Understanding the difference between tax avoidance vs tax evasion is crucial for individuals and businesses. While they may sound similar, they have vastly different implications. Tax avoidance refers to legal strategies used to reduce tax liabilities, while tax evasion involves illegal activities to avoid paying taxes altogether. In this article, we will explore the key distinctions, consequences, and how CuraDebt can assist those dealing with tax debt.

What Is Tax Avoidance?

Tax avoidance is the legal practice of minimizing tax obligations through strategies allowed by the tax code. Individuals and businesses often engage in tax planning, using legitimate methods such as deductions, credits, and investments to reduce their taxable income.

Examples Of Tax Avoidance:

- Claiming Deductions: Many individuals claim deductions such as mortgage interest, charitable donations, or medical expenses to lower their taxable income.

- Contributing To Retirement Accounts: Contributions to 401(k) plans or IRAs reduce taxable income, which is a common and legal way to defer taxes.

- Utilizing Tax Credits: Taxpayers can claim credits like the Child Tax Credit or the Earned Income Tax Credit, which directly reduce the amount of tax owed.

Tax avoidance is legal because it involves using the tax code’s provisions to one’s benefit. However, it is important to follow all regulations carefully to avoid crossing into illegal territory.

What Is Tax Evasion?

Tax evasion, on the other hand, is the illegal practice of deliberately misrepresenting or hiding information to reduce tax liability. This can include underreporting income, inflating deductions, or hiding money in offshore accounts. Tax evasion is a serious crime that can result in heavy penalties, interest, and even imprisonment.

Examples Of Tax Evasion:

- Underreporting Income: A taxpayer may fail to report all sources of income to avoid paying taxes on the full amount.

- Using Offshore Accounts: Some individuals hide assets in offshore accounts to evade U.S. taxes.

- Claiming False Deductions: Fraudulently inflating deductions for business expenses or charitable contributions to lower taxable income.

Dealing with tax debt? CuraDebt can help you with that. Our experienced professionals will work with you to resolve your tax issues. Take a free consultation now and get started on the path to financial freedom.

Key Differences Between Tax Avoidance And Tax Evasion

Though tax avoidance and tax evasion both aim to reduce tax burdens, the key difference lies in their legality. Tax avoidance is a legitimate strategy, while tax evasion is a criminal act. Let’s explore the major distinctions:

- Legality: Tax avoidance is legal and encouraged as long as taxpayers stay within the bounds of the law. Tax evasion, however, is illegal and punishable by law.

- Methods: Tax avoidance uses provisions in the tax code, such as deductions and credits, to reduce taxes. Tax evasion involves deceitful practices like underreporting income or inflating deductions.

- Consequences: Tax avoidance may result in fewer taxes paid but remains within the law. Tax evasion leads to serious penalties, usch as the following.

Consequences Of Tax Evasion

Tax evasion can have severe legal and financial consequences. Those who engage in tax evasion risk being caught by the IRS, which actively pursues tax evaders. Here are some of the consequences of tax evasion:

- Fines And Penalties: The IRS imposes significant fines on individuals or businesses found guilty of tax evasion. These fines can be as high as 75% of the underpaid taxes.

- Interest Charges: In addition to fines, the IRS charges interest on the unpaid tax balance, which continues to accumulate until the debt is paid in full.

- Criminal Charges: Tax evasion is a criminal offense, and those convicted may face imprisonment. The length of the sentence can vary depending on the severity of the offense.

These consequences underscore the importance of paying taxes correctly. If you’re struggling with tax debt, it’s important to act quickly to resolve the issue before it escalates. CuraDebt is here to help you through this process.

Real Testimonials: Stories Of Tax Avoidance And Tax Evasion

While understanding the legal and financial implications of tax avoidance and tax evasion is essential, hearing real stories can give these concepts even more context. Here, we share testimonials from individuals faced both tax avoidance and tax evasion, highlighting the importance of proper tax planning and compliance.

What People Are Saying On Reddit

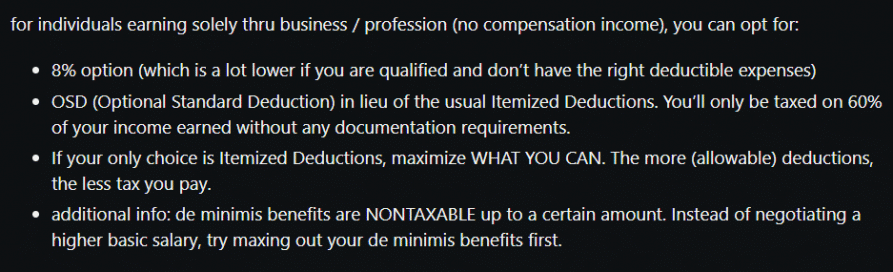

The user shares strategies that have worked for them over the years. These methods are entirely legal, helping individuals minimize their tax burden without crossing the line into tax evasion

Tax Evasion Case

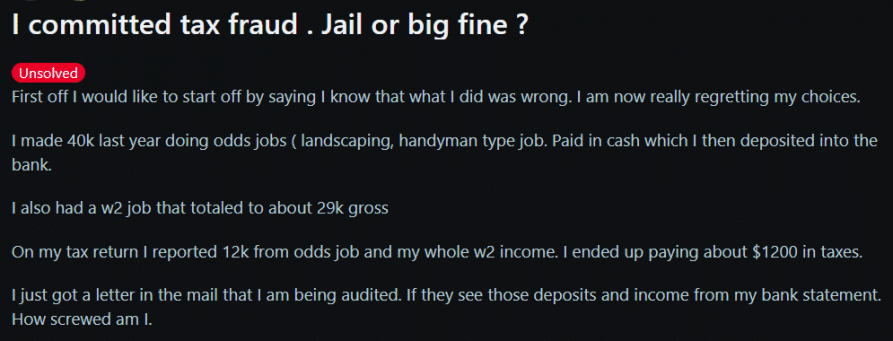

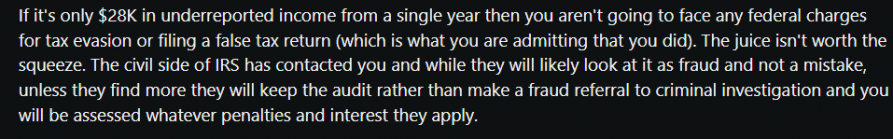

This person openly admitted to committing tax evasion by underreporting their income, and he is now undergoing an IRS audit. While the individual shared his fears about the possibility of going to jail, many responses from viewers reassured him that jail time is unlikely in most cases of tax evasion

Consequences Of Tax Debt

While tax evasion leads to penalties and potential imprisonment, tax debt itself also carries serious consequences. Tax debt occurs when individuals or businesses owe more in taxes than they can pay. If left unresolved, tax debt can lead to:

- Accruing Interest And Penalties: The IRS imposes interest and penalties on unpaid tax balances. These additional costs can quickly accumulate, making the original debt more difficult to pay.

- Wage Garnishment: If tax debt is not addressed, the IRS can garnish wages, taking a portion of your income to satisfy the debt.

- Asset Seizure: In extreme cases, the IRS may seize assets, such as homes or cars, to cover unpaid taxes.

Interested in learning more about the consequences of tax debt? Check out this article.

Facing tax debt can be overwhelming, but you don’t have to go through it alone. CuraDebt specializes in helping individuals resolve their tax debts and avoid further consequences. Take a free consultation today and see how we can assist you in getting back on track financially.