Stressed about debt? You’re not alone—and picking the right debt relief company can make all the difference.

With so many options out there, it’s tough to know who to trust. That’s where we come in. In this article, we’ll take a close look at Simple Debt Solutions—what they offer, what real customers are saying, and whether they might be the right fit for you. No jargon, no pressure—just the clear info you need to make a smart choice for your financial future.

What Is Simple Debt Solutions?

Simple Debt Solutions is a debt relief company that helps people struggling with unsecured debts—like credit card balances, personal loans, and medical bills—find a way out. Unlike traditional lenders, they don’t just offer loans; they negotiate with creditors to potentially reduce what you owe, making repayment more manageable.

While their main focus is debt relief, their homepage highlights that they also prioritize loan solutions for those who may benefit from refinancing or consolidation. This makes them a flexible option whether you need to settle debt or restructure payments.

How Does Simple Debt Solutions Work?

This debt relief provider offers two potential paths for clients: negotiated settlements or loan solutions. Here’s how their system operates:

- Initial Financial Review

- Free consultation to analyze your debt-to-income ratio.

- Assessment of which solution (settlement or loan) might fit your situation.

- No obligation to proceed after evaluation.

- Program Enrollment

- For settlements: You’ll make monthly deposits into a dedicated account.

- For loans: They facilitate connections with lending partners.

- Clear explanation of fees for either option.

- Action Phase

- Settlement route: Their negotiators contact creditors to seek reduced payoffs.

- Loan route: They help arrange refinancing or consolidation loans.

- Regular updates provided on progress.

- Resolution

- Both options aim to reduce overall financial straint resorting to bankruptcy.

- Successful settlements typically resolve within 24-48 months.

- Loans immediately replace existing debts with new payment terms.

Simple Debt Solutions: Fees At A Glance

Simple Debt Solutions charges fees only if they successfully settle your debts, typically 15%–25% of the enrolled debt amount. For example, settling $10,000 in debt could cost $1,500–$2,500 in fees paid over time.

While they advertise no upfront fees, some clients report monthly account maintenance charges. Loan facilitation (if offered) may include third-party lender fees (1%–6%). Always review contracts carefully and BBB complaints for more.

If this company is the right choice depends on your specific financial picture. We’ll show alternatives later to help you make an informed decision. But before that, let’s examine real customer experiences. Client reviews can reveal important insights about how Simple Debt Solutions operates in practice.

Simple Debt Solutions Reviews

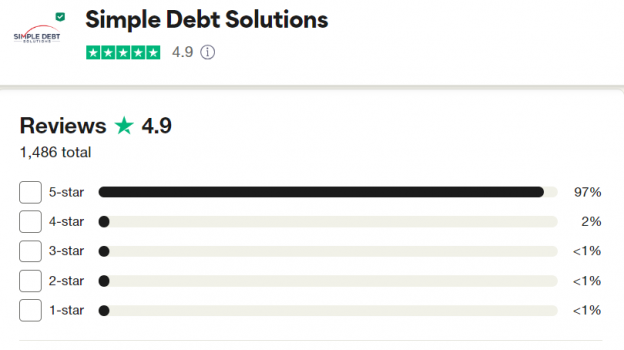

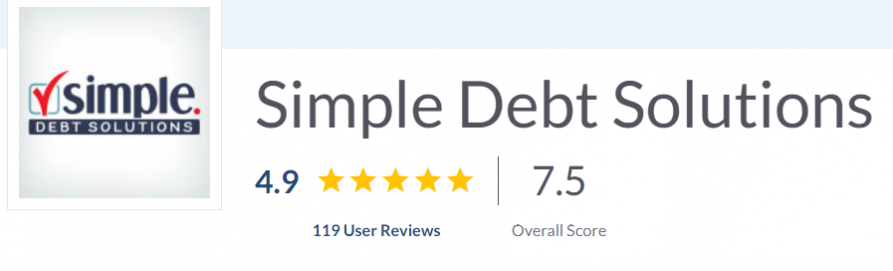

Trustpilot Reviews

Simple Debt Solutions boasts an impressive 4.9/5 average rating on Trustpilot. Here are some highlights:

- Positive Review: “Good explanation, short sweet and straight to the point.”

- Positive Review: “Conversation during initial phone interview was high energy and very friendly. It made me look forward to working for this company.”

- Negative Review: “I called to see about a personal loan, and the only thing they were interested in was consolidating my loan so I can pay them a monthly fee. Bad representation of a company. This is not a loan company but a company disguising as a third party.”

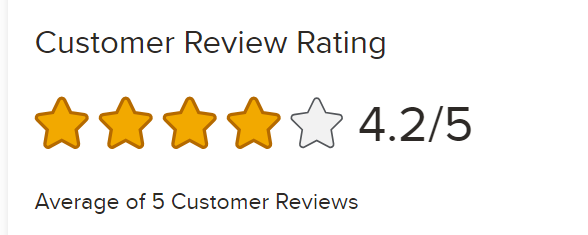

BBB Reviews

Simple Debt Solutions has a solid 4.2/5 rating with the Better Business Bureau (BBB). Feedback includes:

- Positive Review: “I highly recommend this business, customer service is second to none! Two thumbs up.”

- Positive Review: “Straight answers, very helpful and caring, overall awesome & smooth experience.”

- Negative Review: “I was told that I applied for a loan to pay my debt, they are doing the same thing that I was doing making payment credit went 780 to 620.”

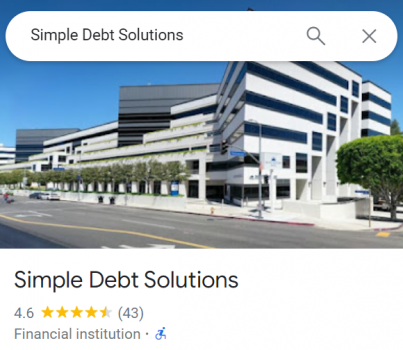

Google Reviews

On Google, Simple Debt Solutions has a strong 4.6/5 average rating. Here’s what clients are saying:

- Positive Review: “Excellent service from start to finish. They helped me regain control of my finances.”

- Positive Review: “I had the pleasure to speak with a representative who helped me so much and helped me understand everything and how much the program will help me grow in so many positive ways.”

- Negative Review: “Don’t sign up for this company. They are a scam and refuse to respond to my concerns after signing up. Do proper research like I wish I had and realize there are other options to settle debt. Most of their positive reviews are fake.”

Best Company Reviews

Simple Debt Solutions holds a 4.9/5 average rating on Best Company. Notable reviews include:

- Positive Review: “I have nothing but confidence that this decision will provide me with peace of mind and a new beginning.”

- Positive Review: “I feel at ease now that I’m on the right track to pay off all my debt and get back on my feet again.”

- Negative Review: “They refused to respond to my concerns, blocked my email and are a total scam of a company.”

While Simple Debt Solutions earns strong ratings overall (4.2-4.9/5 across platforms), reviews reveal a clear divide: satisfied clients praise their helpful service and debt relief results, while frustrated customers cite miscommunication, credit damage, and confusion about loan versus consolidation services. The disparity suggests outcomes may depend heavily on individual circumstances and expectations.

Simple Debt Solutions: Pros & Cons

Now that we’ve examined Simple Debt Solutions’ process, fees, and customer reviews, let’s summarize their key strengths and weaknesses:

| Advantages ✅ | Drawbacks ❌ |

|---|---|

| Strong reputation (4.2-4.9/5 across review platforms) | Some customers report confusion about loan vs debt relief services |

| No upfront costs for debt settlement program | Fees can be high (15-25% of enrolled debt) |

| Clear, step-by-step process | Monthly account maintenance fees may apply (5−5−15) |

| Helps avoid bankruptcy for eligible clients | Not all debt types qualify (secured loans excluded) |

| Positive feedback about customer service | Occasional complaints about post-enrollment communication |

While Simple Debt Solutions has helped many clients manage debt, their services may not suit everyone’s needs. The best choice depends on your specific financial situation and goals.

Conclusion: Is This Company The Right Choice?

Simple Debt Solutions has helped many clients, but mixed reviews show results vary. While their debt relief program works for some, others face challenges with communication and fees. It’s clear that success depends on your specific situation—and whether their approach aligns with your needs.

If you’re looking for a personalized and transparent alternative, CuraDebt offers a proven path forward. Our free, no-pressure consultation helps you explore all your options—not just a one-size-fits-all solution. We take the time to understand your goals and craft a plan that actually works for you.

Ready for real debt relief? Contact CuraDebt today and speak directly with an expert. Let’s find the right solution—together