With financial difficulties impacting millions, finding the right debt relief solution can make all the difference. As individuals consider different companies, understanding how each one works and what real clients have experienced is crucial. One company many may come across in their search is Priority Plus Financial. Here, we’ll take an in-depth look at Priority Plus Financial, examining how it works, the services it provides, and what real customers have said.

CuraDebt offers debt relief services to help you make the best decision for your financial future. Take our free consultation now!

What Is Priority Plus Financial?

Priority Plus Financial is a debt relief company that focuses on assisting clients struggling with unsecured debt, such as credit, medical bills, and personal loans. Priority plus financial promotes itself as a service that makes loans. However, they also help you to reduce debt through negotiation and management.

The goal of Priority Plus Financial is to work directly with creditors on behalf of their clients, helping clients pay off debts for less than the amount originally owed. Debt relief can be a valuable option for individuals experiencing financial hardship who cannot keep up with high-interest payments. Working with Priority Plus Financial may help reduce these debts, allowing clients to pay a lower balance over a set period. Priority Plus Financial’s services are intended to simplify and reduce debt while helping individuals avoid filing for bankruptcy.

If you’re looking for a reputable debt relief company to help with your financial situation, consider trying CuraDebt’s free consultation to see how we can help.

How Does Priority Plus Financial Work?

Priority Plus Financial’s process starts with a consultation to assess your debt situation. Here, they work with you to determine whether debt consolidation or settlement aligns best with your financial goals.

- Debt Settlement: Priority Plus Financial helps negotiate with creditors to reduce your total debt amount. The idea is to reach a settlement that allows you to pay a fraction of your original debt, usually as a lump sum.

- Debt Consolidation: Rather than reducing the total debt amount, consolidation simplifies your payments. Priority Plus Financial may help consolidate multiple debts into a single payment plan, potentially at a lower interest rate.

After setting up a plan, clients make monthly payments, which Priority Plus Financial uses to pay off the creditors based on negotiated terms. Their services are most effective for individuals struggling with high-interest credit card debt, medical bills, and personal loans.

If debt settlement interests you, CuraDebt also specializes in this area. Contact us for a free consultation to explore if this option fits your financial needs!

Debt Consolidation Vs. Debt Settlement

Certainly, debt relief services can differ in significant ways, and it’s important to know the difference between debt consolidation and debt settlement before deciding on the best option.

Debt Consolidation

Involves combining multiple debts into one manageable payment, usually with a lower interest rate. With consolidation, clients don’t reduce their overall debt, but rather simplify the repayment structure. This can be ideal for individuals who are comfortable paying off the full amount of debt but are seeking more favorable terms to make the process easier.

Priority Plus Financial offers debt consolidation assistance by helping clients streamline their payments.

Debt Settlement

Debt settlement, on the other hand, reduces the total amount owed rather than restructuring the payment terms. In this process, a debt relief company negotiates with creditors to reach an agreement where clients can pay a portion of the original balance. This option is more suitable for individuals who are unable to pay the full debt amount but have funds available for a one-time or scheduled settlement.

At CuraDebt, we specialize in debt settlement to help clients reduce their overall debt burden. If this solution aligns with your needs, reach out for a free consultation to see how we can help negotiate lower payments on your behalf.

Priority Plus Financial Reviews

Understanding real customer experiences is key when choosing a debt relief company. Let’s explore what clients have said about Priority Plus Financial on popular review platforms like Trustpilot, BBB, and Google.

Trustpilot

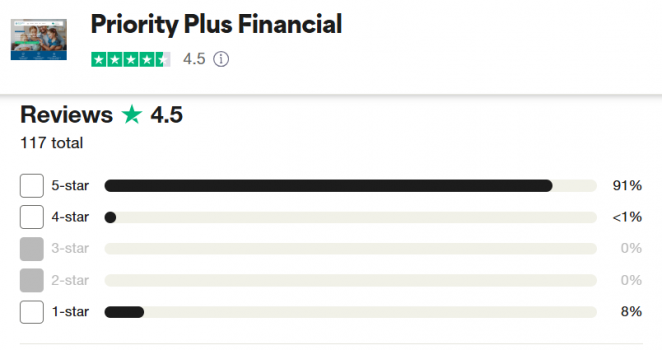

Priority Plus Financial has an average rating of 4.5 stars on Trustpilot, indicating generally positive experiences among its customers. Here’s what some of them had to say:

- Positive Review: “I’ve had no issues with this company. Answered all my questions in a timely and professional manner.”

- Positive Review: “I am impressed with the knowledge, professionalism that was given to me. Gave me the confidence to move forward with the program.”

- Negative Review: “The company is super shady, and they use coercive practices to trick customers.”

Better Business Bureau (BBB)

Priority Plus Financial holds an average rating of 4.36 out of 5 stars on the Better Business Bureau (BBB) website. Here’s a snapshot of customer feedback:

- Positive Review: “They’ve helped me out a ton. Friendly and professional staff.”

- Positive Review: “Every representative I spoke with was extremely knowledgeable and supportive. They gave me several different options and helped me navigate a tough decision.”

- Negative Review: “I received a letter from Priority Plus Financial offering a loan at 5.99%. This gave me the impression they were a reliable lender with competitive rates. However, my experience revealed a pattern of broken promises and misleading information. They don’t actually offer loans. Instead, they pushed their debt settlement services, which wasn’t what I was looking for.”

Google Reviews

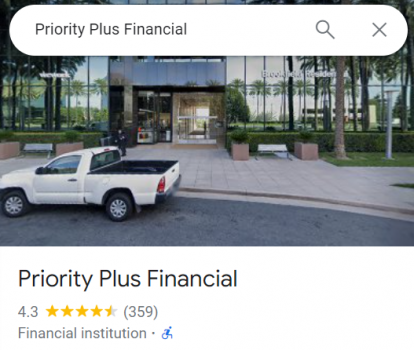

On Google, Priority Plus Financial has an average rating of 4.3 stars. Here’s what some users had to say:

- Positive Review: “It was truly a pleasure reaching someone that instantly understood my situation by actively listening to my circumstances and not only understanding my predicament, but actually empathizing with my situation.”

- Positive Review: “Great company. Understands what you are going through and takes great care to make sure you are not alone in your journey to financial health and well-being.”

- Negative Review: “The person I spoke with tried to push me to sign the agreement ASAP. The program was new to me, so I asked questions and hoped to get answers, but the person kept saying he mentioned it already and became very annoyed.”

What People Are Saying On Forums

In addition to formal reviews, individuals often discuss companies like Priority Plus Financial on forums such as Reddit.

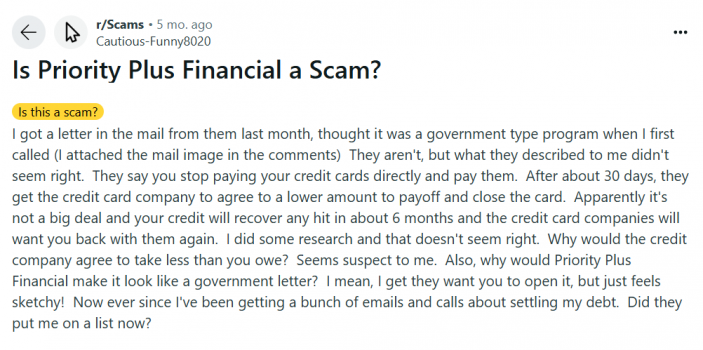

Skepticism About Debt Settlement Services

In one Reddit thread, a user shared their skepticism about Priority Plus Financial’s debt settlement offerings. The individual questioned the legitimacy of debt settlement services in general, expressing doubt over whether these services could truly negotiate lower balances. While some may hesitate to trust these services, many companies like Priority Plus Financial do work directly with creditors on behalf of their clients. It’s common for people to have varying comfort levels with debt relief options, and understanding each method can help in making the best decision.

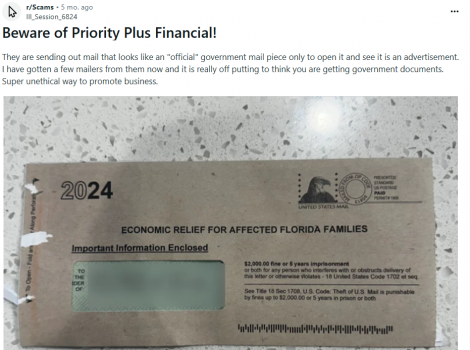

Concerns Over Marketing Practices

Another Reddit post described how Priority Plus Financial mailed promotional materials resembling government notices. The user felt this marketing approach was misleading.

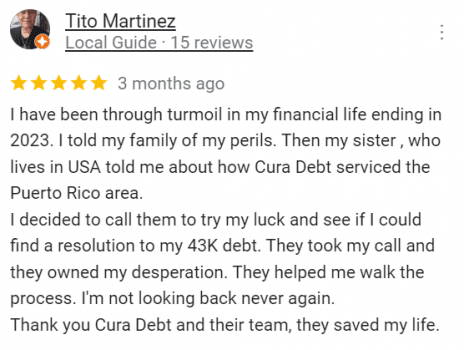

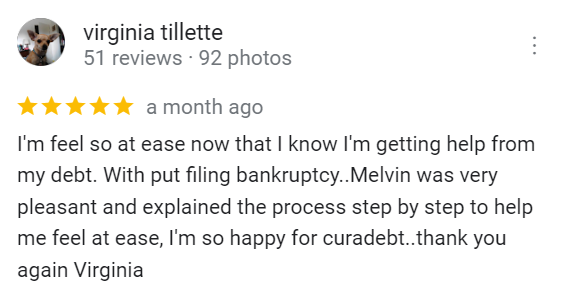

CuraDebt Reviews

If you’re looking for reputable assistance with debt relief, CuraDebt has helped thousands of clients resolve debt issues through personalized services. With our focus on debt settlement, CuraDebt negotiates directly with creditors to reduce debt burdens, allowing clients to regain financial stability. Let’s look at what our clients are saying:

If you are struggling with debt, let us help you! Take our free consultation.

Conclusion: Is This Company The Right Choice?

Priority Plus Financial has garnered generally positive feedback from customers on platforms such as Trustpilot, BBB, and Google Reviews. Many clients have praised the company for its debt reduction services, professionalism, and helpful guidance. However, some common concerns include communication delays and questions about transparency, especially regarding services.

If you’re considering a debt relief service, comparing multiple companies is always a good idea. CuraDebt offers a free consultation and specializes in debt settlement, which could be a valuable solution if you’re looking to reduce your overall debt amount. Choosing the right debt relief company is a personal decision, but with thorough research, you can find a service that aligns with your goals.