Why Income Tax Preparation Matters For Small Business Owners

Running a small business comes with its own set of challenges, and tax preparation can be one of the more overwhelming tasks. If you’re not careful, you could miss out on important deductions or even face penalties for incorrect filings. But don’t worry, this guide will help you navigate the essentials of income tax preparation for small business owners, so you can stay compliant with the IRS and make the most of your deductions.

If you’re already feeling the burden of unpaid taxes, CuraDebt offers a free consultation to help you explore debt relief options and get back on track financially.

Essential Steps In Income Tax Preparation

1. Choose the Right Business Structure

Your tax obligations heavily depend on your business structure—whether you’re a sole proprietor, LLC, S-Corp, or C-Corp. For example, sole proprietors file using Schedule C along with their personal tax returns, while corporations file separately using Form 1120. Each structure has different tax implications, so consult with a tax advisor to ensure you’re using the best structure for your business.

2. Understand Tax Deadlines

Small businesses are often required to pay estimated taxes quarterly. These deadlines typically fall in January, April, June, and September. Missing these deadlines can lead to penalties, so it’s important to stay on top of your tax obligations. The IRS also expects businesses with employees to handle payroll taxes, including Social Security and Medicare contributions.

3. Maximize Your Deductions

One of the best ways to reduce your tax liability is by understanding and claiming all eligible deductions. Common deductions for small business owners include:

- The home office deduction (if you work from home)

- Vehicle expenses (if used for business purposes)

- Business equipment depreciation

- Insurance premiums related to your business

By keeping accurate records and receipts, you can ensure you’re not missing out on valuable deductions that could lower your taxable income.

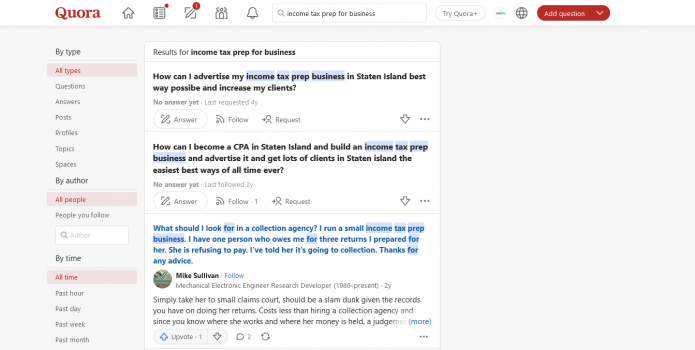

Real-Life Experiences: What Other Business Owners Say

Many small business owners share their tax preparation journeys on platforms like Quora, Reddit, and X. Here are a few real-life stories to give you insight into their experiences:

• Reddit User: “I had no idea how complicated tax filings would be for my small business. Hiring a tax consultant saved me from a big mistake that could have cost me thousands in penalties.”

Quora Comment: “I didn’t realize I could deduct my home office until I spoke to a professional. Now I save a lot every year, and I keep much better records.”

X (formerly Twitter): One small business owner tweeted: “After getting hit with a tax penalty last year, I decided to outsource my tax filings to a professional. It’s one less thing to worry about during tax season.”

These stories highlight the importance of understanding the tax filing process and, if needed, seeking professional help to avoid common mistakes.

Helpful Tax Resources

For a deeper understanding of specific tax topics related to small businesses, consider these helpful videos:

1. IRS Small Business Tax Workshop – This official IRS video series walks you through the basics of small business tax preparation.

2. Five Easy Tax Strategies for Business Owners – This video provides practical and easy-to-implement tax-saving strategies for small business owners, focusing on immediate relief and optimization.

3. Essential Tax Tips for Small Business Owners – This video shares essential tips for handling taxes as a small business owner, including deductions and filing requirements.

How CuraDebt Can Help

If your small business is already facing IRS penalties or has accumulated tax debt, don’t wait to seek professional help. CuraDebt specializes in resolving tax debt, offering personalized solutions tailored to your unique situation. Our team can guide you through the steps necessary to settle your tax debt or set up manageable payment plans with the IRS.

Get a free consultation today and start your journey toward financial relief.

Conclusion: Simplifying Income Tax Preparation

Proper income tax preparation is essential for the success of your small business. By staying informed about tax deadlines, maximizing deductions, and keeping accurate records, you can reduce your tax burden and avoid unnecessary stress. If tax debt is already a concern, CuraDebt is here to help you resolve it.