What Is Imputed Income? Meaning And Examples

Have you ever received a non-cash benefit from your employer and wondered if it affects your taxes? That’s where the concept of imputed income comes into play. While it might not seem like a big deal, imputed income can impact your taxable wages, your tax bracket, and even your financial planning. In this comprehensive guide, we’ll unpack the meaning of imputed income, provide real-world examples, clarify what’s not considered imputed income, and explain how to report it. Whether you’re an employee or an employer, understanding this is a critical step toward effective financial management.

Do you need tax help? CuraDebt is here for you.

Imputed Income Meaning

At its core, this is the value of non-cash benefits provided by an employer that must be included in an employee’s taxable income. The IRS requires this to ensure that perks or advantages given in lieu of salary are taxed appropriately, promoting equity in taxation. Examples might include free housing, personal use of a company vehicle, or even low-interest loans.

Examples Of Imputed Income

Let’s explore some common scenarios:

- Life Insurance Over $50,000

Employers often provide group-term life insurance. If the coverage exceeds $50,000, the premium for the excess coverage is considered imputed income.

- Personal Use Of Company Car

If your employer allows you to use a company car for personal errands or commutes, the value of that usage is imputed income.

- Dependent Care Assistance Over $5,000

Employers providing dependent care benefits must report amounts exceeding $5,000 as imputed income.

- Employer-Paid Gym Memberships

If the gym membership isn’t part of a wellness program tied to work performance, its value is taxable.

- Below-Market-Interest Loans

If your employer offers you a loan at an interest rate lower than the market, the difference is considered imputed income.

- Housing Allowances

Free or subsidized housing provided to employees (unless for the employer’s convenience) often counts as imputed income.

- Education Benefits Over $5,250

Employers can offer tuition assistance up to $5,250 annually tax-free. Anything above that threshold becomes imputed income.

What Is Not Imputed Income?

It’s equally important to understand what doesn’t qualify. The IRS excludes several benefits from taxable income:

- Health Insurance Premiums

Employers contribute to health insurance premiums without adding these amounts to employees’ taxable income.

- De Minimis Benefits

Employers provide small, infrequent perks like coffee, snacks, or holiday gifts, and these remain tax-free.

- Retirement Contributions

Employers fund contributions to retirement accounts such as 401(k)s, and employees enjoy tax-deferred treatment for these amounts.

- Business-Related Expenses

Employers reimburse legitimate business expenses, like travel or office supplies, as long as employees submit proper documentation.

- On-Premises Meals

Employers supply meals for their convenience, such as during on-call shifts, and employees benefit from these tax-free meals.

- Discounts Within IRS Limits

Employers offer discounts on goods and services, and as long as the savings stay below IRS thresholds (e.g., 20% for services or at-cost goods), employees don’t pay taxes on these benefits.

How To Report Imputed Income

Accurate reporting is essential for both employees and employers. Here’s how it’s typically handled:

- Employer’s Responsibility

Employers calculate the imputed income value and report it on the employee’s W-2 form as part of gross income.

- Employee’s Role

Employees should review their W-2 for accuracy. The amount of imputed income listed should align with the benefits received.

- Tax Withholding

Employers usually withhold taxes on imputed income, so employees don’t face a large tax bill at year-end.

- Special Cases

Certain fringe benefits, like housing allowances or overseas benefits, might require additional forms or IRS guidelines.

- Professional Guidance

For complex situations, consulting a tax professional ensures compliance and avoids potential errors.

Common Mistakes To Avoid

- Ignoring Non-Cash Benefits

Some employees overlook benefits like gym memberships or subsidized meals, only to face tax discrepancies later.

- Underreporting Benefits

Failing to include imputed income in gross wages can lead to penalties.

- Assuming All Benefits Are Tax-Free

Always check whether a benefit qualifies for exclusion under IRS rules.

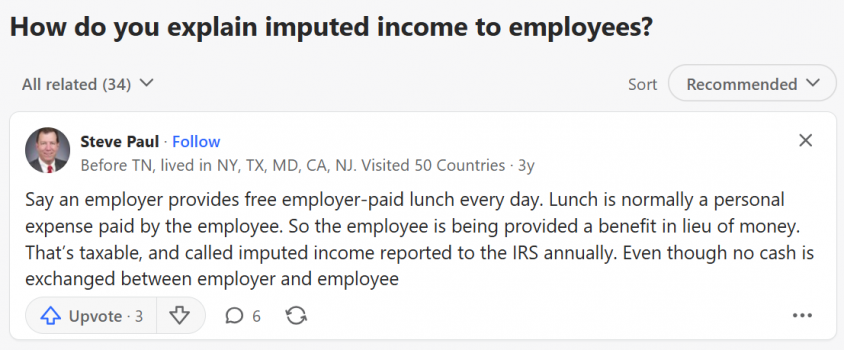

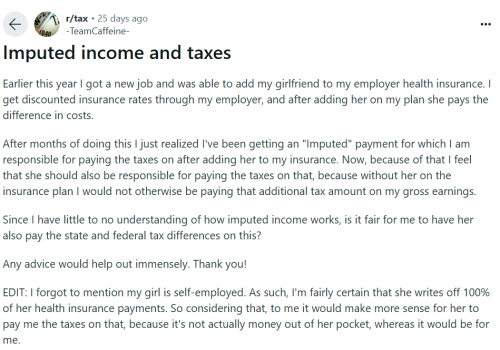

What People Are Asking Across Platforms

Many individuals turn to forums like Reddit and Quora for real-life answers about imputed income. These are some cases where it is well explained how it works.

Do You Need Tax Help?

If imputed income or tax debt is causing confusion, CuraDebt is here to help. Our team specializes in tax debt relief and offers a free consultation to address your unique concerns. Let us guide you toward financial peace of mind.

CuraDebt Reviews

CuraDebt has helped countless clients overcome tax challenges and manage debt effectively. Our personalized approach ensures that you get the support you need to navigate complex financial issues. Join the thousands we’ve assisted—schedule your free consultation today!

Conclusion

Imputed income may seem overwhelming, but understanding its meaning, examples, and reporting requirements makes it manageable. Whether you’re dealing with taxable fringe benefits or planning your finances, staying informed is key. If tax debt is adding stress to your life, CuraDebt’s expertise can make all the difference. Contact us for a free consultation and take the first step toward a more secure financial future.