Dealing with tax debt can be a daunting experience, leaving many individuals and business owners feeling overwhelmed and anxious. One of the most pressing concerns is the potential for the Internal Revenue Service (IRS) to seize your assets in order to satisfy unpaid tax obligations. In this article, we will explore the types of assets the IRS can take, what they cannot take, the consequences of tax debt, and how CuraDebt can assist you in navigating this challenging situation. Understanding your rights and responsibilities regarding tax debt is crucial, so let’s dive in!

Facing tax debt? Let us help! Schedule your free consultation with CuraDebt today.

Which Assets Can The IRS Take?

The IRS has a variety of tools at its disposal to collect unpaid taxes, and they can seize several types of assets to fulfill tax obligations. Here are some assets that the IRS may take:

1. Bank Accounts

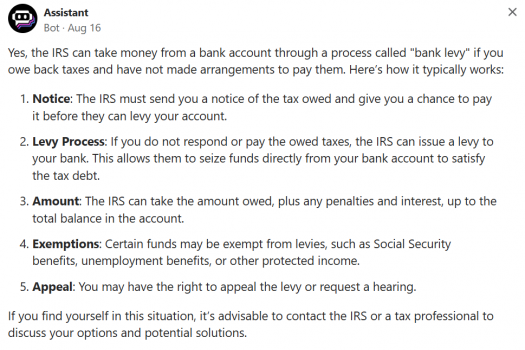

The IRS can issue a bank levy, which allows them to withdraw funds directly from your bank account to cover your tax debt. It’s essential to stay informed about your tax situation to avoid unexpected withdrawals.

2. Wages

Through a wage garnishment, the IRS can take a portion of your paycheck to pay off your tax debt. This typically involves a legal process, but once the IRS garnishes your wages, it can significantly affect your monthly budget and cash flow.

3. Real Estate

The IRS can place a lien on your property, which gives them a legal claim to your real estate until the tax debt is paid. If the debt remains unpaid, the IRS may eventually foreclose on your property and sell it to satisfy the obligation.

4. Vehicles

The IRS can seize vehicles that you own outright. This includes cars, trucks, boats, and any other motorized vehicles. If they choose to seize your vehicle, they will typically sell it at auction to recover the owed taxes.

5. Business Assets

If you are a business owner, the IRS can take business assets such as inventory, equipment, and receivables. This can have devastating effects on your business operations, making it difficult to continue functioning effectively.

6. Investments

The IRS may seize investment accounts, including stocks, bonds, and mutual funds, to settle tax debts. They can also levy retirement accounts, although there may be additional rules and protections surrounding retirement assets.

7. Life Insurance Policies

If you have a cash value life insurance policy, the IRS can use the cash value to pay off your tax debt. However, term life insurance policies, which don’t accumulate cash value, are typically protected from seizure.

Which Assets Can The IRS Not Take?

While the IRS has broad authority to seize assets, certain protections exist for specific items. Here are assets that the IRS generally cannot take:

1. Primary Residence Protections

Your primary home is generally protected from seizure unless you have significant equity in it and have defaulted on tax obligations. Even in these cases, the IRS typically prefers to place a lien rather than seize the home outright.

2. Essential Personal Property

The IRS cannot take essential personal items such as clothing, household furniture, and appliances necessary for daily living. This is to ensure that you can maintain a basic standard of living.

3. Tools of Trade

If you use specific tools or equipment to earn a living, these items are generally exempt from seizure. The IRS recognizes that individuals need these tools to continue working and earning income.

4. Public Benefits

Assets that are considered public benefits, such as Social Security payments and unemployment benefits, cannot be seized by the IRS to settle tax debt.

Other Consequences

Aside from the potential seizure of assets, tax debt can lead to several other significant consequences, including:

1. Interest and Penalties

Tax debts accrue interest and penalties over time, making it increasingly difficult to pay off the original amount owed. These additional costs can quickly add up, further complicating your financial situation.

2. Loss of Tax Refunds

If you have an outstanding tax debt, the IRS may offset your future tax refunds to pay down your tax obligation. This can disrupt your financial planning and leave you without anticipated funds.

3. Credit Score Impact

Unpaid tax debts can negatively affect your credit score, making it challenging to secure loans or credit in the future. A lower credit score can hinder your ability to make major purchases or obtain favorable interest rates.

4. Legal Action

In severe cases, the IRS may pursue legal action to collect outstanding tax debts. This could involve court proceedings and potential additional legal fees, leading to even more financial strain.

5. Stress and Anxiety

The stress of tax debt can affect your mental well-being. Constant worry about potential asset seizures and financial instability can lead to anxiety and other mental health issues.

Other Questions And Experiences

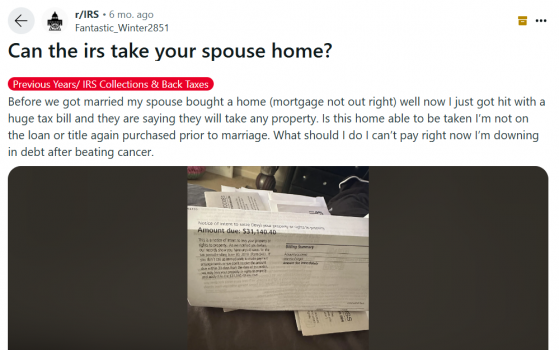

Many people turn to forums like Quora or Reddit to seek advice and share experiences regarding their tax debt situations. Here are some common concerns and insights found in those communities:

A user asks whether the IRS can seize their spouse’s home, which was purchased before their marriage, and shares a photo of a note from the IRS. The community largely advises that they should seek professional assistance.

Can The IRS Take Money From My Bank Account?

This user explains the process the IRS follows when seizing money from your bank account.

How CuraDebt Can Help You

At CuraDebt, we understand the stress and anxiety that tax debt can bring. Our team of professionals is dedicated to helping you navigate your tax issues with empathy and expertise. We offer a range of tax relief services designed to help you resolve your tax debt efficiently and effectively. Whether you’re facing potential asset seizures or struggling to manage your tax payments, we can work with you to create a personalized plan that meets your needs.

Our free consultation provides you with the opportunity to discuss your situation with one of our knowledgeable advisors, who will guide you through the available options and help you take the first steps toward regaining financial stability.

Don’t let tax debt control your life, reach out to us today and discover how we can assist you in finding the relief you deserve.

What Our Customers Are Saying

At CuraDebt, we pride ourselves on our commitment to customer satisfaction. Here are some comments that our clients have shared about their experiences with our services:

We’ve successfully assisted many individuals, and you could be next! Take advantage of our free consultation today!

Conclusion

Navigating the complexities of tax debt can feel daunting, especially with the potential for the IRS to seize your assets. Throughout this article, we’ve highlighted the types of assets the IRS can take, such as bank accounts, wages, real estate, and vehicles, while also noting the protections available for certain items, including your primary residence and essential personal property. It’s important to be aware of the various consequences of tax debt, which can range from accruing interest and penalties to affecting your credit score and overall financial stability.

Understanding your rights and the IRS’s processes is vital for making informed decisions about your financial future. The stress and anxiety associated with tax obligations can take a toll on your mental well-being, but you don’t have to face this challenge alone.

Our dedicated team is committed to providing you with tailored solutions designed to address your specific tax issues. Whether you’re seeking to negotiate with the IRS, set up a manageable payment plan, or explore various tax relief options, we stand ready to assist you in finding the best path forward.

Remember, many individuals have successfully overcome their tax debt challenges with our support, and you could be next. We invite you to take advantage of our free consultation, where you can discuss your situation with our knowledgeable advisors and explore the options available to you. Don’t let tax debt control your life any longer—reach out to CuraDebt today, and let’s work together to achieve the financial peace you deserve. Your journey to relief starts now!