Simple Path Financial Reviews: Here Is What You Need To Know

Managing debt can feel overwhelming, especially when you’re trying to find the best solution without adding more stress to your plate. If you’re considering debt consolidation or looking for a loan to regain control of your finances, choosing the right company is key. One name that often comes up in the industry is Simple Path Financial. They offer services like debt consolidation loans designed to help individuals regain financial stability. But how do they work?

In this in-depth review, we’ll explore how Simple Path Financial operates, what real customers are saying on platforms like Trustpilot, the Better Business Bureau (BBB), and Google, and whether their services align with your financial goals.

What Is Simple Path Financial?

Simple Path Financial, based in sunny Irvine, California, prides itself on providing effective financial solutions tailored to meet various needs. Their offerings include personal loans and specialized debt consolidation loans. Simple Path Financial primarily aims to simplify individuals’ financial management and help them regain control over their finances.

What sets them apart is their commitment to accessibility—offering flexible terms that cater to different credit profiles. While they market themselves as a one-stop shop for financial solutions, it’s crucial to dive deeper into their offerings to determine whether they align with your specific needs and goals.

How Does Simple Path Financial Work?

Simple Path Financial focuses on providing personal and debt consolidation loans. Their process is designed to simplify borrowing and help clients better manage their financial obligations. Here’s how it works:

1. Free Consultation

The process begins with a free consultation. Potential clients can either apply online or respond to a mail offer they’ve received. During this initial step, Simple Path Financial gathers basic financial information, including income, credit score, and existing debt, to assess the client’s eligibility for a loan.

2. Loan Prequalification

Once you share your basic financial details, Simple Path Financial reviews your situation and lets you know if you qualify for a loan. Clients who meet the requirements are prequalified and given a range of loan options tailored to their needs.

3. Customized Loan Proposal

Once prequalified, Simple Path Financial presents loan terms, including interest rates, repayment periods, and monthly payment amounts. They specialize in debt consolidation loans, combining multiple debts into one fixed monthly payment to simplify financial management.

4. Approval And Funding

After agreeing to the loan terms, clients proceed with a formal application. Upon approval, funds are disbursed directly to the client or, in some cases, creditors, depending on the loan’s purpose. The process is generally quick, with funds available within a few business days.

5. Repayment

Clients make monthly payments based on the agreed terms, benefiting from the simplicity of a single loan and potentially lower interest rates compared to credit card debt.

Debt Consolidation Loan Vs. Debt Settlement

Choosing the right strategy depends on your financial goals.

- Debt Consolidation Loans: Ideal for simplifying payments, but may extend your repayment timeline or incur higher overall interest costs.

- Debt Settlement: Often results in lower overall debt and a quicker resolution, especially beneficial if you’re struggling to keep up with payments.

Here is an informative video that will help you better understand how they differ.

Simple Path Financial Reviews

Many customers appreciate Simple Path Financial’s friendly service and streamlined process, while others have raised concerns about unexpected terms. Here’s what real users are saying…

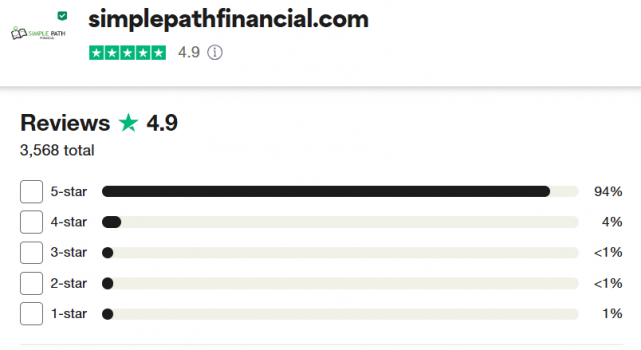

Trustpilot Reviews

Simple Path Financial has an impressive 4.9/5 rating on Trustpilot, based on over 3,000 reviews. Customers often highlight the supportive customer service team and efficient loan process. For example:

- Positive Review: “I am very grateful for the excellent service that I received from the very beginning to the end.”

- Positive Review: “Very informative, very helpful answering all my questions in a very, simple, plain English way to understand.”

- Negative Review: “They send you a preapproved loan and then bait and switch you into debt settlement.”

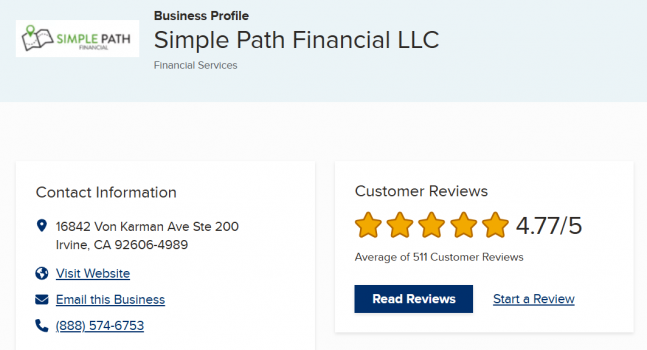

Better Business Bureau (BBB)

Simple Path Financial has an A+ rating on the BBB and an average customer score of 4.77/5 from over 500 reviews.

- Positive Review: “They were so kind and helpful, never made me feel pressured, and made me truly feel like I was taking back my life again.”

- Positive Review: “All the representatives were very helpful and friendly and explained my program thoroughly.”

- Complaint: “They refer you to shady partners who try to take advantage of you. When you call them out, different agents get involved, making it harder to get a straight answer.”

Google Reviews

On Google, the company averages 4.3 stars. Clients frequently praise the efficiency of the process. Here’s what some customers have said:

- Positive Review: “Their proficiency and strategic counsel have been important in surmounting corporate obstacles. I like their expertise and dedication to client success.”

- Positive Review: “Simple process and amazing results! We highly recommend working with Simple Path Financial.”

- Negative Review: “This company is bad. Stay away, they might sell your information to another company.”

CuraDebt Reviews

While evaluating debt relief options, it’s also helpful to explore other well-established companies like CuraDebt, known for its expertise in debt settlement.

Here’s what some of our clients have shared:

Conclusion: Is This Company The Right Choice?

Simple Path Financial has earned a solid reputation for debt relief services. Positive reviews highlight their professional customer service, while complaints suggest room for improvement in transparency regarding terms.

We understand how deeply financial stress affects your daily life and finding the right support matters. While you research different debt relief companies, consider CuraDebt’s proven track record of helping thousands find their path to financial peace. We’ve spent decades developing comprehensive solutions for every type of debt challenge. Take a breath, explore your options, and discover why our clients trust us with their financial future. Start with a free consultation to see if we’re the right fit for your journey to financial freedom.