Debt can quickly spiral out of control, especially when it’s spread across multiple sources like credit cards, loans, and medical bills. If you’re overwhelmed by debt, you might be considering using a personal loan to consolidate everything into one manageable payment. But is it the right solution? In this article, we’ll explore whether using a personal loan to pay off debt is a smart choice, weighing the pros and cons. We’ll also discuss other alternatives to help you regain control of your finances.

Why This Could Be A Bad Idea

While a personal loan might seem like a quick and easy way to pay off multiple debts, it’s important to consider the potential downsides before moving forward.

Interest Rates And Terms

Personal loans typically offer lower interest rates compared to credit cards, but the rates can still be high depending on your credit score. Even with a lower rate, a personal loan may still have fees, like origination fees, which could make it more expensive than you initially think. Additionally, personal loans often come with fixed terms, which means you’ll have a set repayment schedule that can extend for several years. This could stretch out your debt repayment timeline and make it harder to get ahead financially.

Risk Of Further Debt Accumulation

One of the biggest risks of using a personal loan to pay off your debt is the temptation to rack up new debt. Once you clear your existing balances, it’s easy to fall back into old spending habits, leading to more debt. Without addressing the root causes of your financial challenges, a personal loan might offer temporary relief but not a permanent solution.

Hidden Fees

In addition to interest rates, personal loans may come with fees that add to the overall cost. Be sure to read the fine print before committing to a loan. Common fees include origination fees, late payment fees, and prepayment penalties, which can significantly increase the total amount you owe over time.

What Can You Do Instead?

If using a personal loan to pay off debt doesn’t seem like the right choice, don’t worry – there are plenty of alternatives that might better suit your situation. Let’s explore some options:

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan. This can streamline your monthly payments and possibly lower your interest rate. Some people use personal loans for this purpose, but there are also other consolidation programs available that may be more suitable for specific types of debt.

Debt Settlement

Debt settlement is a process where you negotiate with your creditors to pay less than the full amount you owe, offering a practical way to reduce your debt significantly. This approach allows you to resolve outstanding balances faster and can provide much-needed financial relief. By reaching a settlement, you take an important step toward regaining control over your finances and moving closer to a debt-free future.

Credit Counseling

If you feel lost in the debt maze, credit counseling might be a good option. A credit counselor can help you create a budget, negotiate with creditors, and develop a plan to pay down your debt without taking on a personal loan. Credit counseling services are typically free or low-cost, making them a viable option for many individuals.

Bankruptcy (As a Last Resort)

For some, bankruptcy may be the only way to escape overwhelming debt. However, this should be considered as a last resort due to its long-term impact on your credit score and finances. If you’re contemplating bankruptcy, it’s important to consult a professional who can guide you through the process.

If you’re unsure which option is best for you, CuraDebt offers a free consultation to discuss your financial situation and explore the best debt relief solution. We’re here to help you find the path to financial freedom.

How To Evaluate Your Debt Relief Options

When it comes to managing and eliminating debt, it’s essential to make an informed decision. Here are a few important factors to consider as you evaluate your debt relief options:

1. Know Your Total Debt

Understanding exactly how much you owe is the first step. List all your debts, including credit cards, personal loans, medical bills, or other outstanding payments. Take note of the interest rates for each, as this will influence the best strategy to pay them off.

2. Review Your Monthly Income And Expenses

Take a close look at your income and expenses to determine how much you can afford to put toward debt repayment each month. If you’re struggling to meet minimum payments, a consolidation loan or other options might help reduce your monthly burden.

3. Understand Your Goals

What is your long-term financial goal? Do you want to eliminate debt as quickly as possible, or are you looking for a more manageable repayment plan? Your goals will influence which method works best for you, whether that’s using a personal loan, enrolling in debt settlement, or opting for credit counseling.

4. Consider The Costs And Terms

Each debt relief option comes with its own costs, terms, and conditions. For example, while a personal loan might offer a lower interest rate than your existing debts, it may come with fees or other costs. Evaluate the overall cost of each option, factoring in any associated fees, to ensure it’s the most affordable solution for you.

By taking these factors into account, you’ll be better equipped to make an informed decision that aligns with your financial situation and goals.

What People Are Saying Across Platforms

Sometimes it’s helpful to get advice from others who have been in similar situations. Platforms like Reddit are full of discussions on debt relief, and here are two examples:

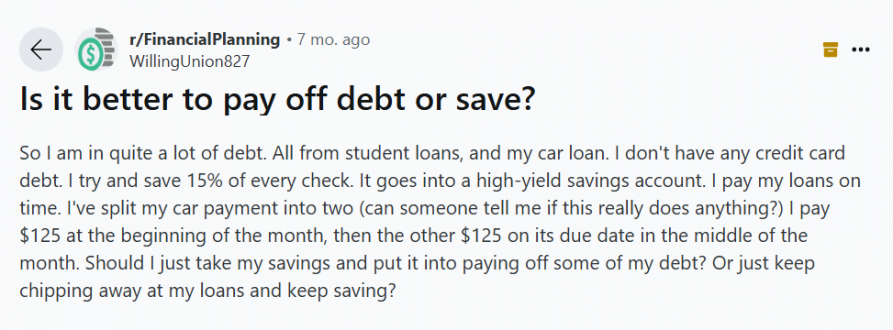

Should I Pay Off Debt Or Invest?

A Reddit user asked if it’s better to invest or pay off debt. The answers varied, but many users pointed out that it depends on the interest rates of the debt. If your debt has a high-interest rate, paying it off first can save you money in the long run. This type of advice can help you make an informed decision about your finances.

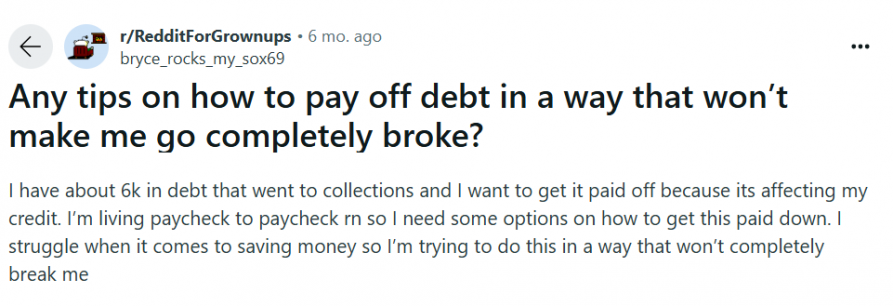

What’s the Fastest Way To Get Out Of Debt?

Another user asked for the fastest way to get out of debt, and many responses suggested using the debt snowball method. This approach involves paying off your smallest debts first and then moving on to larger ones. It’s a great way to build momentum and stay motivated, but it may not always be the fastest method for everyone, depending on your debt balance.

Both of these discussions highlight the importance of considering all factors when deciding how to approach debt repayment. Take the time to explore different options and speak to an expert for personalized advice.

CuraDebt Reviews

At CuraDebt, we’ve helped thousands of people regain control of their finances. Here are just a few of the positive reviews from our clients:

These are just a few examples of how we’ve helped people in similar situations. If you’re facing debt challenges, CuraDebt can help you, too. Let us guide you through the process and help you find the debt relief solution that’s right for you.

Conclusion

Paying off debt can feel overwhelming, but you don’t have to face it alone. While using a personal loan to pay off debt may seem like a good idea, it’s important to understand the potential risks and explore other alternatives like debt settlement.

If you’re ready to take control of your debt, CuraDebt is here to help. We offer a free consultation to discuss your options and help you find a personalized debt relief solution. Don’t wait – take the first step toward a debt-free future today!