Small Business Debt Relief: 5 Strategies to Succeed

Running a small business can be rewarding, but small business debt relief is often necessary when debt becomes a significant hurdle. If your business is struggling under the weight of debt, don’t worry—you’re not alone. Many business owners face similar challenges and find their way to financial freedom through strategic planning and the right support. In this guide, we’ll explore five practical strategies to manage and reduce small business debt effectively.

Is Your Business In Debt?

Don’t panic. You’re not the only one facing financial stress. Managing a small business comes with ups and downs, and debt is often part of the journey. The key is to approach it with a clear plan and professional guidance when necessary. Let’s explore some proven ways to regain control and reduce your small business debt effectively.

Need a loan or help with debt relief? CuraDebt is here for you.

1. Evaluate Your Financial Situation Thoroughly

Before taking any steps, it’s crucial to understand your current financial standing.

- What To Do: Conduct a detailed review of your debts, income, and expenses. Create a comprehensive list of all your creditors, balances, interest rates, and payment schedules.

- Why It Works: This clarity allows you to prioritize high-interest debts and find areas to cut back.

- How CuraDebt Can Help: If organizing your finances feels overwhelming, CuraDebt offers a free consultation to analyze your situation and recommend tailored solutions.

2. Create A Realistic Budget And Stick To It

When your small business needs debt relief, a solid budget is the cornerstone of debt management.

- What To Do: Outline a monthly budget that accounts for all business income and necessary expenses. Include a plan for debt repayments, even if it’s incremental.

- Why It Works: Staying disciplined with a budget helps you avoid unnecessary spending and focus on debt reduction.

- Extra Tip: Use accounting software or hire a financial advisor to streamline budgeting processes.

3. Negotiate With Creditors

You might be surprised at how willing creditors are to work with you.

- What To Do: Contact your creditors to discuss your financial challenges. Request lower interest rates, extended payment terms, or even partial debt forgiveness.

- Why It Works: Negotiating can significantly reduce your monthly burden, freeing up cash flow for other needs.

4. Diversify And Increase Revenue Streams

Bringing in additional income can make a huge difference in managing debt.

- What To Do: Explore new revenue opportunities, such as expanding your product line, entering new markets, or offering complementary services.

- Why It Works: Extra revenue can be directed toward paying off debt faster, reducing interest payments over time.

- Quick Tip: Focus on low-cost, high-return strategies to minimize risk while maximizing profits.

5. Consider Debt Settlement With CuraDebt

Sometimes, the best solution is to work with a professional debt relief company like CuraDebt.

- What To Do: Debt settlement involves negotiating with your creditors to reduce the total amount owed. CuraDebt specializes in creating custom plans to help small businesses manage their debt more effectively.

- Why It’s The Best Option: Debt settlement can save you money and time while alleviating the stress of handling creditors alone.

- Free Consultation: Our team offers a free consultation to assess your situation and explain how we can help. Contact us today to learn more about our proven solutions. We can assist your small business with debt relief

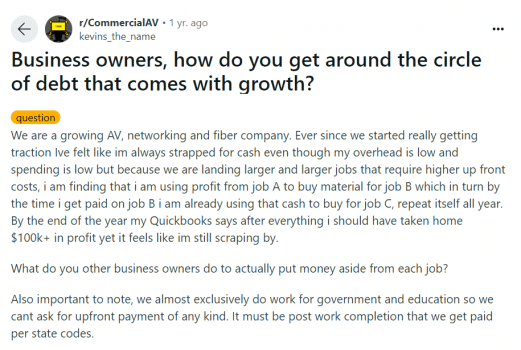

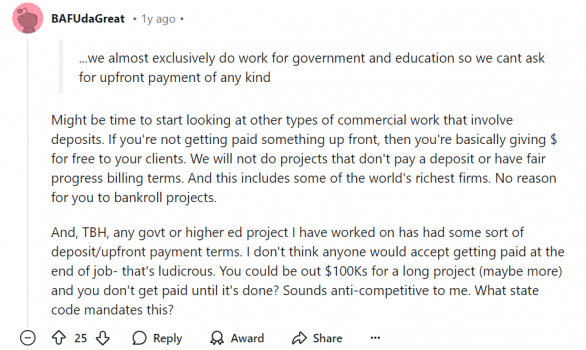

What People Are Saying Across Platforms

Sometimes, seeking advice and sharing experiences on platforms like Reddit or Quora can provide helpful insights.

On Reddit: A user recently asked business owners how to escape the cycle of debt. Responses highlighted the following strategies.

On Quora: Another user asked how to manage business debt. This post got several responses that affirmed what we have discussed and other perspectives.

These discussions show that you’re not alone—many business owners are exploring similar paths to overcome their challenges.

CuraDebt Reviews

If you need help with debt, CuraDebt is here for you and your business. We’ve helped many business owners take back control of their money. Don’t just believe us—our clients have shared their experiences. Keep an eye out for the testimonials we’ll be sharing to show how CuraDebt has made a difference.

Do you want debt relief for your small business? Take our free consultation now.

Conclusion

We have explored 5 key strategies for small business debt relief. By reviewing your finances, making a budget, talking to creditors, finding new ways to earn money, and getting help from CuraDebt for debt settlement, you can find financial stability and peace of mind.

Take the first step toward relief today—schedule your free consultation with CuraDebt. Let us help you create a tailored plan to overcome debt and secure your business’s future.