When dealing with debt, the temptation to pay only the minimum amount due each month can feel like a convenient way to manage finances. However, this strategy often traps people in a cycle of prolonged debt. Paying only the minimum keeps you in debt longer due to accumulating interest and slower principal repayment. In this article, we’ll uncover why this approach can be detrimental and explore smarter strategies for financial freedom.

Need a loan or help with debt relief? CuraDebt is here for you.

The Hidden Costs Of Paying Only The Minimum

Paying the minimum may seem manageable, but it leads to long-term financial burdens. Here’s why:

- Interest Accumulation: Most of your payment goes toward interest, leaving little to reduce the principal.

- Debt Snowball Effect: As balances remain high, interest compounds, and the debt takes longer to pay off.

- Missed Opportunities: Money spent on interest could be invested elsewhere for future growth.

If you feel overwhelmed by debt, CuraDebt offers a free consultation to help you explore options for relief.

Understanding Why Paying Only The Minimum Can Be A Bad Idea

Interest Dominates Your Payments

When you pay only the minimum, most of your payment is applied to interest rather than the principal. For instance, a $5,000 balance on a credit card with a 20% interest rate could take over 20 years to pay off with minimum payments.

The Illusion Of Progress

Paying the minimum gives the impression of progress, but in reality, the debt remains largely unchanged. This illusion can prevent you from addressing the core issue: the principal balance.

Financial Stress And Emotional Impact

Carrying long-term debt can lead to financial stress, limiting your ability to achieve other goals. Instead of focusing on what you owe, you could shift toward building wealth with effective debt management strategies.

Alternatives To Minimum Payments

Breaking free from the minimum-payment cycle requires commitment and a structured plan. Consider these strategies:

- Debt Avalanche: Focus on high-interest debts first, while making minimum payments on others.

- Debt Snowball: Pay off smaller debts first to build momentum.

- Debt Relief Programs: Professional services like CuraDebt can consolidate or negotiate your debts to reduce the overall burden.

The Impact Of Small Adjustments

Paying More Than The Minimum

Adding even a small amount to your minimum payment can significantly reduce your repayment time and interest costs.

Budgeting For Extra Payments

Reassess your monthly budget to identify areas where you can cut expenses and allocate those funds toward your debt.

Utilizing Windfalls

Tax refunds, bonuses, or unexpected income can be applied directly to your debt to accelerate repayment.

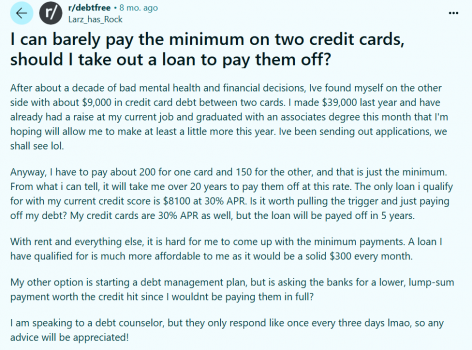

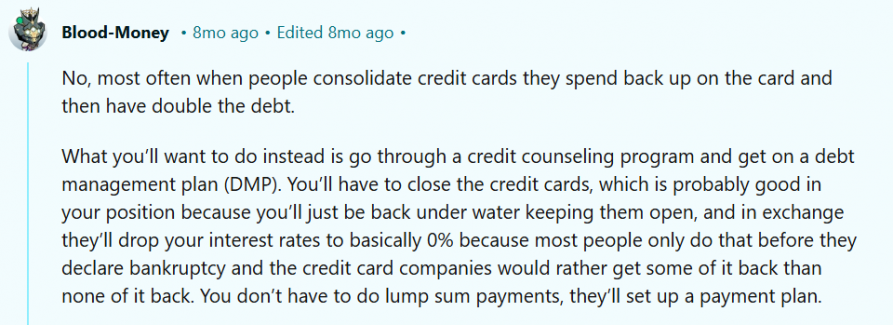

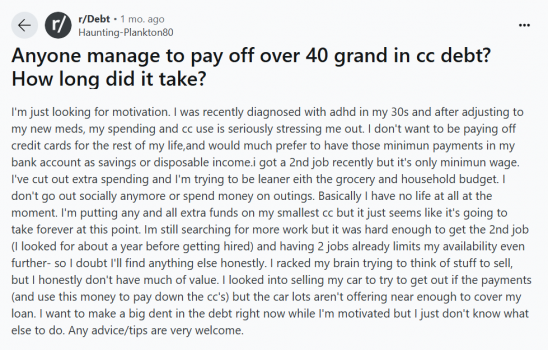

What People Are Saying Across Platforms

Exploring discussions on platforms like Reddit or Quora can provide valuable insights. Many people share their experiences with debt repayment strategies, offering inspiration and practical tips. Here are some perspectives on paying only the minimum on debt.

Keep in mind that while community advice can be helpful, consulting with professionals like CuraDebt ensures tailored solutions.

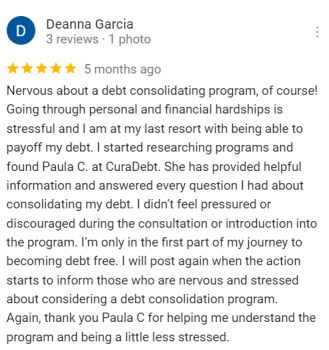

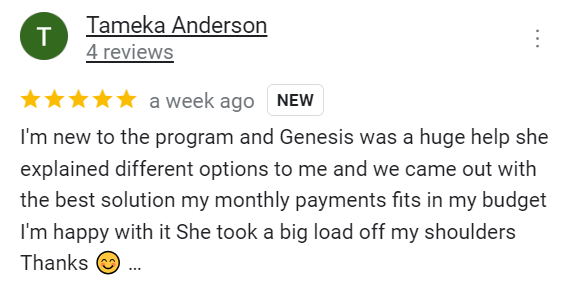

CuraDebt Reviews

Thousands of clients have turned to CuraDebt for professional debt relief services. With personalized plans and expert guidance, we’ve helped individuals regain control of their finances. Here’s what a few of our clients have shared:

You could be next! Schedule a free consultation today to discover how we can help you achieve your financial goals.

Conclusion

Paying only the minimum on your debts may seem like a short-term solution, but it extends the time and cost of repayment significantly. By taking proactive steps—like increasing payments, budgeting wisely, or seeking professional help—you can break free from the debt cycle.

CuraDebt is here to help. With years of experience in debt relief, we provide customized solutions to reduce your debt and regain financial freedom. Contact us today for a free consultation, and take the first step toward a debt-free future.