Difference Between Accepted And Approved Tax Return

Tax season can feel like a maze of paperwork, deadlines, and waiting. If you’ve ever wondered what happens after you hit “submit” on your tax return, you’re not alone. One of the most common questions we hear is: What’s the difference between an accepted and an approved tax return?

Understanding these two stages can help you manage your expectations, plan your finances, and avoid unnecessary stress. Let’s break it down in simple terms so you know exactly what to expect—and when to expect it. And if you ever feel stuck or overwhelmed, remember: there are resources and professionals ready to help you navigate the process with confidence.

What Does It Mean When Your Tax Return Is Accepted?

When your tax return is accepted, it means the IRS has received your submission and completed a basic review. Think of this as the first checkpoint in the process. Here’s what happens at this stage:

- The IRS checks for obvious errors, like mismatched Social Security numbers or missing forms.

- They confirm that your personal information matches their records.

But here’s the key: Acceptance doesn’t mean your refund is on the way. It simply means your return has passed the initial review and is now in line for a more detailed examination.

For most e-filed returns, acceptance happens within 24 to 48 hours. If you filed a paper return, it could take weeks or even months for the IRS to acknowledge receipt.

What Does It Mean When Your Tax Return Is Approved?

An approved tax return is the green light you’ve been waiting for. At this stage, the IRS has completed a thorough review of your return and verified its accuracy. Here’s what they’re checking:

- Does your reported income match the information they have on file (like W-2s or 1099s)?

- Are your deductions and credits accurate and supported?

- Are there any red flags, such as unpaid back taxes or errors that need clarification?

Once your return is approved, the IRS authorizes your refund (if you’re owed one) and begins the process of sending it your way.

Key Differences Between Accepted And Approved Tax Return

To make it even clearer, here’s a quick comparison of the two stages:

| Aspect | Accepted Tax Return | Approved Tax Return |

|---|---|---|

| Definition | The IRS has received your tax return and performed basic checks. | The IRS has reviewed and verified your return for accuracy. |

| Error Verification | Checks for basic mistakes like typos or missing forms. | Confirms all details, such as income and deductions, match records. |

| Refund Status | Refund not yet authorized—it’s the initial stage of processing. | Refund is approved and ready for disbursement. |

| Timeline | Typically happens within 24-48 hours for e-filed returns. | Can take 7-21 days, depending on return complexity and IRS workload. |

How Long Does It Take To Go From Accepted To Approved?

The timeline for approval can vary based on several factors:

- Filing Method: E-filing is faster than paper returns.

- Time of Year: Returns filed during peak tax season (January–April) may take longer.

- Complications: Missing documents, flagged deductions, or mismatched information can delay approval.

In most cases, e-filed returns are approved within 7 to 21 days of being accepted. However, if the IRS needs additional information or finds an error, the process can take longer.

How Long Will It Take To Get My Refund?

Once your return is approved, the clock starts ticking on your refund. Here’s what to expect based on how you chose to receive it:

- Direct Deposit: The fastest option, usually taking 1 to 5 business days.

- Paper Check: Can take 2 to 4 weeks to arrive in the mail.

Delays can happen if the IRS needs to verify your identity or resolve issues with your return. If you’re unsure about the status of your refund, you can always check the IRS Where’s My Refund? tool for updates or errors flagged in your return.

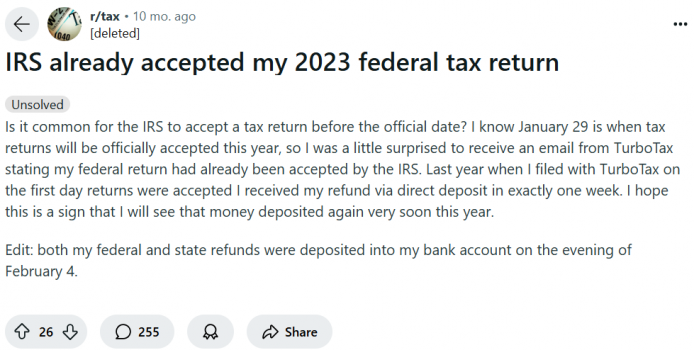

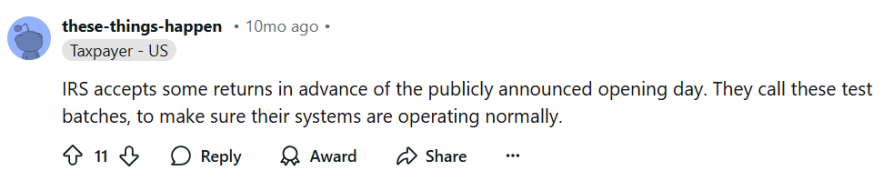

Taxpayers Across Platforms

Sometimes, the experiences of other taxpayers can offer insights into the variability of refund timelines. On platforms like Reddit and Quora, you’ll find discussions highlighting the range of processing times:

For example, one Reddit user shared they received their refund in less than 10 days, while another mentioned waiting over two years due to complications. Look at this difference! Processing times can vary widely.

On Quora, users often ask how long it takes for the IRS to accept returns. Responses frequently emphasize that the timeline can differ yearly based on IRS processing loads and tax law updates.

Need Tax Debt Help? You’re Not Alone—We’re Here for You

Tax season can be overwhelming, especially if you’re dealing with tax debt or other complex issues. The paperwork, the deadlines, the fear of making a mistake—it’s a lot to handle on your own. But here’s the good news: you don’t have to face it alone.

At CuraDebt, we specialize in helping people just like you navigate tax challenges and find relief from financial stress. Whether you’re struggling with tax debt or need help negotiating with the IRS, we’ve got your back.

Don’t just take our word for it—here’s what some of our clients have to say about their experience with CuraDebt:

Final Thoughts: You Don’t Have To Face Tax Season Alone

Understanding the difference between accepted and approved tax returns can help you navigate tax season with confidence. While the IRS works to ensure accuracy at every stage, the process can still feel overwhelming—especially if you’re dealing with tax debt or other financial challenges.

If you’re feeling stressed or unsure about your next steps, remember: you don’t have to figure it out on your own. At CuraDebt, we’ve helped thousands of people just like you find relief from tax debt and take control of their finances.

Whether you’re dealing with unpaid taxes, unsure about your refund status, or just need someone to guide you through the process, we’re here to help. Our team of experts will work with you to create a personalized plan that fits your unique situation.

Take the first step toward financial peace of mind. Reach out for a free consultation today, and let’s work together to find a solution that works for you. Your brighter financial future starts here.