Dealing with the IRS and tax obligations can be challenging, but what happens to these debts when a person passes away? Knowing how tax debt is handled after death can provide peace of mind to those with IRS obligations and their families. This guide will walk through scenarios that can help clarify what happens to IRS tax debt upon death and offer insights into how CuraDebt’s services might help.

How IRS Tax Debt Is Handled After Death

1. If You Have A Surviving Spouse

When a taxpayer passes away with an outstanding IRS debt and leaves behind a surviving spouse, handling this debt will depend on how the couple filed taxes:

- Joint Tax Returns: If a couple filed jointly, the IRS typically holds the surviving spouse liable for the tax debt. Joint filers are considered equally responsible for tax obligations.

- Separate Tax Returns: In cases where each spouse filed separately, the IRS usually pursues the deceased’s estate for repayment rather than placing the burden on the surviving spouse. However, this can vary depending on the total assets and the specifics of the estate.

2. If You Leave Behind An Estate

Upon death, any IRS debt owed generally becomes the responsibility of the deceased’s estate. The executor is tasked with settling outstanding debts before distributing assets to heirs. Here’s how it works:

- Estate Value and Liabilities: The IRS requires executors to report all assets, income, and debts of the deceased, including any tax debt. Executors must first address outstanding IRS obligations, even if it means using estate assets to cover the costs.

- Insufficient Estate Assets: If the estate lacks enough funds to settle IRS tax debt, the IRS may write off any remaining balance, as they cannot pursue heirs for individual repayment. However, they may attempt to collect from jointly held or transferable accounts.

3. If No Executor Or Estate Exists

If there is no will or appointed executor, the IRS may pursue relatives or partners based on their involvement in the deceased’s financial matters. Without an executor or estate in place, family members may need to step forward to clarify their liability with the IRS.

Key Factors Affecting IRS Tax Debt After Death

The Role Of The Executor

An executor plays a vital role in handling IRS tax debt after someone’s passing. They are legally responsible for ensuring that all debts are paid from estate assets, including tax debt. Executors must:

- File Any Final Tax Returns: Executors may need to file a final individual tax return for the deceased, covering all income up until the date of death.

- Pay Outstanding Tax Debt: Before distributing assets to heirs, the executor must use available funds from the estate to settle IRS debts, including filing fees and interest.

IRS Collection Limits On Deceased Taxpayers

The IRS has specific guidelines around deceased individuals’ debt, and may even consider installment plans for estates that cannot fully cover tax debt. This ensures that executors have manageable options for addressing remaining balances without compromising the estate’s integrity.

What Happens To Income Earned After Death?

After someone passes away, income earned, such as rental income or investment interest, typically receives different treatment than income earned during their lifetime. Here’s how it generally works:

- Estate’s Tax Obligations: The estate typically attributes any income earned after death rather than the deceased individual. The estate may need to file a Form 1041 (U.S. Income Tax Return for Estates and Trusts) to report income accrued during the probate process.

- Beneficiary Tax Responsibility: In cases where assets generate income and pass directly to beneficiaries (such as stocks or rental properties), those beneficiaries may need to report and pay taxes on this income.

Executors should work with a tax professional to navigate these complex issues and ensure proper filing for any income earned on behalf of the deceased or their estate.

Dealing With A Loved One’s Tax Debt After Their Death

Handling a loved one’s tax debt after their passing can be emotionally and financially overwhelming. Here are some steps to help manage the process effectively:

- Gather All Relevant Documents: Start by collecting all tax records, IRS notices, and financial documents.

- Consult With the IRS: Contact the IRS directly to determine the exact amount of tax owed and clarify next steps.

- Consider Professional Help: Working with a tax professional or tax debt relief company like CuraDebt can ease the burden by guiding executors and family members through IRS processes and settlement options.

- Review Potential Installment Plans: If estate assets aren’t sufficient to pay the debt, explore the possibility of an installment agreement with the IRS, which can help spread out payments without risking the estate’s distribution plan.

Taking a professional approach and understanding these steps can help alive family members manage tax debt obligations with confidence.

What People Are Saying On Reddit

For anyone navigating the loss of a loved one and inheriting their tax obligations, online communities like Reddit offer support and insights. Here are two real scenarios shared by Reddit users:

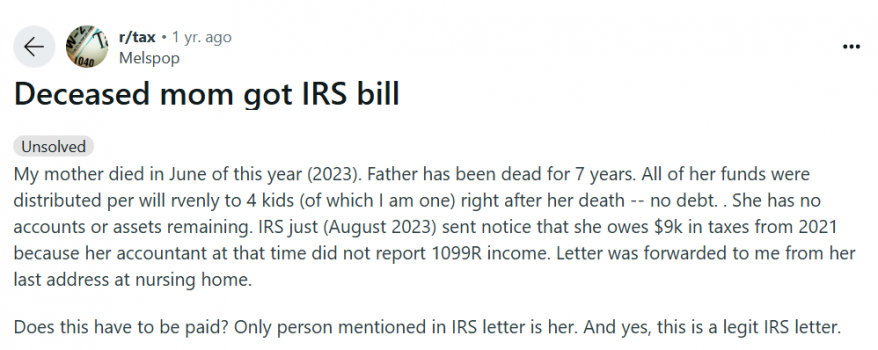

A user shared that her deceased mother received a tax bill from the IRS, and she was unsure if she needed to pay the debt. Other users chimed in, advising her to connect with the IRS and verify the debt’s status to avoid potential penalties.

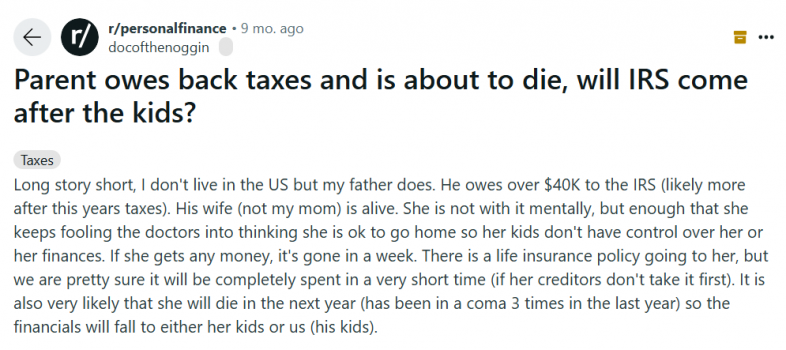

Another user inquired whether he needed to pay off his deceased father’s IRS debt. One reply clarified that generally, heirs are not responsible for tax debt, but exceptions may exist depending on the type of assets or account structures.

These discussions highlight the varied situations families face and the importance of clear communication with the IRS.

Do You Owe Tax Debt?

Managing IRS debt is always easier before it compounds over time, and CuraDebt’s tax relief services are here to assist with every step. If you’re currently carrying IRS tax debt, remember that you don’t have to navigate these challenges alone. Through our free consultation, we’ll provide insights into your situation and discuss personalized options for tax relief. Whether you want to reduce penalties, set up an installment plan, or negotiate a settlement, CuraDebt is committed to helping you regain your financial peace of mind.

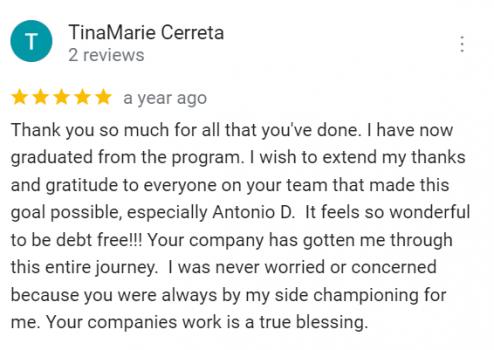

What Our Customers Are Saying

We’re proud of the positive impact our team has had on so many individuals facing tax debt challenges. At CuraDebt, we prioritize customer satisfaction and relief from tax burdens, allowing our clients to regain control of their finances with confidence. See how we have helped these people—and you could be the next!

Conclusion

Understanding what happens to IRS tax debt when someone passes away can bring clarity to an otherwise overwhelming situation. Executors, surviving spouses, and family members need to know their responsibilities and the options available. From handling joint tax returns to dealing with income earned posthumously, there are steps families can take to address IRS obligations with minimal stress. Additionally, online communities can provide shared experiences that bring valuable insights to similar situations.

If you’re dealing with IRS tax debt or concerned about the future, CuraDebt offers a compassionate, effective approach. Our free consultation service is an excellent first step toward managing or resolving tax debt, helping you or your loved ones achieve a debt-free life and protect what matters most. Reach out today to learn more about how CuraDebt can support you in relieving tax debt stress and securing financial peace.