The IRS Partial Payment Installment Agreement: Do You Qualify?

When facing significant tax debt, finding a manageable solution can be a top priority. The IRS offers various options to help taxpayers with outstanding balances, and one option that may reduce your burden is the IRS Partial Payment Installment Agreement (PPIA). But how does this plan work, and do you qualify for it? This guide will explain everything you need to know about the PPIA, including its benefits, requirements, and how it compares to other IRS settlement programs. If tax debt feels overwhelming, this article is here to help you understand your options and determine whether the PPIA is the right path for you.

The IRS Partial Payment Installment Agreement

The IRS Partial Payment Installment Agreement (PPIA) is a type of payment plan allowing eligible taxpayers to pay off their tax debt over time while potentially reducing the total amount owed. Unlike traditional installment agreements, where the taxpayer must pay the entire debt, a PPIA allows the taxpayer to make monthly payments on only a portion of the debt. The agreement usually lasts for a set period, often up to 10 years, during which the IRS collects monthly payments based on the taxpayer’s ability to pay.

How It Works

Under a PPIA, the IRS reviews the taxpayer’s financial situation, including income, expenses, and assets, to determine an affordable monthly payment amount. If the taxpayer qualifies, the IRS may agree to a payment plan that is less than the full tax balance due. This can significantly ease the financial burden for taxpayers who cannot pay off their debt in full. After the PPIA term expires, the remaining tax debt may be forgiven, offering long-term relief.

When Should You Consider A Partial Pay IRS Installment Agreement?

Not all taxpayers qualify for a PPIA, and it’s essential to understand when this option might be the best fit for your situation. The PPIA is generally suitable for taxpayers who meet the following criteria:

- Limited Financial Resources: If you’re unable to meet the full payment obligations due to a tight budget, the PPIA could provide more manageable terms.

- Income Constraints: Taxpayers with low income or irregular income may find that a PPIA accommodates their cash flow limitations.

- Existing IRS Liens: If the IRS has placed a lien on your property, a PPIA could prevent further collection actions while you make agreed payments.

- No Other Options Available: For those who don’t qualify for programs like the Offer in Compromise (OIC) but still need relief, the PPIA can be a viable alternative.

CuraDebt’s tax specialists can help you determine if a PPIA is right for you by analyzing your financial situation and advising on the most effective relief options. Take our free consultation now!

IRS Partial Installment Agreement Requirements

To qualify for a PPIA, applicants must meet specific requirements and follow the application process closely. The IRS evaluates the taxpayer’s eligibility based on financial documentation and income stability.

Key Requirements For PPIA Eligibility

- Proven Financial Hardship: Taxpayers must demonstrate financial hardship, typically by completing IRS Form 433-A (Collection Information Statement) for individuals or Form 433-B for businesses.

- All Filed Returns: You must have filed all required tax returns before applying for a PPIA.

- Compliance with Future Tax Payments: Once approved, taxpayers must comply with current tax obligations, including future tax payments and filings, to maintain the PPIA status.

- Minimal Assets or Ability to Pay in Full: If the IRS determines you have sufficient assets or financial capacity to pay the full debt, they may deny the PPIA application.

- Financial Review Every Two Years: The IRS requires a financial review every two years for PPIA participants. During this review, if your financial situation improves, your payment amount may increase.

Partial Payment Installment Agreement Vs. Other Installment Agreements

The partial payment plan differs from other IRS installment agreements in these ways:

- With PPIA, a debtor does not have to pay their entire tax debt. But, unlike other installment agreements, PPIA requires lots of financial documentation to prove to the IRS that a debtor is in true financial hardship and unable to pay their full tax debt.

- Comes with a 2-year review. Unlike other IRS installment agreements, the IRS may reconsider the terms of a debtors PPIA after the 2-year review of their financial situation

- The application process is longer. A streamlined installment agreement can be set up almost instantly, but in the case of a partial payment installment agreement, it can take up to a month to be approved.

Partial Payment Installment Agreement (PPIA) Vs. Offer In Compromise (OIC)

The IRS Partial Payment Installment Agreement and the Offer in Compromise (OIC) both provide potential relief but differ significantly in eligibility requirements and benefits.

Offer In Compromise (OIC)

An OIC allows taxpayers to settle their tax debt for less than the full amount owed. The IRS considers factors like income, expenses, and asset equity to determine if a reduced settlement is acceptable.

Benefits Of OIC:

- Resolves tax debt faster than PPIA if approved.

- May offer greater debt reduction for qualifying taxpayers.

Drawbacks Of OIC:

- Strict eligibility requirements make it challenging to qualify.

- Requires a comprehensive evaluation of finances, including assets.

Choosing Between PPIA And OIC

While an OIC offers potentially significant tax forgiveness, it is often harder to qualify for than a PPIA. A PPIA might be preferable if you’re unable to qualify for an OIC or need longer payment terms. CuraDebt offers a free consultation to help you determine which option aligns best with your unique financial circumstances.

Why You Need Tax Debt Resolution

If you’re facing tax debt, taking steps toward resolution is essential to protect your financial well-being and avoid escalating penalties and interest. Tax debt can impact your credit, lead to IRS collection actions, and create stress. By proactively addressing it, you can regain financial stability and protect your assets.

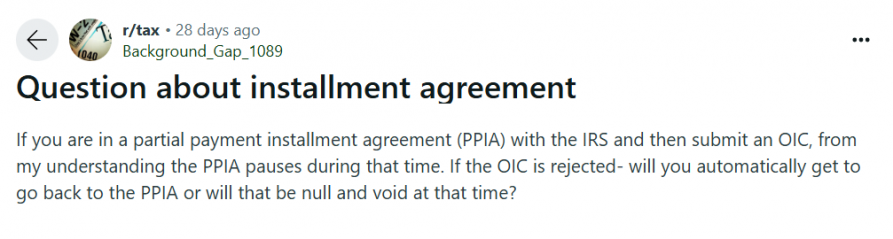

More Questions

Navigating IRS installment options can be confusing, and it’s common to have additional questions. Online forums like Reddit and Quora are helpful resources where others share their experiences and insights, often providing answers to specific queries.

The answer is that while the PPIA will pause during the OIC review, it does not resume automatically if the OIC is rejected. This process requires communication with the IRS to reinstate the PPIA, so be prepared for potential follow-ups.

The IRS lets taxpayers combine several overdue tax years into one PPIA, making it easier to manage payments. This helps those with multiple years of debt by allowing them to make just one monthly payment.

Conclusion

The IRS Partial Payment Installment Agreement (PPIA) offers a practical solution for taxpayers who cannot afford full payment on their tax debt. With the possibility of reduced payment amounts and eventual debt forgiveness, the PPIA can provide financial relief for those who qualify. However, meeting the eligibility requirements and understanding the financial implications are essential steps to ensure success in the program.

At CuraDebt, our team of tax professionals is experienced in helping individuals navigate tax debt. By offering a free consultation, we aim to provide personalized guidance and support, ensuring you have the knowledge and confidence to manage your tax debt effectively.

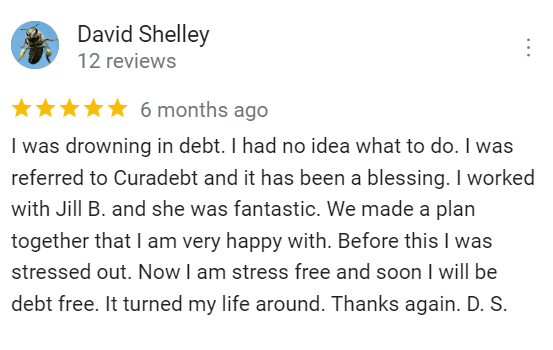

CuraDebt Reviews

Our clients frequently talk about their good experiences with CuraDebt, highlighting our focus on clear communication and personal help. With a team of tax experts, we assist clients in finding the best debt relief options for their specific financial situations. Our history shows that clients rely on us for reliable and effective support during the debt relief process, helping them take charge of their financial lives again.

As you can see, we have helped these people, and you can be next! Take our free consultation now!