If you’re struggling with IRS tax debt, here you’ll find some tax relief options to settle your debt and avoid penalties.

Understanding IRS Tax Debt and Why It’s Important to Act Now

Owing money to the IRS can quickly become overwhelming. When facing tax debt, the IRS has significant authority to collect what you owe. This can range from garnishing your wages to placing liens on your property, giving the IRS broad power to recover the debt. Unfortunately, ignoring these debts will only make the problem worse, as penalties and interest will continue to accumulate over time. Fortunately, there are several options for tax debt relief that can help you either settle your debt with the IRS for less than what you owe or make it more manageable to pay off over time. These solutions provide much-needed relief for individuals facing financial strain.

If you’re struggling with back taxes, CuraDebt can offer a free consultation to guide you toward a solution that works best for your situation.

Common IRS Tax Debt Relief Options

1. Offer in Compromise (OIC)

An Offer in Compromise (OIC) is a tax relief program offered by the IRS that allows you to settle your tax debt for less than the total amount owed. It’s designed for taxpayers who can’t pay their full debt without financial hardship. To qualify, you must demonstrate that paying the full amount would create significant financial strain. If approved, the IRS agrees to accept a reduced amount, either in a lump sum or through a payment plan. This option provides relief for those struggling with overwhelming tax debt but comes with strict eligibility requirements.

Although the Offer in Compromise can offer debt relief, approval rates are low. Many taxpayers find it beneficial to work with professionals like CuraDebt, who can help increase the likelihood of approval by ensuring all documentation is properly prepared and submitted.

2. Installment Agreement (Payment Plan)

If you’re unable to pay your full tax debt immediately, an Installment Agreement can help by spreading the payments over time. There are different types of installment agreements:

- The Streamlined Installment Agreement is a great option for taxpayers who owe under $50,000 in debt. With this agreement, you can spread your payments over up to 72 months, and it has the added benefit of not requiring extensive financial documentation, making it easier and more convenient to apply.

- Partial Payment Installment Agreement: If you can’t afford a full payment, you may qualify for this option, allowing you to pay less each month based on your financial situation.

3. IRS Fresh Start Program

The IRS Fresh Start Program was created to make it easier for taxpayers to qualify for debt relief. This program expands eligibility for Offers in Compromise and streamlines installment agreements for individuals with up to $50,000 in debt. It’s an ideal solution for those who want to avoid penalties and get back on track with the IRS.

How the IRS Collects Tax Debt: What to Watch Out For

If you fail to address your tax debt, the IRS can take aggressive actions to collect. These actions include:

- Tax Liens: A tax lien is a legal claim the IRS places on your property if you don’t pay your taxes. It’s the government’s way of ensuring they get their money back. A tax lien can hurt your credit score, making it harder to sell or refinance your home.

- Tax Levies: A levy allows the IRS to seize your assets, including bank accounts, wages, and even personal property like your car or home.

- Wage Garnishment: The IRS can take a portion of your paycheck to cover your tax debt, leaving you with less income for everyday expenses.

Taking action early to address your tax debt is crucial to avoiding these harsh collection methods.

Real Stories: How People Settled Their IRS Debt

Dealing with IRS tax debt can be overwhelming, and many people have shared their personal experiences online about what worked (or didn’t work) for them. Here’s what real taxpayers have said about their journey to resolve tax debt with the IRS.

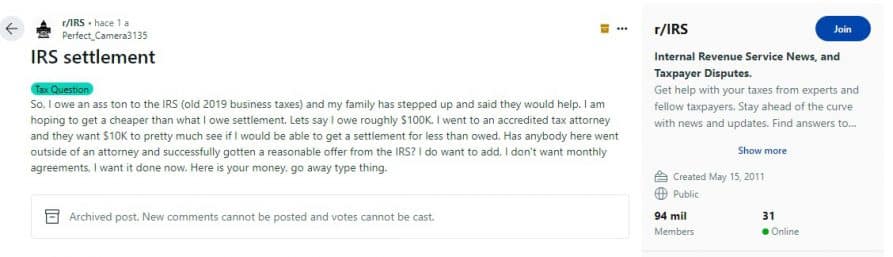

1. Learning the Hard Way

One user on Reddit shared how they tried to settle their tax debt on their own, only to find themselves facing even bigger issues:

“I thought I could handle the IRS myself, but after months of struggling with paperwork and getting nowhere, I finally caved and hired a tax company. It was expensive, but worth it. I ended up settling for much less than I originally owed.”

2. Positive Outcome with Professional Help

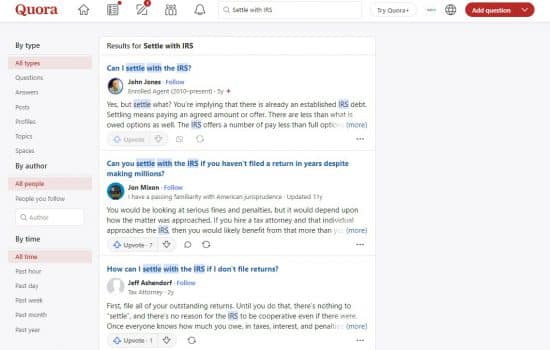

On Quora, a user detailed their experience using a tax relief company to handle their Offer in Compromise application:

“Feeling completely overwhelmed with over $30,000 in back taxes, I decided to hire a tax attorney. After months of negotiating with the IRS, we finally reached a settlement for about $8,000. I genuinely couldn’t have achieved that without their help!”

3. Feeling Relieved After Using a Payment Plan

One user shared their story on X, stating:

“The IRS wage garnishment was really overwhelming, but once I set up an installment plan, the pressure finally lifted. Now, I can manage my debt without feeling like I’m drowning every month.”

Why Choose CuraDebt for Tax Debt Relief?

At CuraDebt, we’ve helped individuals resolve their tax debt for over 20 years. We fully understand the complexities involved in IRS negotiations, whether it’s through Offers in Compromise or installment agreements. In both cases, we work to ensure you get the best possible outcome.

Here’s how CuraDebt can help:

- Personalized Debt Solutions: We tailor solutions based on your financial situation, ensuring you get the best possible outcome.

- Expert Guidance: From helping with complex tax relief applications to negotiating directly with the IRS, we handle the entire process for you.

- Free Consultation: Unsure of your options? Our team offers a free consultation to help you understand your IRS tax debt relief choices.

Take the first step toward settling your tax debt by contacting CuraDebt today for a free consultation.