Are you interested in getting a loan and came across Symple Lending? Before making a decision, it’s important to dive into some reviews to determine if this company is trustworthy. When dealing with financial services, especially loans and debt consolidation, understanding how a company operates and what its customers are saying can make a huge difference.

In this article, we’ll explore Symple Lending’s background, services, and customer feedback to help you decide if it’s the right choice for you.

Looking for personalized guidance? we’ll introduce you to CuraDebt’s free consultation services, so you can make the best choice for your financial future.

Now, let’s take a closer look at our review of Symple Lending.

Need a loan or help with debt relief? CuraDebt is here for you.

What Is Symple Lending?

Symple Lending is a financial services company that offers personal loans aimed at debt consolidation. The company focuses on helping individuals streamline their finances by combining multiple debts into a single loan, usually with a fixed interest rate. This loan type can streamline monthly payments for individuals managing multiple high-interest debts, such as credit cards or personal loans.

The company emphasizes fast loan approvals and claims to offer competitive interest rates. But, like any financial decision, it’s crucial to understand the terms, conditions, and customer feedback to determine if this service is right for you.

Symple Lending Services

Symple Lending offers a range of financial products, primarily focused on personal loans and debt consolidation. Here’s a brief overview of their key services:

- Personal Loans: Symple Lending provides unsecured personal loans that can be used for various purposes, including debt consolidation, home improvements, and other major expenses. Their loans are marketed as having competitive interest rates, but the actual rates offered will depend on the borrower’s credit profile.

- Debt Consolidation Loans: This service allows individuals to consolidate multiple high-interest debts into a single loan with a potentially lower interest rate. Debt consolidation can be appealing to people overwhelmed by managing multiple payments each month.

- Loan Terms: Symple Lending offers flexible loan terms, with repayment periods ranging from 2 to 7 years. They claim that borrowers can apply online and receive a decision in minutes.

While debt consolidation loans may provide temporary relief, they don’t reduce the total amount you owe. If you’re searching for a solution that can help lower your debt amount, CuraDebt‘s debt relief programs could be a good option. Our debt settlement services focus on negotiating with creditors to reduce your overall debt and can be more beneficial in the long term than taking out another loan.

Explore CuraDebt‘s free consultation to learn about your debt relief options.

Symple Lending Reviews

Customer reviews provide valuable insight into the reliability and trustworthiness of a company. Let’s take a closer look at what customers are saying about Symple Lending across different platforms.

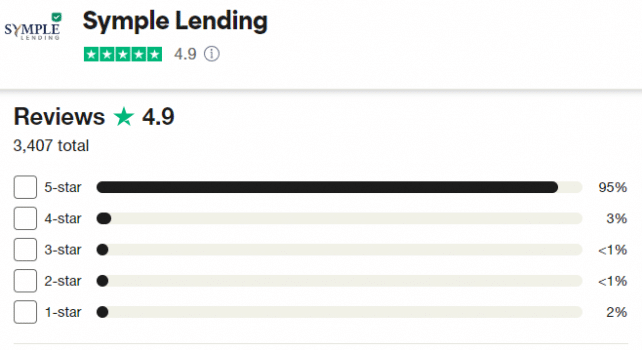

Trustpilot Reviews

Symple Lending has a strong presence on Trustpilot, where they hold an impressive average rating of 4.9 stars. Many customers praise the company for its fast application process and helpful customer service.

Here are a few specific reviews from Trustpilot:

- Positive Review: “Symple Lending made the loan process simple and stress-free. I was approved quickly, and the funds were available within days.”

- Positive Review: “I was able to consolidate my debts easily with Symple Lending. The terms were clear, and customer service was always available to answer my questions.”

- Negative review: “Poor communication, failure to set accurate expectations, nothing went as expected, and unable to follow with simple callback appointments.”

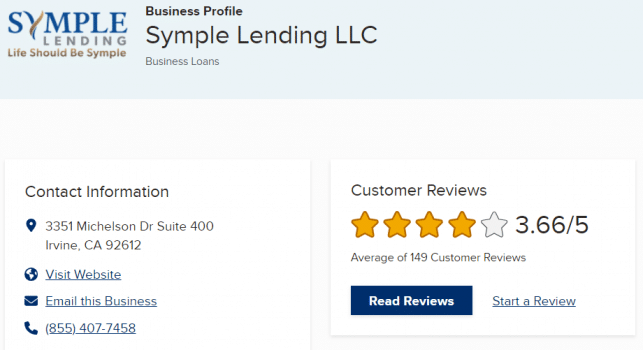

Better Business Bureau (BBB) Reviews

The Better Business Bureau (BBB) also provides insights into customer experiences with Symple Lending. On the BBB platform, Symple Lending holds a customer rating of 3.66/5 stars. While the company maintains an overall positive rating, some customers have raised concerns, which are important to take into account.

Here are a few common complaints from the BBB:

- Customer Service Issues: Some customers mentioned difficulties in reaching customer support after their loans were approved. Delayed responses and unclear communication were recurring issues in the complaints.

- Loan Terms: A few customers reported that the loan terms they received weren’t what they initially expected, particularly regarding interest rates and fees.

Birdeye Reviews

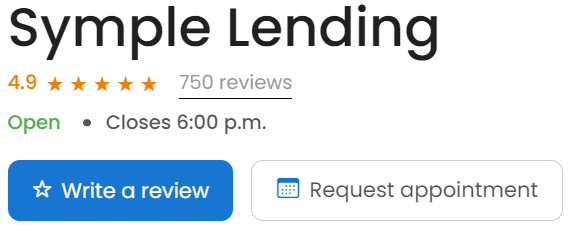

Symple Lending also has a strong presence on Birdeye, where they have an average rating of 4.9/5 stars. Similar to Trustpilot, many customers praise the company for its fast approval process and friendly customer service.

Here are a few specific reviews from Birdeye:

- Positive Review: “The process was smooth, and I got my loan quickly. Symple Lending made it easy to consolidate my debts.”

- Positive Review: “I had a great experience with Symple Lending. The rates were reasonable, and the customer service team was very helpful throughout the process.”

While reviews are largely positive, it’s still important to ensure that the company’s services align with your financial needs and goals.

Is This Company A Good Choice?

Symple Lending offers personal loans and debt consolidation services that may suit some borrowers, especially those looking for quick, convenient solutions. However, as with any financial decision, it’s important to thoroughly review customer feedback and understand the full terms of any loan before proceeding.

While many customers report positive experiences with Symple Lending, there are also complaints related to customer service and loan terms. If you’re considering debt consolidation, it’s important to compare multiple options to ensure you find the right fit for your financial needs.

If you’re overwhelmed by debt and looking for a solution, CuraDebt‘s debt relief programs may be a better option.

Contact CuraDebt today for a free consultation and explore how we can help you regain control of your finances.