Debt can feel like a heavy weight on your shoulders, leaving you stressed and unsure of where to turn. If you’re struggling to keep up with payments to Wells Fargo or other creditors, you’re not alone—and there’s hope. Debt settlement could be the lifeline you need to regain control of your finances and breathe easier. In this article, we’ll walk you through how debt settlement works, share a real-life success story of someone who settled their Wells Fargo debt, and offer practical tips to help you take the first step toward financial freedom.

Let’s tackle this together, because no one should have to face debt alone.

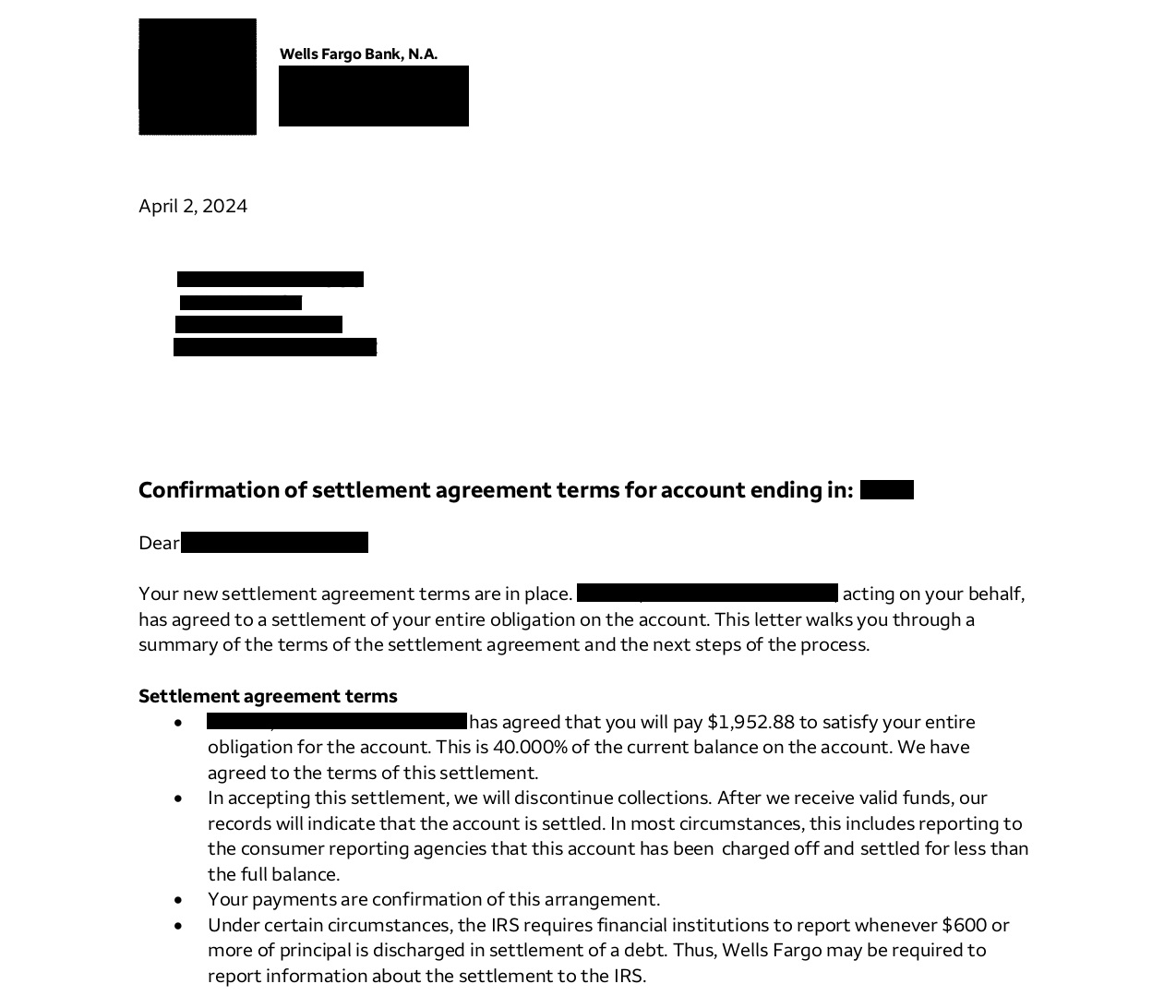

Real-Life Success: Wells Fargo Debt Settlement Letter from April 2024

Here’s proof that debt settlement works: A recent client successfully settled their Wells Fargo debt through CuraDebt. The original balance of 4,882.20 was reduced to 1,952.88, representing a 60% savings on the total debt.

The settlement was structured into 20 manageable monthly payments, beginning in April 2024 and concluding in November 2025. This outcome not only provided immediate financial relief but also allowed the client to resolve their debt in a structured, stress-free way.

Key Details of the Settlement:

- Original Debt: $4,882.20

- Settled Amount: $1,952.88 (40% of the original balance)

- Payment Plan: 20 monthly payments

- Timeline: April 2024 – November 2025

This is just one example of how CuraDebt has helped thousands of clients achieve significant savings and resolve their debts efficiently.

How Debt Settlement Works

Debt settlement is a process where creditors agree to accept less than the full amount owed to resolve a debt. It’s an ideal solution for individuals facing financial hardship who are unable to pay their debts in full. Here’s how it works:

- Assessment: A debt settlement company evaluates your financial situation, including your debts, income, and expenses.

- Negotiation: The company negotiates with your creditors to reduce the total amount owed.

- Settlement: Once an agreement is reached, you make payments toward the settled amount, often in a structured plan.

- Resolution: After completing the payments, the debt is considered settled, and you’re free from the financial burden.

Take The First Step Toward Financial Freedom

Debt can feel like an endless cycle, but it doesn’t have to be. With debt settlement, you can reduce what you owe and take control of your financial future. Imagine cutting your debt by 40%, 50%, or even 60%—like our client who settled their Wells Fargo debt. That kind of relief is possible, and it starts with a single step.

At CuraDebt, we’ve helped thousands of people just like you find their way out of debt. With over 24 years of experience, we know how to negotiate with creditors to secure the best possible outcomes. We’ll work with you to create a personalized plan that fits your unique situation, so you can move forward with confidence.

Your financial freedom is closer than you think. Contact CuraDebt today for a free consultation. Let’s sit down together, review your options, and create a plan that puts you back in control. You deserve to live a life free from the stress of debt—and we’re here to help you make it happen.

Disclaimer: Average settlements result in savings of 40-60% of the balance at the time of settlement. Final offers vary depending on creditor policies, financial hardships, account age, and other factors. CuraDebt works diligently to secure the best possible outcomes for each client.