Getting sued by a debt collector can feel overwhelming, but it’s important to know you’re not alone and there are steps you can take to protect yourself. Whether it’s a surprise or something you expected, understanding your rights and responsibilities is key to navigating this situation. Let’s explore what to do if a debt collector sues you, common mistakes to avoid, and how to approach the process with confidence.

Need a loan or help with debt relief? CuraDebt is here for you.

Understand The Basics Of A Debt Lawsuit

When a debt collector files a lawsuit, it’s their formal attempt to recover money they believe you owe. This is usually a result of unpaid debts that have been turned over to collections. Responding appropriately to the lawsuit is crucial, as ignoring it can lead to serious consequences, like default judgments or wage garnishments.

What To Do If A Debt Collector Sues You

1. Review The Legal Documents

When you’re served with a lawsuit, carefully review all the documents. These will typically include:

- The complaint, which outlines the debt collector’s claims.

- The summons, detailing when and how you must respond.

Check for inaccuracies, such as the wrong amount, a debt you don’t recognize, or discrepancies in the creditor’s information. Mistakes in the lawsuit could give you leverage to contest the case.

2. Respond To The Lawsuit

Filing a formal response is critical. Here’s how:

- Adhere To Deadlines: Typically, you have 20–30 days to respond.

- File An Answer: Deny the allegations you dispute or lack knowledge of. This prevents a default judgment.

- Seek Legal Advice: Consulting with an attorney can ensure your response is appropriate and complete.

3. Gather Evidence

If you believe the debt is invalid or the amount is incorrect, gather supporting documents, such as:

- Payment records

- Correspondence with the original creditor

- Evidence of identity theft, if applicable

This evidence can strengthen your defense in court.

4. Negotiate A Settlement

Often, debt collectors are open to negotiation to avoid the cost of litigation. Consider proposing a repayment plan or a lump-sum settlement for a reduced amount. Ensure any agreement is documented in writing.

Looking for a reputable debt relief company? Take our free consultation now.

What Not To Do

When faced with a debt lawsuit, it’s just as important to avoid certain actions as it is to take the right steps.

Ignore The Lawsuit

Ignoring a lawsuit won’t make it disappear. In most cases, it leads to a default judgment in favor of the debt collector, giving them legal authority to garnish your wages or seize assets.

Admit Liability Without Proof

Even if you think the debt is yours, don’t admit liability without confirming the debt collector has proper documentation proving you owe the amount claimed.

Miss Deadlines

Failing to respond within the stipulated time frame can severely limit your options. Always keep track of deadlines.

How To Navigate A Debt Lawsuit

Understanding the legal process can reduce stress and improve your chances of a favorable outcome.

Learn About Your Rights

Under the Fair Debt Collection Practices Act (FDCPA), debt collectors must adhere to strict rules when pursuing debts. They cannot:

- Harass or intimidate you

- Make false claims about the debt

- Sue you for debts past the statute of limitations

Knowing your rights empowers you to challenge unethical practices.

Consider Legal Assistance

If the lawsuit feels overwhelming, consult with a legal professional. They can review the case, identify weaknesses in the debt collector’s argument, and represent you in court if necessary.

What People Are Saying Across Platforms

Real-Life Experiences

Online forums like Reddit or Quora can offer valuable insights into debt lawsuits. Here are a few examples.

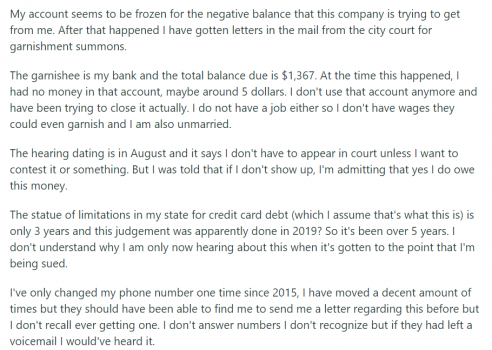

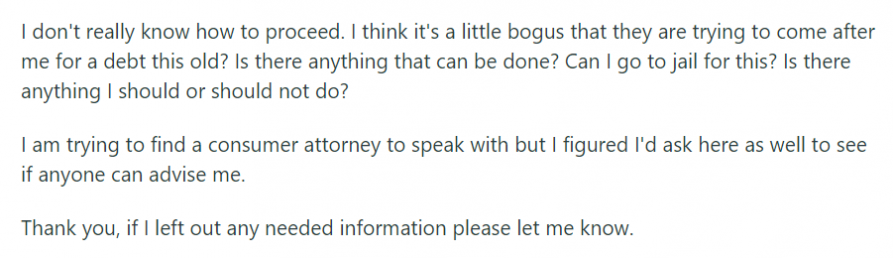

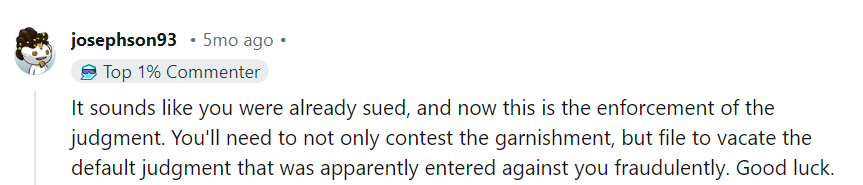

A user shares their experience of being sued and facing enforcement of a judgment. In the comments, users discuss the importance of responding to lawsuits promptly to avoid reaching this stage.

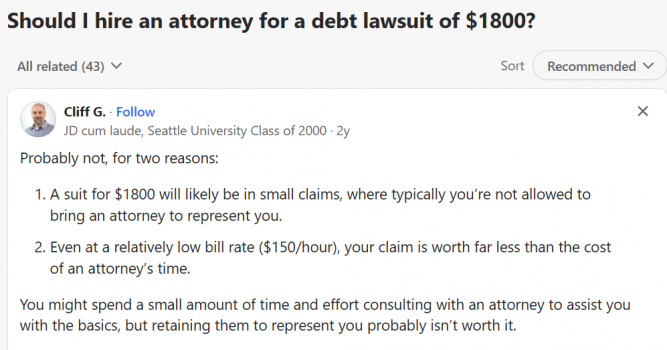

On another post, someone asks if hiring an attorney for a $1,800 debt lawsuit is worth it. Responses suggest that while legal representation is valuable, the cost might outweigh the benefits for smaller debts.

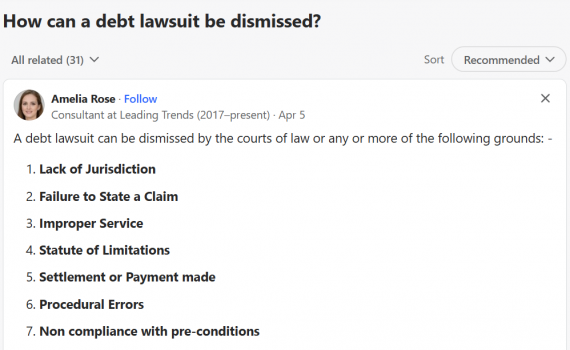

A user inquires about dismissing a debt lawsuit. Contributors explain that lawsuits can sometimes be dismissed due to improper documentation, exceeding the statute of limitations, or lack of standing by the debt collector.

These discussions highlight the need for informed decision-making when faced with a debt lawsuit.

Why CuraDebt Can Help You

If you need help with debt, you’re not alone. CuraDebt has helped countless individuals regain control of their finances. Our team of experts works to understand your unique situation and tailor solutions to your needs.

From negotiating with creditors to guiding you through complex financial challenges, CuraDebt is here to help. Many clients report reduced stress, manageable payment plans, and a clearer path to financial freedom. You could be next!

Conclusion

Facing a debt lawsuit can be intimidating, but taking proactive steps can make all the difference. Review your documents, respond appropriately, and seek legal advice when needed. Remember, ignoring the lawsuit won’t make it go away.

CuraDebt offers a free consultation to help you explore your options and take the next steps with confidence. Let us support you in navigating your financial challenges and finding the relief you deserve.

Call us today for your free consultation and start your journey toward financial peace of mind!