with the additional money I have already given them.”

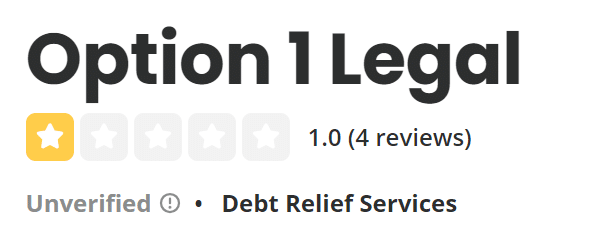

Yelp Reviews

On Yelp, Option 1 Legal averages 1/5 based on 4 reviews. Most reviews highlight dissatisfaction.

- Negative Review: “If you are looking for a debt relief company to help you out, please do not use this one! You will lose money, they will rip you off, no customer service, do the opposite of what they say, and your credit score will be worse than they tell you.”

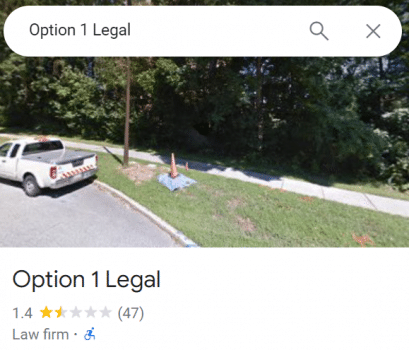

Google Reviews

Option 1 Legal has a 1.4/5 rating on Google Reviews. Client feedback includes:

- Positive Review: “They came at a time when I needed to consolidate all my debt. They did just that! Perfectly.”

- Positive Review: “Very good company, they did everything they said were going to do”

- Negative Review: “Absolutely the worst. I ended up in worse shape than before I entered their program. I wanted to avoid court cases but ended up taken to court multiple times. Horrible communication! I still have questions and get no answers. They’ll “get back to me” and never do. I got better advice from my creditors representatives. I just want this to be over.”

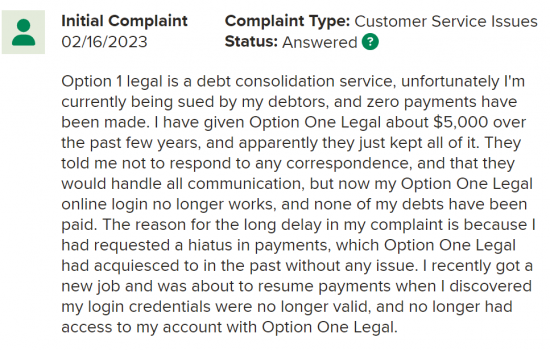

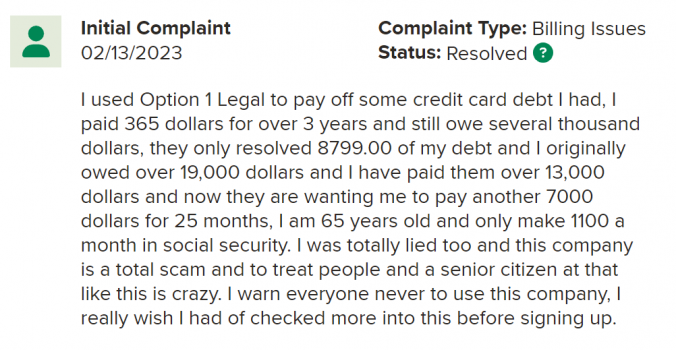

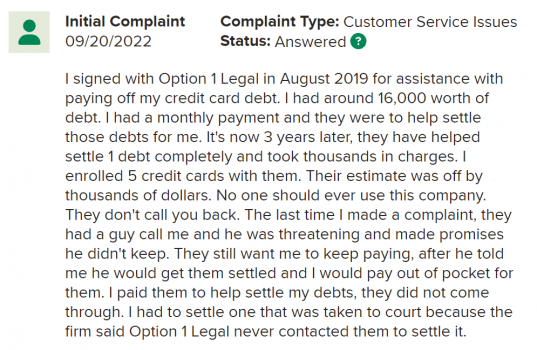

BBB Complaints

Option 1 Legal holds an F rating with the Better Business Bureau (BBB) and is not accredited. Complaints often cite unmet promises, lack of transparency, and insufficient results. Clients have expressed frustration over the fees charged and minimal progress in resolving their debts.

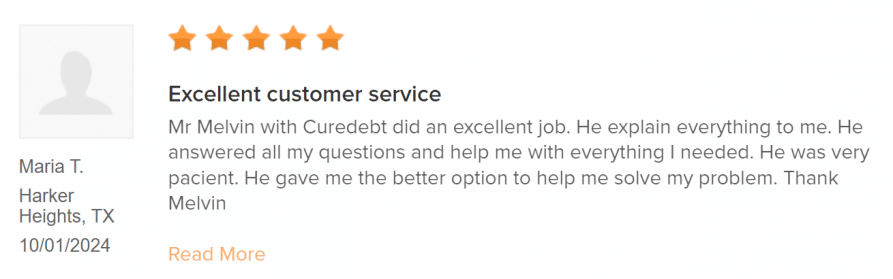

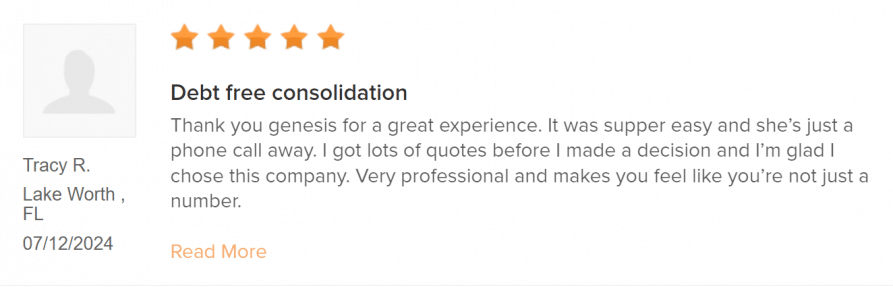

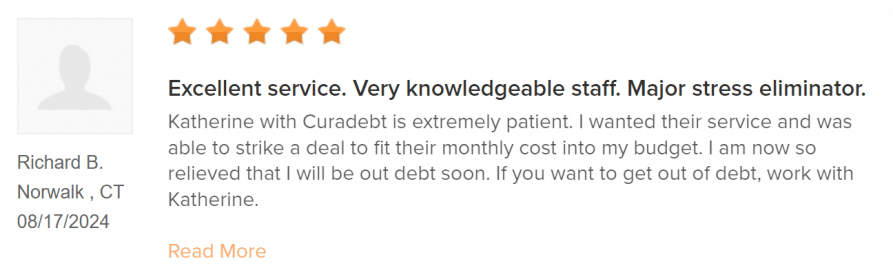

CuraDebt Reviews: A Trusted Alternative

At CuraDebt, we’ve helped thousands of clients achieve financial freedom through personalized debt relief solutions. Here’s what our clients say:

Could you be next? Take the first step toward financial stability with CuraDebt’s free consultation today!

Conclusion: Is This Company The Right Choice?

Option 1 Legal provides debt relief services, but client reviews highlight challenges, including poor communication and unmet expectations. Their ratings on Trustpilot, Yelp, and Google suggest room for improvement, and their BBB complaints raise concerns about their practices.

If you’re exploring debt relief, CuraDebt offers a free consultation to discuss your financial situation and craft a personalized solution. Unlike other companies, CuraDebt focuses on transparency, client satisfaction, and delivering results.

Contact CuraDebt today and take the first step toward a debt-free future. Don’t let financial stress control your life—let us help you reclaim your financial freedom!